Why Car Charging Group s Slow And Steady Approach Might Help It Win The Race Ecotality Inc

Post on: 22 Июль, 2015 No Comment

Note: This article covers micro-cap stocks. Please be aware of the risks associated with these stocks.

On Aug. 8, ECOtality, Inc. (ECTY) notified the U.S. Department of Energy that if it is unable to obtain additional financing, it may not be able to fulfill its obligations as outlined under the Electric Vehicle (EV) Project. In response, the DOE suspended all payments to the company, the likely outcome being ECTY’s bankruptcy. The announcement follows a number of other EV industry bankruptcies — A123. Coda. and Better Place. to name a few — and raises questions as to the future of the EV industry and the companies that rely on it. This article aims to answer some of those questions.

ECOtality, Inc.

First, a look at ECTY. The company runs three separate lines of business: Blink, a consumer EV charging station solution; Minit Charger, an industrial charging solution; and ETEC LABS, a research and development unit. In 2009, the DOE awarded the company $99.8M to help it expand its EV charging network. Since then, ECTY has reported revenue growth from $13M in 2010, to $28.4M in 2011, and $54.7M in 2012. The company’s profit margin was (17.5%) in 2012, improving from (79.1%) in 2011. At first glance, these figures look reassuring. A more detailed analysis however, suggests otherwise.

More than 70% of the revenue that ECTY generated during 2012 was from expansion of its Blink network, funded by the DOE. The revenue growth the company reported is therefore not an accurate representation of the growth of the industry. The $99.8M grant ECTY received from the DOE was subject to predetermined targets, which forced the company to aggressively drive revenue growth and expand into a market that was not big enough to financially justify the infrastructure it created. ECTY is now at the point where the infrastructure is in place, but there are not enough EVs on the road to meet the company’s operational expense. The key point is that this does not mean the EV industry as a whole is in trouble, just as it does not mean that its constituent companies do not warrant investment.

The EV Industry

In 2011, the EV industry sold 45K vehicles. In 2012, this more than doubled to 113K vehicles. Battery costs are falling, from $1K per kilowatt-hour (kWh) in 2008 to $485/ kWh last year. Global EV stock is rising, currently at just over 180K vehicles. The 15 governments that make up the Electric Vehicle Initiative (EVI) are targeting 20M EVs on the road by 2020, with 7.2M EV sales for the same year. What these figures suggest is that the market is set to grow exponentially in the coming five to 10 years and, in turn, EV industry companies should position themselves to take advantage.

