Why Falling Prices Should Be Welcomed By Preferred Stock Investors

Post on: 16 Март, 2015 No Comment

As the Federal Reserve tries to decipher the economic tea leaves and the rest of us try to second guess what the Fed’s conclusions will be, the dividend income of preferred stock investors has realized a nice uptick.

In anticipation of a period of increasing interest rates, newly introduced preferred stocks have started offering higher dividend (coupon) rates in order to remain competitive with the increasing yields offered by existing issues [1].

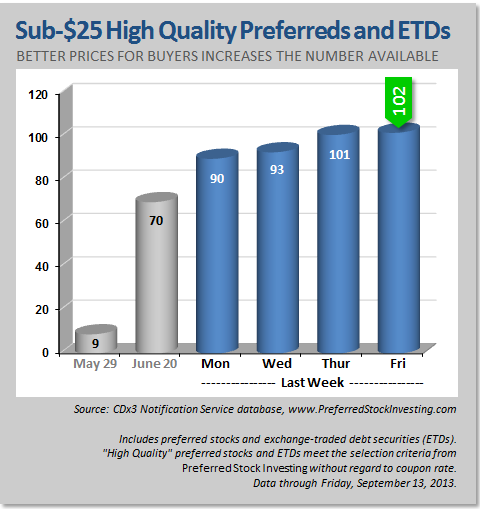

The uptick in new issue dividend rates was triggered by a much-awaited fall in preferred stock prices — first during late-May through mid-June then again during the first week of August (see the June 12 article Preferred Stock Buyers: Time To Start Paying Attention ).

Hopefully, the higher returns available for lower market prices are indicative of a return to a buyer’s market for preferred stocks, a market that will be free of the distortions caused by Quantitative Easing, the Fed’s bond-buying program.

Take Advantage of Rate and Price Changes Over Time

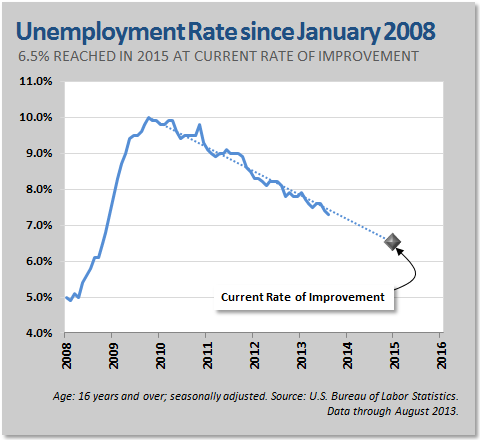

Rates go up and down over time and the last thirteen years have been no exception — 2001 to early-2004: Decreasing; mid-2004 to early-2009: Increasing; mid-2009 to mid-2013: Decreasing.

As rates fluctuate, your preferred stock portfolio will swing from favoring dividend income (during higher rate/lower price periods) back to favoring capital gain income (once rates fall again, pushing up the price of your shares).

It is for this reason that savvy preferred stock investors are long-term investors, taking advantage of the known inverse relationship between rates and prices over time.

Those trying to apply shorter-term investing strategies to a preferred stock investment frequently exclude themselves from the opportunity to take advantage of longer term rate and price changes.

Lower Prices Produce Better Results

Preferred stock investors have historically earned their highest returns from preferred stocks purchased during periods of lower market prices — the type of conditions that we now appear to be transitioning into.

Let’s look at some real data. From a researcher’s perspective, the extreme conditions of 2008 shined a big bright light onto market behaviors that are usually harder to measure. Dividend rates, pushed up by cash-starved banks, rose sharply during the crisis, pushing prices down just as dramatically making the benefits of buying high quality shares during such conditions easy to see.

Wells Fargo (NYSE:WFC ) provided two examples that year with BWF (7.875 percent, March 7) and WCO (8.625 percent, August 14), both since redeemed.

Prices were falling at the time so shares were available for prices well below these securities’ $25 par value (WCO shares actually fell below $20 shortly after its August IPO).

Two years later, once rates came back down and prices went back up accordingly, BWF and WCO shares were being sold for $26.69 and $28.31, respectively. Shareholders who purchased their shares in 2008 while prices were falling and held them until rates changed direction again realized effective annual returns of 14.7 percent and 56.3 percent on these two high quality preferred stocks.

This chart shows the results when long-term preferred stock investors, having the patience to take advantage of rate and price fluctuations over time, buy high quality [2] shares during periods when prices are falling (e.g. 2008) and sell those same shares once rates swing back down again (e.g. 2010/11) and prices, accordingly, go back up [3].

