Why Money Market Funds Break The Buck Yahoo Finance

Post on: 16 Март, 2015 No Comment

Why Money Market Funds Break The Buck — Yahoo Finance

Money market funds are often thought of as cash and a safe place to park money that isn’t invested elsewhere. Investing in a money market fund is a low-risk, low-return investment in a pool of very secure, very liquid, short-term debt instruments. In fact, many brokerage accounts sweep cash into money market funds as a default holding investment until the funds can be invested elsewhere.

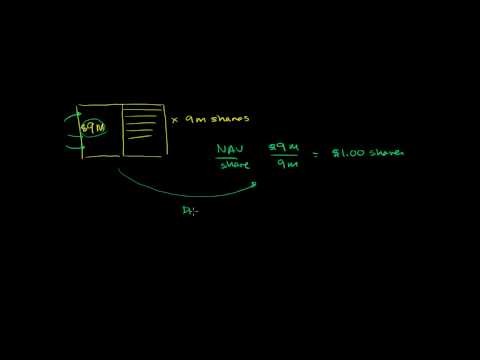

Money market funds seek stability and security with the goal of never losing money and keeping net asset value (NAV) at $1. This one-buck NAV baseline gives rise to the phrase break the buck, meaning that if the value falls below the $1 NAV level, some of the original investment is gone and investors will lose money.

This only happens very rarely, but because money market funds are not FDIC-insured, they can lose money. Find out how this happens and what you can do to keep your risk-free assets truly risk free

Insecurity in the Market

Even though investors are typically aware that money market funds are not as safe as a savings account in a bank, they treat them as such because, as their track record shows, they are very close. But given the rocky market events of 2008, many did wonder if their money market funds would break the buck.

In the history of the money market. dating back to 1971, there was only one fund that broke the buck until the 2008 financial crisis. In 1994, a small money market fund that invested in adjustable-rate securities got caught when interest rates increased and paid out only 96 cents for every dollar invested. But as this was an institutional fund, no individual investor lost money, and 37 years passed without a single individual investor losing a cent.

In 2008 however, the day after Lehman Brothers Holdings Inc. filed for bankruptcy, one money market fund fell to 97 cents after writing off the debt it owned that was issued by Lehman. This created the potential for a bank run in money markets as there was fear that more funds would break the buck.

Shortly thereafter, another fund announced that it was liquidating due to redemptions, but the next day the United States Treasury announced a program to insure the holdings of publicly offered money market funds so that should a covered fund break the buck, investors would be protected to $1 NAV.

Track Record of Safety

There are three main reasons that money market funds have a safe track record.

- The maturity of the debt in the portfolio is short-term (397 days or less), with a weighted average portfolio maturity of 90 days or less. This allows portfolio managers to quickly adjust to a changing interest rate environment, thereby reducing risk.

Readying Yourself for the Risks

Although the risks are generally very low, events can put pressure on a money market fund. For example, there can be sudden shifts in interest rates, major credit quality downgrades for multiple firms and/or increased redemptions that weren’t anticipated. Another potential issue could occur if the fed funds rate drops below the expense ratio of the fund, which may produce a loss to the fund’s investors.

To reduce the risks and better protect themselves, investors should consider the following:

- Review what the fund is holding. If you don’t understand what you are getting into, then look for another fund.

Confusion in the Money Market

Money market funds are sometimes called money funds or money market mutual funds, but should not be confused with the similar sounding money market deposit accounts offered by banks in the U.S.

The major difference is that money market funds are assets held by a brokerage, or possibly a bank, whereas money market deposit accounts are liabilities for a bank, which can invest the money at its discretion — and potentially in (riskier) investments other than money market securities. In a money market fund, investors are buying securities and the brokerage is holding them. In a money market deposit account, investors are depositing money in the bank and the bank is investing it for itself and paying the investor the agreed-upon return.

If a bank can invest the funds at higher rates than it pays on the money market deposit account, it makes a profit. Money market deposit accounts offered by banks are FDIC insured. so they are safer than money market funds. They often provide a higher yield than a passbook savings account and can be competitive with money market funds, but may have limited transactions or minimum balance requirements.

The Bottom Line

Prior to the 2008 financial crisis, only one small institution fund broke the buck in the preceding 37 years. During the 2008 financial crisis, the U.S. government stepped in and offered to insure any money market fund, giving rise to the expectation that it would do so again if another such calamity were to occur. It’s easy to conclude then that money market funds are very safe and a good option for an investor that wants a higher return than a bank account can provide, and an easy place to allocate cash awaiting future investment with a high level of liquidity. Although it’s extremely unlikely that your money market fund will break the buck, it’s a possibility that shouldn’t be dismissed when the right conditions arise.

More From Investopedia

Fri Jun 8, 2012 11:30am EDT

* Downgrade likely to hike repo costs for Spanish banks

* Spanish banks seen increasingly reliant on ECB cash

By Emelia Sithole-Matarise

LONDON, June 8 (Reuters) — Fitch’s credit rating downgrade of Spain compounds funding problems for the country’s struggling banks which may leave them even more reliant on the European Central Bank’s cheap loans.

Fitch slashed Spain’s credit rating late on Thursday, leaving it just two notches short of junk status. It signalled more downgrades could follow as expectations grew Madrid would ask the euro zone for help with recapitalising its stricken banks.

Cuts to individual Spanish banks’ ratings are due to follow, which could complicate their use of repurchase markets which have been an important source of short-term cash.

Many of the big Spanish banks use clearing houses to reduce the risk and cost of repo trades using government bonds but the ratings downgrade will boost the cost, or the initial margin clearers require to offset risks.

This means that for a number of banks. (that) clear through LCH.Clearnet the financing will become much more expensive through repo and it’s possible that some banks will not be allowed to clear if they fall below BB+, said Don Smith, an economist at ICAP.

LCH uses the most conservative of the ratings so this will have an impact of raising, if not immediately but after a short period, the cost of repo financing to banks which increases their reliance for short term funds from the ECB, he said.

Already earlier this week, banks’ use of the ECB’s weekly funding more than doubled as Spain’s troubles left its institutions increasingly dependent on central bank support and as four Greek banks returned to mainstream ECB operations following a two week ban.

The ECB’s weekly offering of limit-free 7-day funding saw a total of 96 banks take 119.4 billion euros, the highest since the second of its two 3-year injections at the end of February and more than double the 51.2 billion euros taken a week ago.

BANK RESCUE DETAILS EYED

Spanish banks have increasingly seen their access to funding markets shrink as they slid deeper into a crisis caused by a burst real estate bubble and the country’s deteriorating fiscal situation.

Effectively they were already locked out of the market. so it’s not of huge concern as they were prevalent in tapping the ECB’s liquidity operations, said Suki Mann, a credit strategist at Societe Generale.

The latest downgrade doesn’t help and it will mean they will need accommodative policy from elsewhere either from the ECB or some form of aid from the troika for the recapitalisation..

The cost of insuring against a default by the country’s banks jumped after Fitch’s downgrade of the country’s rating, with five-year credit default costs for Banco Santander rising by eight basis points to 412.5 bps while those for BBVA were up five bps at 447.5 bps, according to provider Markit.

Both Smith and Mann said they would wait to see the details of any planned Spanish bank rescue to see how far it would go in tackling the sector’s problems.