Why it’s Time to Buy Berkshire Hathaway Stock

Post on: 19 Июнь, 2015 No Comment

At the moment, Berkshire Hathaway is currently flush with cash. They are sitting on a large cash pile of $49 billion at this time. Warren Buffett and Charlie Munger are currently waiting to break out their elephant guns and put some of this cash to work. At the time of this writing, the company stock is hovering around $194,000. It’s about to break its all time record again that was previously set in May at $194,670. The Class B shares are worth roughly $130 per share.

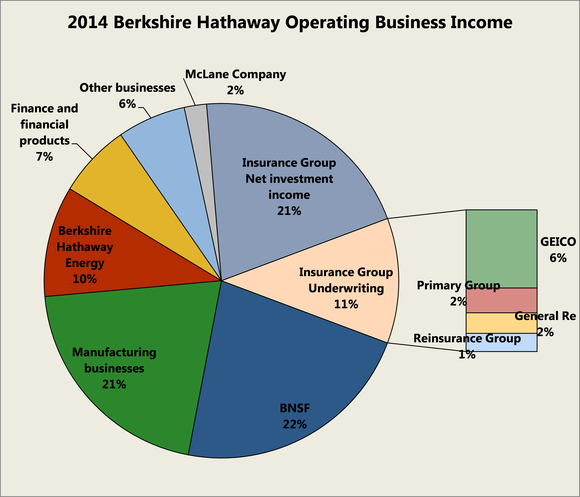

Berkshire Hathaway’s operating profits, excluding derivative and investment gains, rose by 10% to reach $2634 a share during the 2 nd quarter. They reached this massive achievement through help from Burlington Northern Santa Fe railroad, Geico, and the company’s power, energy and manufacturing operations.

Berkshire Hathaway stock shares are up roughly 8% this year, but they are still quite appealing because they are only trading at 1.35 times the June 30 book value which came in at $142,483. Cliff Gallant, a Nomura analyst, has raised his price target on the Class A shares from $199,000 per share to $208,000 per share. He also reiterated his buy rating. In a client note, he stated that the results were “impressive” and “well ahead of our estimates companywide.” He also added that “strong operating earnings like these will be the main driver of book value growth.”

At the moment, Berkshire Hathaway book value has risen by $7500 since the end of the year in 2013. This is a 5.6% gain. It has risen because of the earnings in the company’s investment portfolio, which includes a total of $117 billion worth of equities. It’s highly unlikely that Berkshire Hathaway has tremendous upside potential because of its price/book ratio and the large size of the company, but it should continue to appreciate in line with book value growth, which is coming in at about a 10% rate. The current valuation of Berkshire Hathaway is worth $315 billion.

Per Class A share, profits are currently running at an after-tax rate of roughly $10,000 each year. This also equates to $16.5 billion. It’s quite reasonable to make the assumption that Buffett, as well as other investment managers, can easily generate another $3000 per share, or after taxes what amounts to $5 billion, in gains each year through investing.

Warren Buffett’s willingness to buy back stock at 1.2 times book backed by the cash-rich balance sheet of Berkshire Hathaway will also probably keep a floor under the stock. At this time, the floor is around $171,000 per share for the Class A shares. Each quarter, as book value grows, the share price typically tends to rise. If it tops at $155,000 a share by June 2015, you can expect the floor to rise to about $186,000 per share.

Berkshire Hathaway has no problem buying stock back at 1.2 times book value because Warren Buffett believes that this is a bargain when compared to intrinsic value – and this is a level that he hasn’t disclosed – but which he believes “far exceeds” book value.

Geico, Berkshire Hathaway’s powerhouse auto insurance unit, has made a 10% gain in premiums during the 2 nd quarter. It’s seems to continue to take market share. Its pretax underwriting profit has gone up by 17% to reach $393 million. Burlington Northern Santa Fe railroad, on the other hand, had a 5% increase in profits to reach $1.5 billion. After-tax earnings are running at about $3 billion, or 10 times the amount that Berkshire Hathaway paid when they purchased the railroad back in 2010. At this time, Burlington could roughly be worth $55 billion-$60 billion as of now.

Berkshire Hathaway’s on hand cash from the insurance units and other businesses under the Berkshire umbrella have reached $49 billion as of June 30. From the prior year, this is up $7 billion. This provides plenty of cash for Warren Buffett to make a major acquisition. Since the stock market has reached record levels, there are probably very slim opportunities available right now, especially given the price discipline that Warren Buffett employs. That’s why it’s almost certain that Buffett will hear proposals from interesting sellers.

Throughout the recent years, companies like Barron’s have written favorably about Berkshire Hathaway. They even said that this company is a better purchase than Icahn Enterprises. When the article was first published, Icahn shares traded at $117 and Berkshire Hathaway shares traded at $183,000. Berkshire Hathaway stock is up significantly since then and the Icahn shares have dropped to about $104 per share.

Warren Buffett, who is going to turn 84 years old this month, should joyously spend his birthday knowing that Berkshire Hathaway is in the best shape of its existence. We are sure he’s looking forward to the year 2015, which is the 50 th anniversary of him taking control of the company. Back then it was a struggling textile manufacturer that he turned into one of the biggest businesses that the world has ever seen.

Related Posts:

Here are some related posts you may have missed: