Why Actively Managed Mutual Funds Are Investing in ETFs

Post on: 8 Апрель, 2015 No Comment

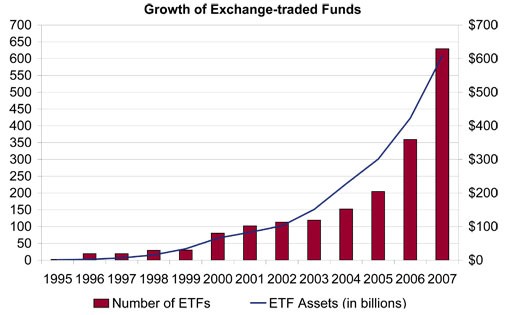

NEW YORK ( TheStreet ) — Actively managed mutual funds traditionally earned their fees by picking the most attractive stocks and bonds. But these days more portfolio managers are investing in ETFs.

According to Morningstar, hundreds of mutual funds have taken the plunge. More than 130 active mutual funds own SPDR S&P 500 (SPY ). Investors in the S&P 500 ETF include Columbia Dividend Income (LBSAX ). Hartford Growth Opportunities (HGOAX ) and AllianceBernstein Dynamic All Market (ADAAX). More than 80 funds have invested in iShares MSCI EAFE (EFA ). including PIMCO Global Multi-Asset (PGMAX ). Sterling Capital Strategic Allocation Equity (BCAAX ) and USAA Global Opportunities (UGOFX ).

Not so long ago, active mutual funds stayed clear of ETFs. After all, active managers were supposed to outdo benchmarks — not load up on index funds. But gradually portfolio managers have discovered that ETFs can play useful roles. ETFs can be convenient ways to gain market exposure quickly, says Cory Banks, managing editor of ETF Report.

Portfolio managers use ETFs in a variety of ways. While some managers take big positions in ETFs, many funds have only limited stakes. Vanguard Windsor (VWNDX ). an active large value fund, has 0.9% of its assets in Vanguard Value ETF (VTV ). and Vanguard Morgan Growth (VMRGX ) has 0.8% in Vanguard Growth (VUG ).

For such active funds, ETFs can offer easy ways to manage cash. Say investors suddenly pour money into a fund, and the portfolio manager can’t decide which stocks to buy. To avoid sitting in cash — which could be a drag on returns — the manager could hold an ETF as a temporary measure.

ETFs can also be used to manage taxes. Say a manager has a loss in a stock but doesn’t want to give up on the holding. The fund can sell the shares, book the loss, and put the proceeds in cash. Under IRS rules, the manager must wait more than 30 days to buy back the shares. Instead of keeping cash, the fund may decide to hold an ETF for a few weeks and then repurchase the original stock.

ETFs have become popular with asset allocation funds. These attempt to outdo the benchmarks by shifting sector allocations. By using ETFs, portfolio managers can quickly target asset classes. AllianceBernstein Dynamic All Market uses a mix that includes futures and ETFs. The fund recently had 20% of assets in SPDR S&P 500 and 5% in Vanguard MSCI Emerging Markets ETF (VWO ) .