Why Higher Yielding Stocks Aren’t Always Your Best Bet

Post on: 13 Август, 2015 No Comment

Written on 23 September 2014 by Meagan Evans

If you own any Aussie stocks. the chances are you received above average dividend payments this year. And, unlike RBA governor Glenn Stevens, I imagine you arent complaining about that.

Indeed, one of the highlights of the recent reporting season was the surprise lift in dividends. Despite challenging operating conditions, company boards responded to shareholders demands for income.

The higher dividends were mainly thanks to higher payout ratios. Not from improved outlooks or great earnings results. This shouldnt concern you in the short term. But over the longer term, it is something to keep your eye on.

A companys payout ratio is different from its dividend yield. Yield is the dividends paid divided by the companys share price. While payout ratios are the proportion of profit that a company pays to shareholders as dividends.

Take RCR Tomlinson for example. Its payout ratio is 29%. You get this by dividing its dividends per share ($0.10) by its earnings per share ($0.34). 29% of earnings go to shareholders, while the company keeps the rest.

Historically, payout ratios have averaged 6070% in the Australian stock market. Theyre now up around 80%.

For the most part, investors cheered on these higher payout ratios. This has a lot to do with our dividend imputation system, or franking, which credits you with tax already paid by the company.

As mentioned, Glenn Stevens isnt one of those cheering. Hes frustrated that companies arent reinvesting their earnings. He says hes done all he can to support the economy by cutting interest rates. And now its up to companies to reinvest their earnings. Stevens said, Many businesses remain intent on sustaining a flow of dividends and returning capital to shareholders and are somewhat less focussed on implementing plans for growth.

Then why are companies raising their payout ratios?

First, in the current economy, there are only limited opportunities for businesses to reinvest earnings. With few opportunities, companies might as well keep shareholders happy. If they dont need the cash for growth or acquisitions, then it makes sense to return it.

However its not just limited business investment opportunities that are bumping up payout ratios. Company boards are feeling pressure from shareholders. Investors are chasing yield, shifting into shares due to todays low return on cash and bonds.

With interest rates at record low levels, its a struggle to find decent yields. Youll be lucky to find a bank that will return more than the rate of inflation. And you wont do much better by locking your cash away in a term deposit.

Bond yields are disappointing too. Take, for example, the Century bond issued by the Cleveland Clinic, a not-for-profit medical and research centre, in the US last week. Lend them your money for 100 years and theyll pay you a miserly 5% each year. Though I suppose thats better than the negative return you can earn on some European bonds.

In the search for income, simply shifting your money into high yielding stocks isnt the answer. Here are a few things to look for.

Be wary of high yield

I know, you want higher yield! It sounds counterintuitive, but dont just buy stocks with the highest yields.

And Im not talking about only avoiding weak businesses that pay high yields. Even when comparing quality stocks, theres a good chance that over time the one with the higher yield wont pay the most.

Yields can be misleading. A company could be trading on a high yield, not because it lifted its dividend, but because it was sold off for good reason. Following on, you can expect a fall in the dividend or find it cut altogether.

Dont view yields in isolation. As mentioned, yield is a function of both the dividend payment and the share price. If dividend payments rise, yield rises. But a falling share price will also result in higher yields.

High yielding dividend-paying stocks are often seen as stable investments. But at a certain point they actually become riskier than the average stock.

In todays low interest rate environment, investors have jumped on any stock with a high yield. The result is overpriced stocks. When rates rise, and they eventually will, these high yield stocks will lose their appeal and get crushed.

Low but rising payout ratios

Pay attention to a companys payout ratio. High dividend payout ratios are often favoured by investors. But higher isnt always better. If operating conditions worsen, theres not much room to smooth dividends. And a fall in earnings is likely to equal a cut to dividends.

Companies with lower payout ratios are generally better able to maintain dividends. And the lower the payout ratio, the more room there is to raise them.

Small to average sized payout ratios are ideal. If youre investing for dividends, aim for companies with lower payout ratios below 70% is best. This reassures you that dividend growth can continue and that dividends wont be crushed if earnings dip.

Theres a good chance a dividend isnt sustainable if more than 85% of profits are paid out. For example, a company with a 90% payout ratio distributes $0.90 of each dollar of earnings to shareholders. That doesnt leave much room to raise dividends, let alone grow the business.

The big four banks have long been a favourite with dividend seeking investors. And again they raised their payout ratios after reporting higher profits. But half of this profit growth was from falling bad debt charges. When bad debt charges come back to more typical levels it will be tough for the banks to keep growing dividends.

Rising dividends

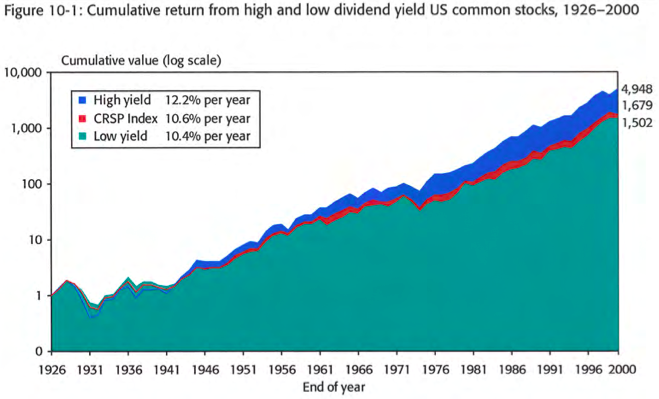

In the long term, dividend growth trumps dividend yield. Stocks with the highest yield today are the least likely to grow in value.

Invest in companies that raise dividends often and by a lot. Those that raise their dividends year after year. Find stocks with a history of raising dividends and the ability to grow them. Take Exxon Mobil for example. The oil and gas company has increased its dividend payment every year for 32 years. Little wonder its one of only four companies with a perfect AAA credit rating from Standard & Poors.

Make sure dividends are supported by rising earnings. Higher dividends in the face of falling profits arent sustainable. You want investments that will continue to pay distributions over the long term. Paying a $2 dividend when your earnings per share are $1 is not sustainable.

Low debt and profitable

Only pick companies with low or manageable debt levels. Higher dividends are fantastic. But not if they come at the expense of safety. Too much debt is dangerous. It overextends the business. The company can find itself in a bad spot if the market suffers a downturn, or project funding falls through.

Also, be aware that debt holders receive their interest payments before shareholders receive any dividends. If things turn sour, debt holders will drain the companys cash reserves. This means, as a shareholder, you may not get your dividend. Always closely check a companys debt and its cash flows.

Make sure that dividend payments arent maintained by higher debt levels. And that company earnings are also increasing. Lower profits alongside higher dividends are not sustainable.

Buying for income isnt as straight forward as you may have believed. It takes some thorough research to find the best, safest opportunities.

Regards,

Meagan Evans

Investment Director, Albert Park Investors Guild

Ed note: The above article was originally published in The Daily Reckoning .

From the Port Phillip Publishing Library

Special Report: The Hundredth Robot : Sam Volkering has discovered the next technology set to transform daily life. Its mass adoption moment could be just six months away. And if you invest now, it could transform your wealth in just a few years .

Join Money Morning on Google+