Why bonds are risky right now for your portfolio The Globe and Mail

Post on: 29 Май, 2015 No Comment

With a greater concern for preserving their wealth rather than building more, high-net-worth individuals confronting volatility tend to look for lower-risk investments. But the Catch-22 these days is that traditionally lower-risk vehicles may present higher risk in the long run.

The first step is determining your financial goals. Second, create a basic plan with a financial adviser that has flexibility built into it for those moments when you are feeling a bit more positive or, conversely, a bit more risk averse.

Laura Wallace, vice-president and portfolio manager in Bank of Nova Scotia’s private client group, tells clients to figure out what rough mix of stocks and bonds is likely to meet their needs over the long run, and then establish a range of exposures to equities.

“It might be a 40- to 60-per-cent equity range, for example,” she says. “What we find is that making a pre-established range when times are calm allows you to make the right decision when times are crazy.”

Ideally, you would be at the bottom end of the range and buying stocks at a time like the fall of 2008, when markets imploded. And you would be at the top end of the range and selling stocks during a euphoric period, such as the peak of the Internet bubble in 2000.

What about right now? Ms. Wallace suggests being at the mid-point of your range.

This is due to two factors, she explains. Due to low interest rates, fixed income securities are offering only tiny returns at best, especially once you factor in taxes and inflation. Also, stocks may be cheap, but most experts don’t expect them to rise in the near term.

“We think there’s going to be a fair amount of volatility over the next six months or so, and so the combination of those two things leaves us in the mid-point of our asset range mixes,” Ms. Wallace says.

In other words, since bonds are offering pitiful returns, they are actually a risk to a portfolio.

“I see 10-year treasuries, even Government of Canada bonds, as being one of the riskiest asset classes over the next 12 to 24 months,” says Scott Hall, a vice-president and portfolio manager at Canaccord Financial.

Even a whiff of higher interest rates could push bond returns broadly into negative territory.

But with markets up and down, potential economic crises and slow growth expected for the while, stocks are also risky.

Stocks will continue to be a risk for the next three to 10 years as the global debt super cycle works its way through the financial system, predicts Paul Taylor, chief investment officer at BMO Harris Private Banking.

“Because we accumulated too much debt, economic growth rates are going to be more modest for an extended period of time,” he says. “And therefore earnings in the stock market are going to be tight. Equity markets are just not going to be on this massive upward swing that we’ve been accustomed to in the past.”

And if a default of Greece or another European country sparks a liquidity crisis, all bets are off.

Still, many advisers lean to equities for the long haul, though they differ in their strategies. “Longer term, now probably more so than ever, equities offer better relative value than fixed income vehicles,” says BMO’s Mr. Taylor.

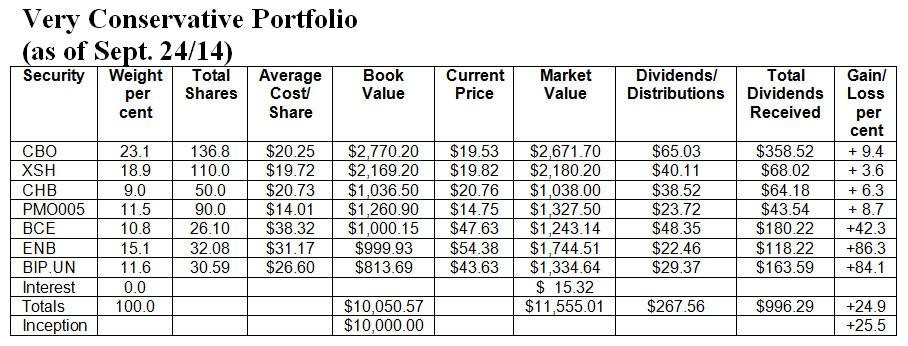

If volatility doesn’t scare you, you might want to kick it up a notch. Why own bonds that yield 2.5 per cent when you can own shares of BCE that yield more than 5 per cent? “If you can wait out the volatility, you’re going to be better off in the BCE stock,” says Scotiabank’s Ms. Wallace.

On the other hand, “with the markets having just rallied 23, 24 per cent off of the October lows, our advice at this point is to probably be looking to take some risk off the table and adopting a slightly more defensive posture, not putting new money to work,” says Canaccord’s Mr. Hall. “If anything, right now we are raising cash. Our expectation is that the markets will in all likelihood pull back, maybe as much as 5 to 10 per cent, after this 20- to 25-per-cent rally. At which point in time we would then look to deploy our cash.”

Mr. Taylor suggests, “Assemble a portfolio of very high-quality securities, some Government of Canada’s, some quality provincials, some blue chip corporate bonds. Hold some convertible debentures, hold some relatively juicy preferred shares, and hold some straight common shares in absolutely blue chip franchises.”

Ms. Wallace adds that she likes natural resources and Canadian financial institutions right now. Mr. Hall says that commodity trading accounts and managed future accounts are good ways to increase your return profile without excessive risk. He is a fan of emerging markets, particularly Brazil, and for high-net-worth clients with an appetite for some risk, he is making use of private equity investments, including smaller oil and gas firms.