Why I Like Bank Of Nova Scotia As A Long Term Dividend Growth Stock The Bank of Nova Scotia (NYSE

Post on: 16 Март, 2015 No Comment

Summary

- Payout ratio of 45% is sustainable and in line with company long term goals.

- Dividend of 4% at current market price.

- Company plans to grow EPS between 5%-10% per year, which will result in increasing dividends.

- Wide geographic & financial services diversification.

- Book value has more than doubled in the last 10 years.

INTRODUCTION

With the financial crisis of 2008-2009 still lurking in the rear view mirror, most people would not think of a bank stock as a good place to put their money to get consistently growing dividends, and for good reason. Many of the too big to fail banks such as Goldman Sachs & Bank of America nearly went under and had to be bailed out by the U.S government, ultimately at the taxpayers’ expense and most either eliminated or severely cut their dividend to free up cash flow.

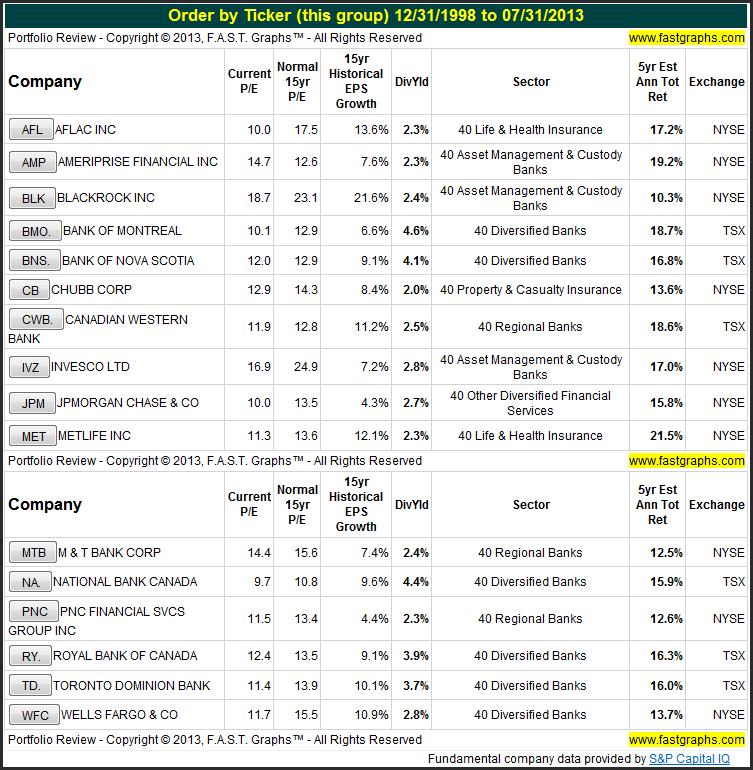

What I am sure many people probably don’t realize about our northern neighbor, is that they have one of the most stable banking systems in the world. During the 2008-2009 financial crisis, not one of the big five Canadian banks needed to be bailed out. These include Toronto Dominion Bank (NYSE:TD ), Bank of Montreal (NYSE:BMO ), Royal Bank of Canada (NYSE:RY ), Canadian Imperial Bank of Commerce (NYSE:CM ) and Bank of Nova Scotia commonly referred to as ScotiaBank (NYSE:BNS ). They all held and continued paying dividends to their shareholders while their U.S. counterparts had to slash or eliminate theirs and take federal aid to keep from going under. Some of this is due to increased regulation in Canada, higher capital ratios, and better management.

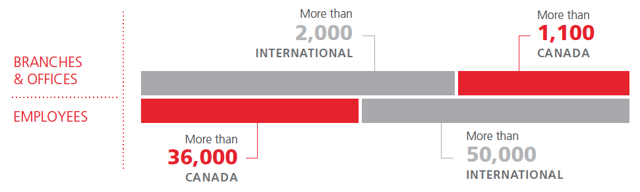

My favorite of these happens to be Bank of Nova Scotia or ScotiaBank. ScotiaBank is traded on both the TSX & NYSE under the same symbol, and is a well diversified financial services firm with a market cap of $68 billion that engages in Canadian Personal & Commercial Banking, International Personal & Commercial Banking, Global Wealth Management & Insurance. Let’s take a look at some of the basics on BNS and maybe you will see why I think as a long term investor who is focused on growing their passive income, it is worth considering for your portfolio.

