Why Do People Think Public Info Gives Them an Investing Edge

Post on: 20 Август, 2015 No Comment

One born every minute

“There’s a sucker born every minute.”

Michael Cassius McDonald

I use Google as the host for my e-mail. I pay a very low price for their business apps, and in exchange for the low price, I get to see their ads.

Usually, I ignore the ads because Ive gotten used to them over the years and dont see anything which particularly captures my attention.

Today was different.

I saw this ad:

I’m glad that I shave my head because if I didn’t, I’d start pulling my hair out.

Don’t get me wrong. I like the Motley Fool. They have some great advice there. I read the Motley Fool Guide to Investing or whatever it was called with the picture of the two founders dressed up as jesters way back when it came out. Their advice is pretty Foolish, with a capital F.

Still, headlines like this just make me cringe.

I’m also not calling The Motley Fool out on the carpet. I included them in my Ultimate Guide to Day-to-Day Finance for a reason. I am calling out the media (and, yes, I have a column for U.S. News & World Report. so there’s a hand in my mouth right now as I’m biting it) for putting out articles like this to give the people the impression that they have some sort of insider information which will help them get rich because now they have a stock tip.

News flash: you won’t get rich off of investing on these “insider” angles and stories. The market might be irrational, but it’s pretty efficient. If there’s a strength or a weakness in a particular sector, then chances are excellent that it’s been sniffed out already. There’s not an odd cash flow statement that some analyst at any one of a number of investment banks hasn’t already pored over, analyzed, and made the trade on to take advantage of it.

Your informational advantage is zero.

Let’s say that I did click on the link in this ad. Let’s say, furthermore, that I decided to actually buy the banks that were recommended, Wells Fargo (WFC) and Bank of America (BAC).

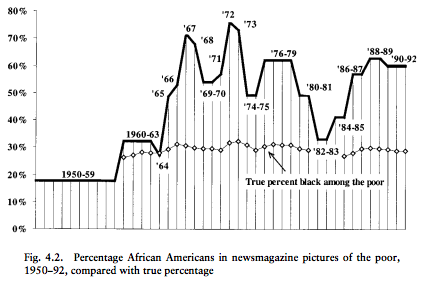

There was already a runup! These are the daily charts for both stocks.

Did the stocks both rise the moment that the editor at fool.com decided to hit the publish button? Probably not, but there sure is a coincidental runup on both stocks at very similar times, isn’t there? Unless you’re a speed reader and then a speed typist who could make Mavis Beacon red with envy, you’re going to be behind the crowd who is dumping their money into these stocks a la the Cramer Effect.

Why do we think that we can use this information to give us an up on the average, ordinary, everyday Joe? Monkey Brain falls victim to a bias called the attentional bias. As Yales Dr. Truett Allison explains, this is a bias which occurs when you focus on only one possible outcome rather than focusing on all of the possible outcomes.

Continues Below

Subscribe to Receive My 52 Week Financial Game Plan and Get a Free E-Book!

YOU: “Maybe we shouldn’t invest all of our money in that stock just because Jim Cramer said to do so .”

MONKEY BRAIN: “STUPID HUMAN. WE NOW HAVE SECRET KNOWLEDGE. MAKE GAZILLIONS.”

YOU: “Um, that covered call on those pork snout futures wasn’t a bright idea, was it?”

MONKEY BRAIN: “MESS UP BECAUSE YOU WERE IN CHARGE. ME IN CHARGE NOW. WARREN BUFFETT RICH. ME SMARTER THAN WARREN BUFFETT.”

In the situation I described at the beginning of this article, falling victim to attentional bias would mean that you would only envision buying the stock before anyone else figured out that the stock was a great buy, and you’d ride it to the top, where you’d presciently be able to determine the highest price it would ever make, and sell right at the peak, taking your money and moving to Tahiti to drink umbrella drinks.

You’d fail to consider all of the other possible outcomes: you’re the last sucker in, or, it was actually a good stock recommendation, but then the banking sector collapsed as CDO markets dried up, killing the liquidity, and causing another government bailout. Instead of looking at the range of outcomes and weighing up the probability of each of the outcomes, you focus on one – the best outcome – and, mistakenly, give it a 100% chance of succeeding.

In order for you to succeed at this type of plan, the market would have to be both irrational and inefficient. Irrational markets would mean that the stock would be undervalued compared to what it should be based on business outlook. Inefficient markets would mean that information is not rapidly incorporated into the stock price. I am a firm believer that the markets are irrational, as investors are human, and all of them have Monkey Brains running around in their heads suggesting investments. However, I am also a firm believer that markets are efficient in that investors process information very rapidly and incorporate that information into buying decisions whether or not the buying decisions are right or wrong.

So, even if there were some sort of breaking news which absolutely, positively had a predictable, telling effect on an individual stock, by the time you were able to do anything about it, the opportunity most likely would have passed, because there would be enough demand in the stock to drive the price up to a point where it would be fairly valued. In fact, because of herd mentality and investor psychology, there’s a reasonable chance that the stock would quickly become overvalued because of all of the retail investors piling in because they saw some headline on the Motley Fool and didn’t understand how the news affected the true enterprise value of the company. Guess on which side of the valuation line your purchase would most likely wind up?

Am I full of crap? Can you make money investing in stocks that you read about on boards and websites? Tell us about it in the comments below!

The Winning With Money course offers 20 lessons, 8 worksheets, and several exercises designed to provide you with the answers you need to have certainty in your financial life. Stop spinning your wheels and take action!