The extreme conditions of 2008 (high rates accompanied by commensurately low prices) make this mechanism easy to see and measure. More typically, Effective Annual Returns (EAR) earned by adding a capital gain on top of the dividend income that these securities provide have been lower than the 35.52 percent seen in the above 2008 chart.

The following chart shows the average Effective Annual Return earned by those using this longer term strategy with high quality preferred stocks since 2001.

The chart assumes that the investor invests in every high quality preferred stock issued over this twelve year period. For an individual investor, that is an unrealistic assumption since doing so involves 170 individual preferred stocks; individual results will, therefore, vary.

Successful Preferred Stock Investing is Long-Term Investing

Traditional preferred stock investors are buy-and-hold investors; they’re in it purely for the great dividend income and rarely sell. That’s their choice. But I think you can see the benefits of using a period of lower prices to add a downstream capital gain on top of your dividend income.

Adding a downstream capital gain assumes that you hold your shares long enough to take advantage of the fluctuations in rates that occur over time (assuming that rates go up and never come back down would ignore several decades of history). It is for this reason that successful preferred stock investing is long-term investing. Those applying a more short-term approach are unlikely to be as fortunate.

As prices move up and down with rates over time, the value of your preferred stock portfolio will move up and down as well; expect it. Patience, at times, will be required. But remember that the market price of a preferred stock only matters on the day you buy it and on the day you sell it (either to another investor or back to the issuing company upon redemption [4]).

While no one likes seeing their portfolio value fall, until you sell your shares such price movement is irrelevant to your preferred stock investing strategy. A period of falling prices is a time to consider buying additional dividend-paying shares, not sell.

Those more used to common stock investing can find this point difficult to digest since value investors are squarely focused on a run-up in price. For value investors, price movement determines the success or failure of their investment.

But successful preferred stock investing is a longer term proposition; its success takes advantage of rate changes and the known effect on prices over time.

While I understand the reasons behind the Fed’s monetary policies, those policies have artificially raised market prices while decimated savers and risk averse income investors for over two years now. The sooner the Fed gets out of our marketplace, the better. As the Fed backs out and prices head toward normal (set by buyers and sellers), preferred stock investors will be treated to increasing dividend payers available for lower market prices, positioning themselves for increased dividend income plus a downstream capital gain.

Footnotes:

[1] Source for all preferred stock data in this article: CDx3 Notification Service database and Preferred Stock Investing, Fifth Edition (PreferredStockInvesting.com ). Disclosure: The CDx3 Notification Service is my preferred stock email alert and research newsletter service and includes the database of all preferred stocks and exchange-traded debt securities traded on U.S. stock exchanges used for the first chart this article.

[2] High quality includes preferred stocks and exchange-traded debt securities that meet the ten criteria from chapter 7 of my book, Preferred Stock Investing. For example, high quality preferred stocks (1) offer cumulative dividends (if the issuing company skips a dividend payment to you they still owe you the money; their obligation to you accumulates), (2) are rated as investment grade and (3) are issued by a company that has a perfect track record of never having suspended a preferred stock dividend.

[3] This chart shows the Effective Annual Return of the indicated securities when purchased and sold using the preferred stock investing method described throughout Preferred Stock Investing, Fifth Edition. Chapter 17 itemizes the investing results of every high quality preferred stock issued between January 2001 and December 2012 using the buying and selling method described throughout the book. The data for this chart was taken from the itemized results for preferred stocks that were introduced during 2008 found within that itemization. For an explanation of Effective Annual Return as applied to a preferred stock investment see Preferred Stock Investors: What Is Your Rate Of Return?

[4] Upon redemption, shareholders receive the security’s par value ($25 per share in this case) in cash from the issuing company. The perpetual ownership trap is a phenomenon that can occur when an investor purchases a preferred stock with a very low dividend rate. Low dividend paying preferred stocks are less likely to be redeemed by their issuer than higher payers. Further, a period of falling prices tends to affect low dividend payers more quickly and severely than higher payers so shareholders of such a low-payer may find their shares hard to sell without realizing a capital loss. The perpetual ownership trap is easily avoided by (1) keeping a 0.5 percent cushion above the bottom of the barrel rate at any point in time (Preferred Stock Investing. page 141) and (2) using a technique called upgrading to keep up with increasing interest rates (Preferred Stock Investing. page 179).

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Securities identified within this article are for illustration purposes only and are not to be taken as recommendations.