DIVIDEND HISTORY

ScotiaBank, commonly touted as Canada’s most international bank, has been in business for 183 years, and has survived two world wars, the depression and the recent great recession. The bank notes that it declared its initial dividend at the rate of 3% per annum on July 1, 1833 and payments have been made continuously since. They have been continuing to increase their dividend over the last 10 years (twice this year) for an increase this year of 7%, and on an annual basis of about 6%-7% for the last decade. As you can see from the chart below, they increased their dividend in ’08 & ’09 and continued to hold it in 2010 before increasing it again in 2011. Lately BNS has been beaten up by the market as much of Canada’s economy is tied to falling oil prices, and their international exposure to Europe’s struggling economy and falling euro continues to weigh on operations there. But hopefully you will see that this is opening up a buying opportunity and simply a blip on the timeline of a company with 183 years of history with good long term growth prospects.

CURRENT VALUATION & ANALYSIS

At the current market price (NYSE) of $56, the dividend of $2.26 ($C 2.56 converted to US$) comes out a 4% annual yield which is virtually double the yield of a 10 year US Treasury Bond. This also puts their payout ratio safely at 45%, within their stated long term goal of 40%-50%. They have also stated an objective of growing their EPS at 5%-10% per year which will drive further dividend growth. In the last ten years, BNS has traded for a range of 10-14 times earning, so with a current P/E multiple at 11.67, and trading near its 52 week low $53.94 (52wk High of $68.71), I see a good margin of safety on a stock that pays a safe and consistent dividend which has returned a compounded annual rate of 9.9% over the last decade (including dividends). You will also notice that the bank has more than doubled its book value over the last decade and currently trades for 1.79 times book (again converted to US dollars) which is below its long term average. Other notable statistics include:

- Net income is up 10.4% in 2014 to $C7,298 (millions) from $C6,610 in 2013.

- ROE of 16.1% and an equity tier 1 ratio of 10.8% (for comparison, a bank has to have a 6% ratio to be considered well capitalized in the U.S) and total capital ratio of 13.9% pointing to the fact the bank is well prepared for any sort of financial crisis like what occurred just a few years ago.

- Total assets up 8.3% in 2014 to $C805,66 (millions) from $743,644

- Book value growth of 11.2% in 2014 to $C36.96 from $33.23 in 2013

- Diluted EPS up 10.7% in 2014 to $C5.66 from $C5.11 in 2013

FUTURE GROWTH

In reading through the 2014 annual report, it seems that the domestic banking sector is growing from strong performances in [the] mortgage and auto lending businesses, as well as double digit growth in [the] credit card business. They also completed the rebranding and launch of Tangerine (formerly ING Bank), their fast growing, low cost direct banking segment. Additionally they’re supported by partnerships with the NHL and Canadian Tire which is one of the largest retailers of a wide range of automotive, sports and leisure, and home products in the country. Their wealth management branch has also seen growth from both their highly ranked Scotia mutual funds, advisory services & online iTrade brokerage platform.

As we look internationally, we will see that they expect negligible growth in Europe in 2015 but have an optimistic view of their continued growth in the U.S, Caribbean and Latin America. From their annual report, they see a huge opportunity in the growing market of Latin America and are well positioned to take advantage of it: We see tremendous long-term potential in this region. As a result, we have sharpened our focus on the four Pacific Alliance countries of Mexico, Peru, Colombia and Chile. The Pacific Alliance trading bloc has more than 210 million people and forms the world’s sixth largest economy. The future for these countries is promising, with strong macroeconomic fundamentals and attractive demographics. Each of these markets enjoys a young, under-banked and growing population, an increasingly educated workforce and a growing middle class. These attributes are conducive to attractive growth rates for banking products and services.

Given these factors, the below image references their medium term objectives. Although somewhat generic, I do believe in the keep it simple stupid and if it ain’t broke, don’t fix it mentalities, and also feel that they are well positioned to achieve these goals.

CONCLUSION

Although I am not a professional investment advisor, I think BNS is worth considering in any dividend growth portfolio. I love the:

- Geographic and financial service diversity which helps them grow and mitigate risk while continuing to reward shareholders.

- Long history of paying and increasing dividends.

- Growth prospects coming from Latin America.

As always, please do your own research before investing, but hopefully I have been able to offer a good snapshot into what I think is one of the better long term opportunities in the financial sector. Ultimately, I think all of the big 5 Canadian banks would be a great addition to any dividend portfolio and would be worth a look with the recent pullback.

Source: BNS 2014 annual report

Disclosure: The author is long BNS, RY. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.