Why do firms engage in mergers and acquisitions Describe a recently completed merger between two

Post on: 16 Март, 2015 No Comment

Extracts from this document.

Introduction

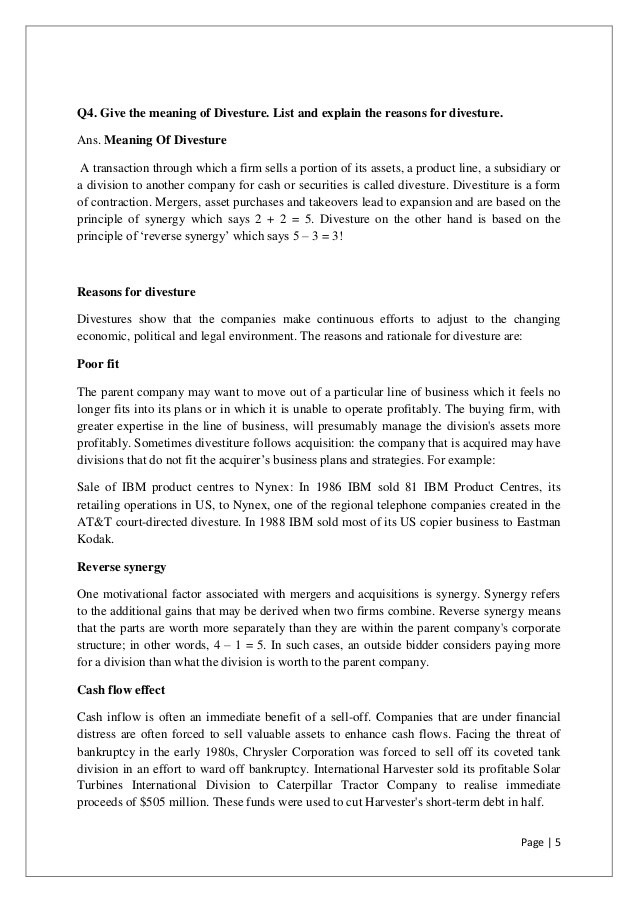

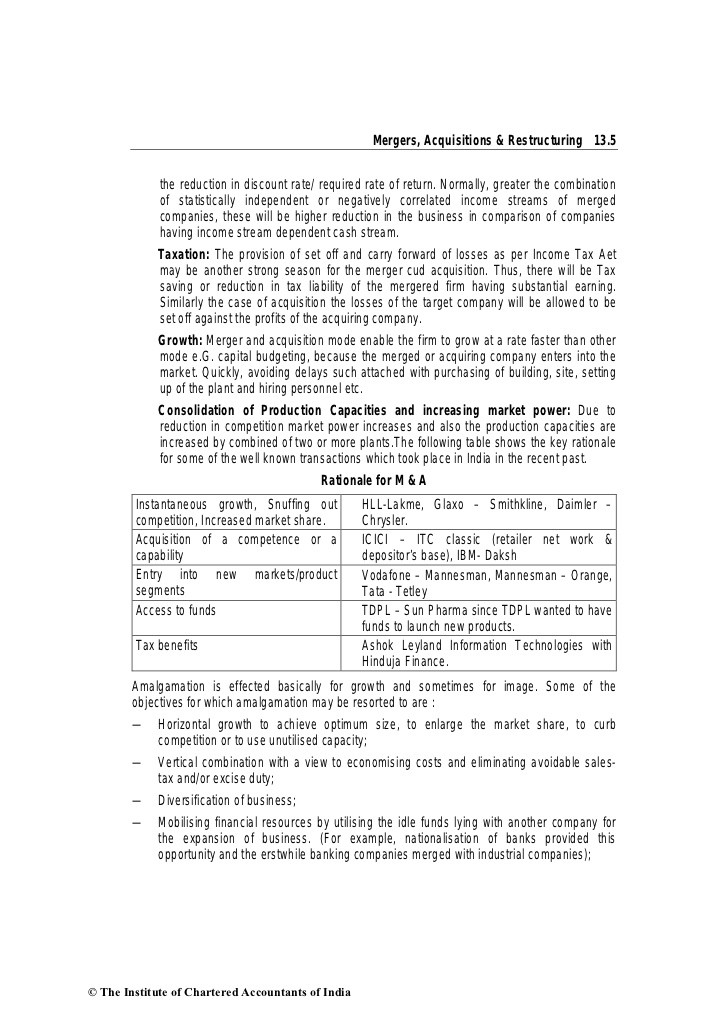

Why do firms engage in mergers and acquisitions? Describe a recently completed merger between two firms identifying the specific reasons given for the merger. Firms merge with or takeover another company for different reasons: Growth; The fastest way for growth to occur is to be involved in a merger and because of this it is the main basic factor for merging, diversification; entering different markets in order to cut the dependency on current product range (conglomerate integration), market power; when two rival companies merge the new company has an increase in market power and reduces the competitiveness of the market. A firm may also merge with the intent to asset strip but this is a short-term attempt to increase cash flow and is more likely to involve a horizontal integration type of merger. There are four main types of business integration, horizontal, vertical backward and forward and conglomerate integration. Vertical integration occurs when one firm takes over or merges with another in a different stage in the production process where-as a horizontal integration occurs when one company merges with another at the same stage of production in the same industry, out of the four types of integration this is the most common with such examples like EasyJet taking over Go and Coca-Cola taking over Orangina. Synergy is a commonly used word to explain why mergers and takeover occur; it means that combining the businesses will produce one enterprise that is more powerful and efficient. . read more.

Middle

By 1996 WH smiths pulled leaving boots to record a loss of 6.7 million for the year, with Boots now in full control they turned things around in the Following year and a profit of 2.5million was made; however in comparison B&Q made 167 million profits that year. Boots decided to pull out and write of the 400 million it spent trying to make it a success, learning from the DIY disaster Boots agreed to stick closer to home in areas it has strong reputation and expertise.