Why Investors Should Take A Look At Halliburton Its Regional Global Positions Halliburton Company

Post on: 16 Март, 2015 No Comment

Summary

- Halliburton remains the largest player in the Completion and Production, and Drilling and Evaluation segments of Oil production in North America generating $4.72 Billion in revenue.

- HAL increases total revenue in North America by 21.72% from Q3 2013 to Q3 2014, while also increasing revenue by 17.53% in the Middle East and Asia from Q3 2013.

- HAL agrees to acquire Baker Hughes in a $34.6 Billion Stock and Cash Transaction expected to close in the second half of 2015.

Halliburton Company (NYSE:HAL ) is the second largest provider of oil products and services to the energy sector specializing in two main segments of Completion and Production, and Drilling and Evaluation. Halliburton focuses on the upstream sector of Petroleum, leaving the North American midstream sector up to Kinder Morgan Energy Partners, and the downstream sector to North America’s Exxon Mobil (NYSE:XOM ). In the past six months, Halliburton’s PPS has slid 44.28% following a simultaneous 73.75% drop in the PPS of Ultra Bloomberg Crude Oil ETF (NYSEARCA:UCO ). Since third quarter in 2013 to third quarter 2014, Halliburton has seen an increase in operating costs and expenses by 11.04% while total revenue has risen by a greater 16.45% leading to an increase in basic income per share attributable to company shareholders of 79.7% from .79 per share third quarter 2013 to 1.42 per share third quarter 2014. There was growth with the gross rig count increasing moderately, where Halliburton cites an increase in horizontal rig developments in the Permian Basin of West Texas and the Southwestern United States. Internationally the rig count grew 4% in the third quarter of 2014 compared to the third quarter of 2013. Halliburton’s total revenue and operating costs and expenses will increase in the second half of 2015 upon Halliburton’s $34.6 Billion acquisition of Baker Hughes (NYSE:BHI ) although cost synergies should prove beneficial to Halliburton Company and its shareholders.

Companywide Highlights 2014:

October 20th 2014, Halliburton declares 20% increase in their dividend from $.15 to $.18 effective December 3rd 2014

Jeff Miller is promoted from Executive Vice President and Chief Operating Officer to President

Halliburton stems agreement with SPT Energy Group Inc. to pursue a joint hydraulic fracturing venture in the Tarim Oil Field expected to produce a barrel oil equivalent (BOE) of 50 million barrels by 2025 (⅙ of China’s projected BOE in 2025)

Halliburton is identified by the Dow Jones Sustainability Index as a leader in corporate sustainability for exceeding the industry averages Economically, Environmentally, and in the Social Performance area

Halliburton increases total revenue in North America by 21.72% from Q3 2013 to Q3 2014, while also increasing revenue by 17.53% in the Middle East and Asia from Q3 2013 to Q3 2014

Halliburton agrees to acquire Baker Hughes in a $34.6 Billion Stock and Cash Transaction expected to close in the second half of 2014

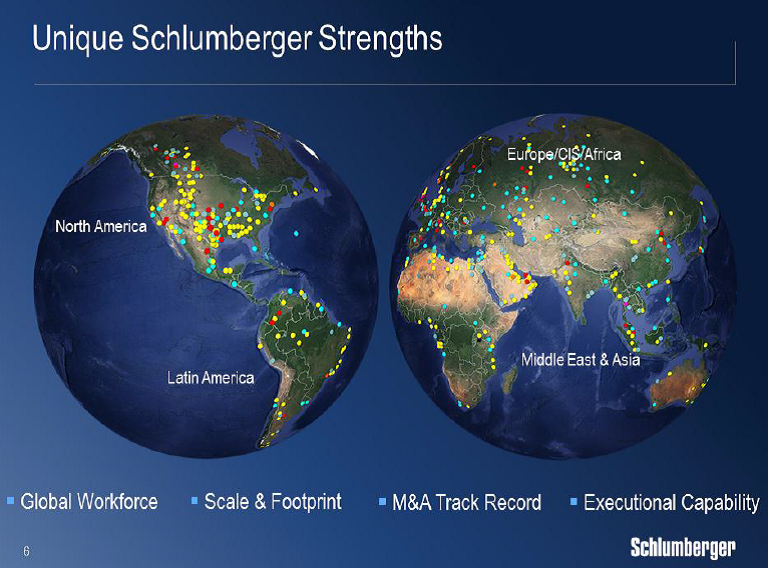

Geographic Strength’s of Halliburton on the Global Stage vs. Schlumberger (NYSE:SLB ):

Halliburton saw a 16% increase in total revenue in North America, while its operating income rose 47% compared to third quarter of 2013 largely due to higher stimulation activity in the U.S. land market. The 20% increase in revenue from the Completion and Production segment led the 16% increase in total revenue in North America over the lesser 10% increase in revenue in the Drilling and Evaluation Segment. Revenue in North America made up 54% of Q3 2014 revenue compared to 52% of Q3 2013 revenue increasing Halliburton’s revenue in the region by 2%.

