Why we believe Wotif may not be a bargain ROGER MONTGOMERY

Post on: 16 Март, 2015 No Comment

The team at Montgomery have a simple mandate – generate satisfactory returns over the very long run for thousands of investors, by investing in high-quality businesses at rational prices. If sufficient quality is unavailable, then funds are kept in the safety of cash. This helps mitigate the risk of permanent capital loss.

When expressed this way, it all seems extremely simple. But underlying the modus operandi is a bevvy of benefits and advantages.

For example, did you know that by holding cash (and avoiding the rubbish), The Montgomery Fund seeks to minimise the points lost? By minimising the losers, we reduce the subsequent timeframes (and returns) required to get our investors ‘back to where they were’.

Another great benefit that flows out of The Montgomery Fund’s process, in seeking the light, is that we must by necessity avoid the dark.

Our work to uncover the best opportunities nevertheless requires us to turn over every stone. When Wotif’s share price plunged from $5.60 to $2.30 more recently, the question we asked was whether all of the brokers and analysts (who were suggesting Wotif is now a bargain) were right. Our quality and performance scores are more than adequate suggesting the company is not going broke between now and the next annual result. Our automated valuation methodology also looks compelling. In other words, our quantitative measures suggested Wotif was worth a closer look. Now comes the qualitative part of the process

You might recall that some time ago we determined Wotif did not have a sufficiently strong competitive advantage to purchase. Remember, this is our own view and applies only to us (you need to make up your own mind and must seek and take personal professional advice).

Here, we reveal some of our more recent notes and highlights for Wotif.

Wotif.com Holdings – Initial Thoughts

(WTF: ASX)

Share price / outstanding: $2.67 / 212m

Market cap / cash / debt: $570m / $115m / $0m

By our reckoning, WTF appears to have run out of topline growth, and without a radical change in direction, growth currently appears poised to turn negative. If negative growth transpires, it could be particularly dangerous given the significant negative working capital that characterises the business model. Negative working capital was a cash flow tailwind during periods of growth, it could however turn into a cash flow drain if growth turns negative. Dividend cuts could therefore be possible and these might cause the share price to fall.

In an effort to stave off revenue declines, management appears to have increased their investment into the business, particularly in advertising, marketing and web development. Yet our estimates suggest the returns on these incremental investments might be negative. If correct, the more management invests, the more value that is destroyed for shareholders.

Finally, WTF is a very small player in an intensely competitive global marketplace for online hotel bookings and flight reservations. Its lack of scale in marketing and web development compared to the likes of Priceline (PCLN; US$62B market cap), Expedia (EXPE; US$9B market cap) or CTrip.com (CTRP; US$6B market cap) place the company at a significant competitive disadvantage. We are particularly concerned that international entrants could offer suppliers (accommodation providers) better repayment terms than Wotif.

In this article we explain some of our thoughts on why we have decided that neither The Montgomery [Private] Fund nor The Montgomery Fund will be buying Wotif shares at this juncture:

1) Growth has stalled; potentially turning negative

- WTF’s key topline driver, bookings growth, appears to have already turned negative.

- Total transaction volume (TTV) growth remains barely positive, suggesting a slight improvement in basket size, possibly driven by relatively stronger growth in flight bookings (12% of total) vis-à-vis accommodation bookings (88% of total). Illustrated below.

- Revenue growth remains barely positive, in part thanks to a hotel commission increase pushed through in FY13.

- WTF’s hotel commissions are around 11%, while international competitors are around 15% or more. On the one hand, this suggests more pricing upside potential for WTF. On the other hand, it could mean WTF’s value proposition and user base is significantly weaker than international peers, so pricing upside from here is could be limited. Also, keep in mind international competitors could offer to pay hotels faster than the terms offered by Wotif.

2) Negative working capital (NWC) could pressure free cash flow and dividends in the future.

- During historical periods of strong topline growth, WTF’s liquidity/funding model has benefited from significant negative Net Working capital (NWC). This stems from WTF receiving cash payments for bookings before it passes them onto hotels/airlines.

What do we mean by negative working capital? Essentially, Wotif has the benefit of all the cash it receives to fund its business. When a customer pays for a hotel room, it will be some time before the hotel is paid. Because of the timing difference between when payments are received and when Wotif passes them (less commission) onto the supplier (the hotel or airline), the company has the benefit of more cash than it can ultimately call its own. This is a very positive feature of these businesses. This is what makes American Express (in the days of travellers cheques) and Woolworths attractive.

