Why Not to Buy Mutual Funds Before They Pay Distributions

Post on: 11 Июль, 2015 No Comment

Getty Images

A common mistake investors make is buying mutual fund just before they pay out dividends and capital gains. At first, buying before a distribution seems like a great idea. It’s free money, right? Immediately after buying, you get to collect income from the fund.

Unfortunately, it doesn’t work that way in real life. In fact, using a taxable account to buy a fund before it makes a distribution can actually cost you money.

The Mechanics of Distributions

The way funds pay their distributions is slightly complex, but it’s important to understand how they work in order to avoid unnecessary headaches.

There are two types of distributions: dividends and capital gains.

With the first, dividends, funds collect income from their holdings, and they retain this income within the fund until they pay out income to shareholders. With bond funds. this income is typically passed along to investors once a month; with stock funds, payouts can occur one, two, or four times a year. When the funds are earning this income and holding it prior to the distribution, it is reflected in the fund’s net asset value (NAV).

For instance, a fund with a total value of $1,000,000 and 100,000 shares collects $50,000 in dividend income, its NAV rises from $10.00 to $10.05. When the fund passes this income on to shareholders in a form of a dividend, that money comes out of the fund and the NAV drops to reflect that change. As a result, the investor receives $.05 per share in the form of a dividend, but the NAV drops to $10.00.

In short, while the investor received income, the total value of their account is the same on the day after the dividend as it was the day before the dividend.

Capital gains work essentially the same way. When a fund sells an investment at a profit, it locks in a capital gain. If, at year end, the total amount of capital gains exceeds the value of capital losses, the fund must pass on the net proceeds to shareholders. As with dividends, these gains are already reflected in the fund’s net asset value before the distribution. And, in the same way, when the payout occurs the fund’s share price drops to reflect the cash that is removed from the fund and sent to shareholders. In other words, a $5 capital gain is accompanied by a $5 drop in the share price.

The end result is also the same as it is with the dividend payout: the total value of the capital gain is the same on the day after the dividend as it was the day before the capital gain.

This means that investors don’t “make” money on the day of the payout. This money has already been made throughout the course of the year, and it has been gradually reflected in the fund’s share price. That’s why any effort to buy before a distribution to “capture” the dividend is futile – in the end, the value of the investor’s account remains the same.

The Impact of Taxes

Unfortunately, there’s more to the story. Investors have to pay taxes on these dividends and capital gains if their hold a “regular,” or non-taxable account, as opposed to a 401(k), Individual Retirement Account (IRA), etc. In this case, the investor doesn’t get to keep all of the distribution – he or she has to give up a portion for taxes. Dividends and short-term capital gains are taxed as regular income, while long-term capital gains are taxed at the capital gains rate.

Consider this example. An investor with a $10,000 account on December 28 receives distributions worth $500. The next day, he or she reinvests the proceeds into the fund. The account is still worth $10,000, but if his or her tax rate is 28%, that $500 is reduced to $340 (or $500 — $160 = $340) on an after-tax basis. As a result, the investor loses a portion of the total value of their account to the government as a result of the distribution.

The Takeaway: Be Aware of the Timing of Distributions

The tax bite isn’t a reason not to invest – after all, paying taxes means that you have made money. After all, dividends and capital gains represent money that the fund made during the course of the year. For shareholders that have held all year, that’s fine. But for investors who are new to a fund, there’s no reason to buy shares shortly before the distribution. In essence, you’re paying taxes on money that you haven’t actually made and created an unnecessary tax bite in the process.

It’s therefore essential to be aware of the timing of upcoming distributions when making a new investment or putting new money into a fund you already own.

With bond funds, this isn’t as much of a problem since distributions occur each month and capital gains are relatively small. However, income-oriented investors who have ventured into the world of stock funds in search of higher returns need to be aware of this issue.

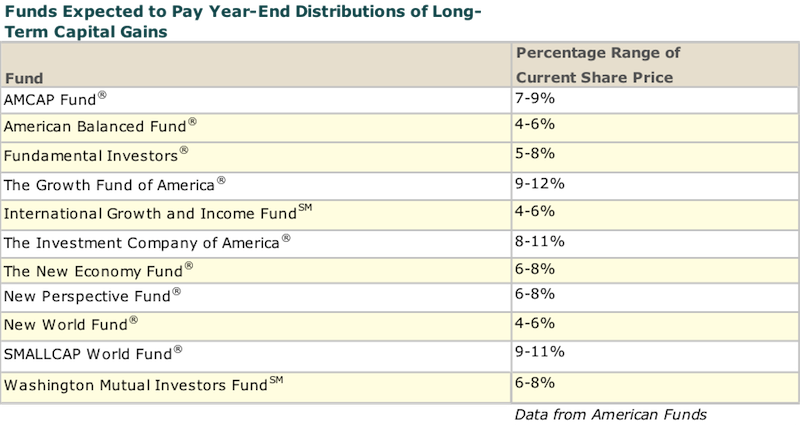

Most funds pay out capital gains in the final week of December, but there are a handful that make their distributions at other times of the year. Keep in mind, then, that this isn’t an issue specific to the fourth calendar quarter – you should always check a fund’s payout history to make sure it isn’t about to pay a distribution.

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Always consult an investment advisor and tax professional before you invest.