(1) Merger of Boots and Alliance UniChem Boots’ efforts to broaden its retail offering over the last ten years — offering dentistry, chiropody and laser eye surgery — have proved largely unsuccessful. The merger between these two companies will create one of Europe’s largest drugs, beauty and healthcare groups with sales of more than 13bn. Although Boots offers a variety of services and is an established household name in the UK, Boots has been struggling in the face of stiff competition from supermarket giants Tesco and Asda. Boots has seen its sales fall in recent years as supermarkets have aggressively targeted the toiletries and over-the-counter medicines markets. The merger with Alliance UniChem would enable the new company to regain market share in these areas and with the expanse of Alliance UniChem into European markets where Boots have failed to impact, a potential whole new market can be captured. Unichem said it had paid close to 18m ($31.2m) . read more.

For the companies’ share prices it has been good. Boots jumped more than 7% in early trading, while Alliance UniChem climbed 5%. This gives shareholders an increased confidence for the merger as the quantitative data suggests success; however, the feel-good factor surrounding Boots may be down to expectations of a bidding war for the retailer, rather than optimism that the merger will revolutionise its business.(4) This merger of these two companies suggests benefits for both the consumer and the shareholders, as decreased cost (suggested 100 million) will give the shareholders better dividends, and should also results in lower prices for the customer, this could be a direct result of lower costs gained by economies of scale from becoming a larger company, or lowering the general market costs because of the increased competition. There are people who see the merger as not a good idea and resources could be better spent, Critics complain that the company has run out of ideas and the merger is a last ditch attempt to revive the business by an increasingly desperate management. Instead of taking on more shops, Boots should be looking at ways of getting the most from their existing floor space, cutting costs and polishing up their brand name, they say.Critics also complain that a merger very rarely delivers on all of its promises, and destroys shareholder value rather than enhancing it. . read more.

The above preview is unformatted text