Why Gann Elliott Wave and Kondratiev Studies Fail

Post on: 27 Август, 2015 No Comment

Blogroll

6 Comments

It is interesting to put (chemical) greed in the equation. We await your book. Environmental factors such as famine and hunger might also have been common in the evolution of man. They might have contributed to his desire to accumulate and (incidentally) his inclination to become obese when food became plentiful.

Robert,

You hit the nail right on the head. If there is a chemical reason, our development in a world where our needs could not be satisfied could have been the basis for our desire to hoard food or its monetary equivalent.

The big question is, whats going to happen in societies where hunger is not longer a threat?

My professor in Economics included this similar question in our exam a year ago (asking us if there is any flaw in Elliott Wave theory) which I actually failed to answer. It is nice to read your insights about it and how I wish that I am still taking my economic course this time.

The true test of whether Elliott Wave or Gann theory works is the use of hard earned cash to make more cash. So far for me the theories work, or I am just one damn lucky soul and dont know it.

Elliott Wave works for short term trading (or I should rather say that I did have success using in short term trading). However, its been predicting an 80% crash of the markets since 1998. The last time I checked on what Pretcher was doing, he said that the crash was there if the Dow was measured in gold, which is both true and useless.

As for Gann, never worked for me. I would be interested in hearing otherwise.

For most of you this will not make sense but I am an Evangelical Christian and I see this as an outworking of sinfull societies correcting themselves of the sin of greed; this is however, a larger manifestation of a life without God. I base this on Gods law for sabatical rest found in Leviticus chapters 25-27 and in particular the year of Jubilee when all property was to be returned, or more likely, people were to return to the property given to them by God. These studies referenced above imply a cycle of 60 to 80 years of worldwide depression, however if the sabatical rest of a 50th year return of property were to happen, much greed would be canceled out. It looks like God was looking after His nation Israel. It may just be that all this tinkering with currencies and peoples freedoms will result in a much harder depression than one where economies have currencies tied to precious metals. We are squeezing every drop out of this lemon.

Why Gann, Elliott Wave and Kondratiev Studies Fail

For a long time Ive studied the works of Gann. Elliott and Kondratiev trying to gain some foresight into the economy cycles. My costly conclusion is that none of these methods work. However, before throwing them out of the window, lets see why they fail, when they fail and to what extent they may have some validity.

First, lets say that at some point all of the above methods worked. It is that past performance that keeps practitioners attached to them. Those methods, particularly Kondratiev and Elliott, touch an area that Traditional Economics and consequently mainstream market analyst dont dare touching: that of mass psychology.

In our society it is better to celebrate the triumphs of the great investors than assign to them the inevitability of larger social forces. Above all, if they pay your salary. However, disregarding the animalistic, organic, and patterned nature of human economic activity is not only anti scientific, but also counterproductive.

I am working on a book which will try to provide a scientific framework for understanding and predicting limits for human economic activity, but that will not be ready for at least another three years. In the meantime, I will share some ideas here.

The most interesting aspect of Gann, Elliot and Kondratiev, is the often even violent response they received. While Gann and Elliott are militantly ignored, dismissed or ridiculed by the capitalist academia, Kondratiev was executed by Stalin. You may wonder why the establishment has such a powerful reaction to these theories.

If you want to start with some basic and contemporary evidence that Traditional Economics is unable to describe human economic activity, you have to nothing but to look at the ongoing melting down of the global credit structure. There is an obvious irrationality to the decision making process of every and all participants in the economic process, from the Fed to the buyers of houses.

Elliott Wave theory and Kondratiev works both provide some insight in why this happened, pointing out to animalistic or natural macro processes that overcome and supersede the individual decision making process. Both works are incomplete, and new scientific evidence may improve upon them. For instance, it is necessary to study the brain chemistry of the inflationary process and how we humans are naturally an inflationary animal. The psychological process that we identify as desire (and which may manifest itself as greed, lust or simple general neurotic dissatisfaction) is at the base of both market activities and the capitalist society as a whole. This is a chemical process that combines the emission of certain reward compounds and the memory of the effect that those compounds had on our brain cells. While most other animals seem to lack this memory of the effect (or at least have a much higher threshold ) and they may repeat the same activities over and over obtaining the same level of satisfaction, we humans need to increase the amount of those compounds to better the previous experience. The study Evolutionary Cognitive Neuroscience. and further studies in evolutionary cognitive neuroscience may start providing the basis for further study in this area.

If scientific studies prove that our desire for making money is just an environmental response based on an evolutionary trait, they will help providing a better answer to the existence of capitalism than the mystical invisible hand of the markets or a supposed inherent and natural desire of humans for making profits. It will also explain why the Marxist theory failed to describe the economic reality and why the experiments of dictatorship of the proletariat eventually reverted to the same patterns of search for individual profit common to the capitalist society.

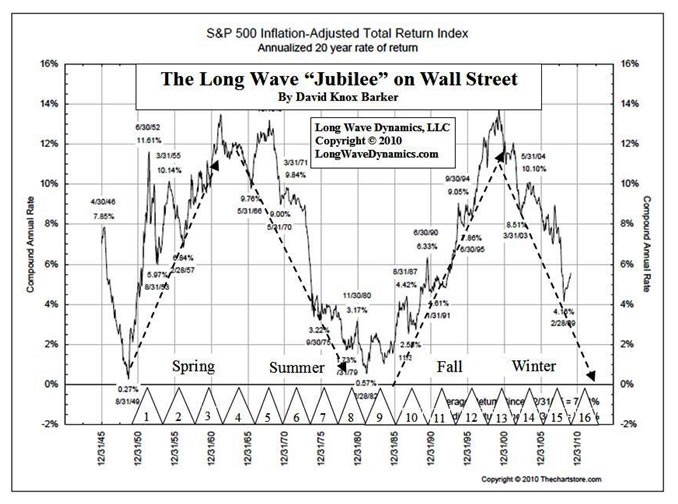

The most current criticism of Gann, Elliott and Kondratiev is that they dont work a fact that is true. However, those theories worked in the past and my own simulations of past market activities show that they did explain certain economic processes and were able to predict future economic processes. However, they were all created during an historical period while prices were all expressed in constant money, money attached to the actual production capacity of the whole of human society by its correspondence to the amount of gold accumulated by humans and assigned to monetary activities.

After 1973 in the US, and in general from the 1930 period onwards for different countries, any analysis of the past could not be extrapolated into the future. The reason is that the market prices in the US after 1973 have not correlation whatsoever with market prices prior to 1973. The last great Elliott prediction was during the 80s, when the current data series was close enough to the previous data series as to make a projection feasible. After that, as the new data series diverged more and more from the previous data series, any and all predictions tended to be wrong by definition. A similar destiny awaited those trying to use Gann and Kondratiev to look into the future.

For instance, measured in constant US dollars (as if they were still gold backed) the Dow Jones shows the pattern predicted by Elliott and it is now in a great depression. However, the economic reality is not based on those dollars, and thus the Elliott pattern does not reflect the economic reality. This may be heralded by the proponents of the floating currency as the ultimate defeat of the natural forces by sheer use of intelligence. My contention, however, is that those forces are not defeated; are pretty much alive and they show in other areas of economic activity (although that needs to be demonstrated and is not the object of this article).

Lets just say that before disregarding the theories, it is necessary to make further study of why they stop working and that before embracing them it is necessary to create a framework of reference in which they may prove useful.