Schlumberger in North America saw a 18% increase in total revenue in North America among a 9% increase in total revenue of Schlumberger and a 5% increase in revenue of Schlumberger’s International Areas. In Schlumberger’s 3rd quarter report, offshore revenue was down 1% while land revenue was up 25% due to an increase in market share gains in pressure pumping, artificial lift and drilling services. The 1% decrease in offshore revenue is correlated to lower multiclient seismic sales. Drilling and Measurement services were in greater demand which is cited as a dominant reason for the increase in revenue of 11% vs. third quarter last year in North America, Latin America, and the Middle East and Asia.

Halliburton in Europe/CIS/Africa had higher activity in their product service lines in the United Kingdom, Nigeria, and Angola along with higher stimulation activity and well intervention services in the Netherlands, which were partially offset by Norway’s decrease in pressure pumping activity leading to a 10% increase in total revenue in the region.

Schlumberger in Europe/CIS/Africa saw a 4% increase in total revenue, led by Central West Africa and Angola’s strong development and exploration activities.

Halliburton in the Middle East and Asia had increased revenue of 10% in Q3 2014 compared to Q3 2013, which was credited to completion tools sales and pressure pumping activity in Saudi Arabia and higher well intervention services in Indonesia.

Schlumberger in the Middle East and Asia led all of its other international markets in terms of growth in revenue. Revenue grew 6% due to robust results in Saudi Arabia, Australia, and the United Arab Emirates (U.A.E.).

Comparing the Behemoths (Wait to compare the two companies until finished with the Geographical analysis and stock charts analysis):

HAL maintained their strong position in North America noted by the increase in revenue from 52% Q3 2013 to 54% Q3 2014, while SLB increased their revenue in North America from 31% Q3 2013 to 34% Q3 2014, increasing their revenue by 3% in the region compared to Halliburton’s lesser 2% increase.

Halliburton and Schlumberger both saw over 6% increases in total revenue in the Middle East/Asia region both citing heightened activity in the region.

In the Europe/CIS/Africa region, both companies saw growth in Angola, and in Central West Africa including growth in Nigeria specifically cited by Halliburton as well as in the United Kingdom and Netherlands.

Global Regional News in Oil:

North America — The United States hit the highest production of Crude Oil since December of 1973, producing 9,046,000 barrels a day in October 2014 compared to 9,068,000 barrels a day in December of 1973 which was a reaction to OPEC’s proclaimed oil embargo that led to the Oil Crisis of 1973 that began that October.

Middle East/Asia — The Middle East continues to push production notably with OPEC nations such as Saudi Arabia, Iraq, Iran, and the U.A.E. leading the push in oil production of their 30 million barrels a day goal to over 30.46 million barrels a day and keeping their production propped up in an attempt to push out producers such as the U.S. who fight to keep their market share among record drops in the price per barrel of crude oil.

Europe/CIS/Africa — In December 2014, the Russian Energy Ministry reported producing 10.67 million barrels a day leading to a post Soviet-Era high unseen since the Soviet-Era production in 1988 of 11.4 million barrels a day. The Russian Energy Ministry also noted that they would not cut Russian output in 2015 and that they expect global crude oil prices to stabilize. As of December 30th 2014, crude oil production in Libya is down 65% from its October high of 850,000 barrels a day. Intermittent protests in Libya and lack of security at Libya’s ports are cited by the U.S. Energy Information Administration as the leading causes for the continued slide after the post civil war ramp up of production.

Latin America — President Nicholas Maduro of Venezuela blames the drop in oil prices globally for the 2.3% drop in Venezuela’s economy in the third quarter of 2014. He cited the United States’ spike in oil production as part of a two-year plan, which is affecting the prices of commodities and many developing economies, and that his country was suffering from an economic war headed by Washington to destroy OPEC.

Notable Company Shareholders:

The Vanguard Group, Inc. is Halliburton’s largest shareholder among institutional holders holding 5.26% of the Halliburton’s shares, while the Vanguard Total Stock Market Index Fund holds 1.56% of Halliburton’s shares

FMR LLC owns 4.5% of HAL

BlackRock Institutional Trust Company owns 2.72% of HAL