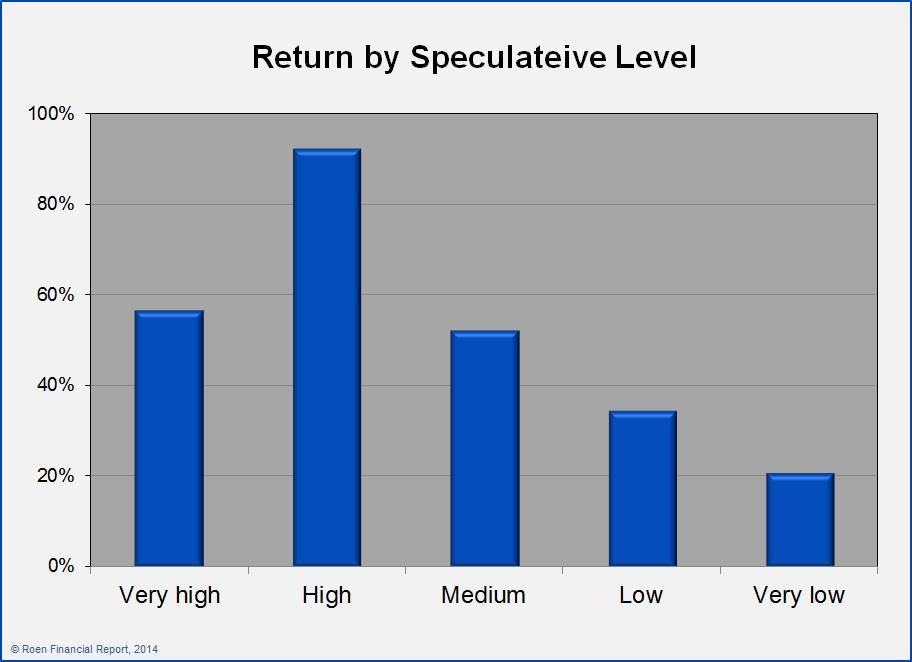

History illustrates that with emerging sectors, a large number of companies start up and as the industry matures, this large number consolidates into a smaller number of surviving companies. The slower the market expands, the higher the number of companies that run into trouble. The bankruptcies over the past year are a direct result of this consolidation. Investors, therefore, should be looking for and to benefit from one of the surviving companies. One such company is Car Charging Group, Inc. (OTCPK:CCGI ).

Car Charging Group, Inc.

CCGI is a company that provides electric charging facilities for drivers of EVs, primarily in the U.S. The company’s business model revolves around buying and installing EV charging stations, and charging EV drivers a service fee for their use. CCGI derives its revenue from this service fee, splitting it with the real estate owners. The majority of CCGI’s charging stations utilize level 2 chargers that take anywhere between two and four hours to fully charge a battery. For this reason, and so that users can occupy themselves during the charge, the majority of the stations are installed on real estate such as hotels, malls, and food outlets.

This year, the company acquired Beam Charging, EVPass, and 360Green, and is currently the world’s largest independent owner of public EV charging stations. Financially, CCGI is small but growing. The company reported a 400% increase in revenue between 2011 and 2012, from $62K to 258K. Gross profit rose from $242 in 2011 to $59K in 2012. Net loss for 2012 was just over $5.2M, rising from $1.1M in 2011, but for a development stage company in the emerging tech sector this is not unusual.

What Advantage Does CCGI Hold Over ECTY?

The advantage that CCGI has compared to ECTY is rooted in the speed with which ECTY grew, and the size of the market that the company requires to sustain its operations as a result. ECTY reported 2012 operational expense at $30.5M, compared to CCGI’s operational expense for the same period of $5M. Admittedly, ECTY generated much more revenue for the period, but as already mentioned, it derived approximately 72% of this revenue from its Blink network installation, the funding for which came from the company’s DOE grant. As of last week, ECTY had drawn upon $96M of its grant, leaving approximately $4million, which at the company’s current burn rate will be accounted for long before the end of 2013. Its operational expense for the three months ended March 31 this year was $6.4M. Annualized, this equates to approximately $26M, the majority of which will have to be met without the help of the DOE. The current EV market simply is not big enough to meet those costs. Conversely, CCGI’s operating expense for 2012 was $5.2M.

One company has built a secondary market for a primary market that does not fully exist. The other is slowly building a secondary market, which will encourage the expansion of the primary market it is designed to support. CCGI is gradually acquiring charging stations, and forming strategic partnerships with real estate owners, ready to take advantage of the exponential growth of the EV industry that analysts predict. ECTY is ready now, but as of yet there is no such advantage to be had.

Risks

As with any development-stage company in emerging tech, there is a certain level of risk associated with holding CCGI stock. In order to maintain its advantageous position, the company must be able to finance its operations until the EV industry grows and it can generate revenue that meets expense. Sale of capital stock is currently financing the majority of expense, and this is likely to be the case for the foreseeable future. Mitigating this risk is that as of March 2013, CCGI reported that it had just over $1M in cash resources to meet its current obligations, and that management believes the company has sufficient resources to fund operations until at least March 2014.

There is also the risk that, contrary to analysts’ expectations, the EV industry will not become — or take much longer to become — commercially accepted. If this is the case, the suppliers of the infrastructure, such as CCGI, will suffer. Again this risk is somewhat mitigated by the quantifiable increase in EV sales, the government support behind the industry and the increased environmental awareness of the typical consumer.

Conclusion

The impending bankruptcy of ECTY is a result of grant-funded, aggressive expansion into a market that at present cannot support the financial requirements of the company. In no way does it reflect the state of the industry as a whole, or its remaining constituent companies. CCGI has steadily developed a network of charging stations that will serve to alleviate consumers’ concerns over range issues, and in doing so should help stimulate growth in the industry. If the company can maintain its low operational expense and continue its steady expansion while the industry matures, it could become a leader in a potentially huge market.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Since you’ve shown interest in ECTYQ, you may also be interested in