In this context, net working capital (NWC) can be a double-edged sword working like any other form of operating leverage to deceive management who believe growth will continue unhindered.

Lets try and explain: as the business grows, the increasing number of both customers and revenue produces enlarged free cash flows, and if managers have only budgeted for growth, dividends funded from the growing cash flows may have increased too. This is illustrated in the table below. Management of this hypothetical company have, for the first four years, paid 75 per cent of the free cash flow (we’ve called it cleared funds) as a dividend. Provided the business keeps growing, there is no problem.

An issue arises however, if business revenues go into reverse. Dividends must be cut to avoid a cash flow drain. If dividends are to be maintained, funds will eventually need to be borrowed or raised to fund the gap.

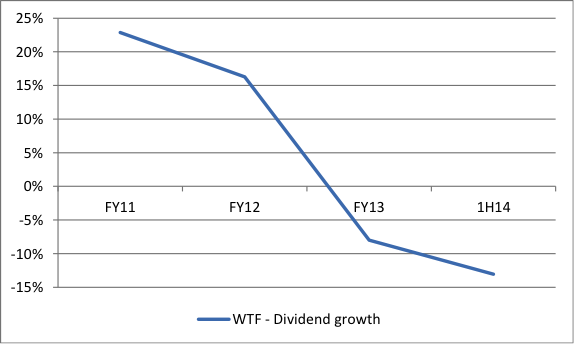

- As growth turns negative, the cash flow tailwind can turn into a headwind and substantially reduce FCF. Its possible we are already seeing the beginning of this effect, as illustrated below.

- If FCF deteriorates, or turns negative, we would expect cuts to dividend growth to continue. There is no guarantee that our précis will play out this way but it is a risk enough to concern us.

3) Incremental returns appear to have turned negative while reinvestment is increasing

- ROEs appear to have been declining and incremental returns appear to have turned negative too (-14%). Meanwhile, the reinvestment rate has increased from 13% in FY11, to 19% in FY13.

*Reinvestment rate is presented as % of NPAT.

- The above analysis has also been conducted on an adjusted basis, which views marketing and development expenses as investments in the business too, which are capitalised and amortised.

- Illustrated below, this analysis also results in estimated negative returns on incremental equity; and a much higher reinvestment rates – when marketing and development is included in the reinvestment amount.

One reading of this performance is that as management increases investment to stave off a topline decline, they are merely accelerating the value destruction for shareholders. Again, there is a chance that managements strategy works, but our conservative approach seeks evidence of it working first.

4) Are management incentives aligned with shareholders?

- Elsewhere, its interesting to note that bonuses paid to senior executives of WTF might not be based on shareholder value, but on accounting profit. This is of course not unique to WTF, however at Montgomery, we aren’t enamoured with bonuses paid primarily on an EBITDA and EPS growth basis. The reason is that such benchmarks can incentivise management to boost profits through the capitalising of expenses. It may not be occurring at WTF but it’s worth investigating.

5) Our current valuation suggests material downside risk

- In other words, when we look at the valuation based on our qualitative finding, we arent seeing any value.

- Adjusting WTF’s current forward earnings yield for the rate of reinvestment at negative incremental returns yields a post-tax economic return of 2-4%, depending on how marketing and development costs are treated. Given this, it would not be surprising to us (upon normalisation of economic returns) to see the stock halve from current levels. Keep in mind this is merely our opinion of the risks and not a prediction nor a recommendation (again, be sure to seek and take personal professional advice).

6) Competitive landscape is intensifying and not supportive of international expansion

- It is interesting to consider WTF in a global context given its offering is global in nature, and online digital channels reduce geographical barriers to competition.

- While WTF boasts nearly 30k contracted properties available for users, Priceline (PCLN, US$62B market cap) boasts around 425,000!

- While WTF boasts nearly 1m customer reviews, TripAdvisor (TRIP, US$13B market cap) boasts around 125m.

- Our point is that the global landscape for online hotel and flight bookings is increasingly competitive and characterised by some major players that can outspend WTF on marketing and web development substantially.

- Perhaps WTF’s best hope is that one of these major players takes it out and while such a scenario is not improbably, we are not in the business of speculating on such outcomes, so for us, we cannot buy Wotif, despite the analysts urging us to swing.

Keep in mind that our views may change. We may speak with the company and they in turn may address some of these concerns to our satisfaction. If such events transpired we (as always) reserve the right to change our view 180 degrees. Based on current views – and information we have processed – we retain a mindset of avoidance.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564) and may contain general financial advice that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs.