Which Retirement Plan Is Right for Me Traditional IRAs Versus Roth IRAs Versus 401(k)s and 403(b)s

Post on: 16 Июль, 2015 No Comment

Kelly writes in:

Im reading about retirement and I see terms like Traditional IRA and Roth IRA and 401(k) thrown around without really explaining what they are or what the differences between them are. Do you have a summary of these plans and how they work?

Theres no better time than the present to offer up some great fundamental personal finance information like this. Im going to ask a series of basic questions about retirement plans and provide the answers for each type of plan so that you can clearly see how they differ in each area.

I myself have had a 403(b) in the past and I currently have a Roth IRA.

One important point to make: this is a summary of the differences between the plans. Plans often change over time as the government alters the tax code and many plans have loopholes that appear and disappear as the years go by. The goal here is to not provide a be-all-end-all reference, but to make clear the big differences between the plans.

Right off the bat, lets clarify a key point. A 401(k) and a 403(b) are essentially the same thing. The difference between the two is whether or not your employer is a for-profit entity (a business) or a certain type of non-profit entity (such as an educational institution). In terms of the employee, theyre virtually identical in their usage. Some types of non-profit entities also offer a 457 plan, which is very similar to a 401(k)/403(b) except with a few less restrictions on withdrawals.

Who Offers the Plan?

How can you get involved in each type of plan?

A Traditional IRA is offered directly from investment houses. In order to open a Traditional IRA for yourself, you have to open an account with an investment house.

A Roth IRA is offered in the same way as a Traditional IRA. You have to set up your account yourself with an investment house .

A 401(k)/403(b) is offered through your employer. Your employer sets up an arrangement with an investment house to provide individual 401(k)/403(b) accounts to their employees. Rather than having a choice of investment houses, you are stuck with using whatever investment house your employer provides.

Which has the advantage? The IRAs have the advantage here. Because you have the freedom to choose which investing house to use and can move from investing house to investing house, these companies have good reason to offer you strong investment options. With a 401(k)/403(b), youre locked into whatever investment house your employer negotiates with, which may or may not provide you with the best investment options. This doesnt mean that the investment choices in a 401(k)/403(b) are terrible; usually, it just means that the fees are a bit higher than they would be with your own IRA.

Who Is Eligible?

Which people are eligible for each type of plan?

You are eligible for a Traditional IRA if you are under the age of 70 1/2. You must also earn some sort of income from work or be married to someone who earns income from work.

You are eligible for a Roth IRA if you are eligible for a Traditional IRA. The requirements are the same.

You are eligible for a 401(k)/403(b) if you are employed by an organization that offers such a plan to its employees.

How Much Can You Invest?

How much money can you invest in each plan each year?

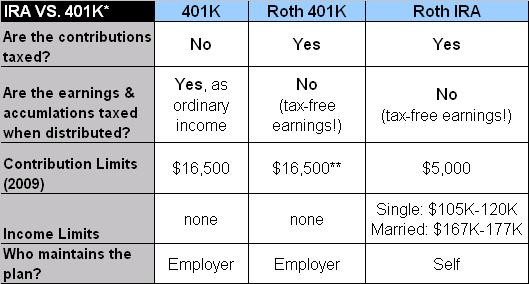

In a Traditional IRA, you can invest $5,000 per year if you are under 50, or $6,000 per year if you are over 50. These numbers are accurate for 2011 and may go up in future years (theyve gone up in the past).

In a Roth IRA, you can invest the same amount as in a Traditional IRA. However, there are income caps for investing in a Roth IRA. If you are single and earning between $107,000 and $122,000 or if youre married and earning between $169,000 and $179,000 per year, your upper limit is less than $5,000 or $6,000 per year. If youre over the top end of that range, you cant invest money at all into a Roth IRA this year.

In a 401(k)/403(b), you can invest up to $16,500 per year as of 2011.

Obviously, in this regard, 401(k)/403(b) plans are the big winner as you can invest more in them.

What Tax Advantages Are Included?

The purpose of a retirement plan is to take advantage of tax breaks. What tax breaks do you get with each of these plans.

A Traditional IRA offers the ability to make contributions that are fully tax-deductible. In other words, if you contribute $5,000 to a Traditional IRA in 2011, you will be able to subtract $5,000 from your taxable income when you file your taxes early next year. This results in a smaller tax bill right now .

A Roth IRA contribution does not offer the tax deductibility of a Traditional IRA contribution. Instead, once you contribute to a Roth IRA and have the account for at least five years, you can withdraw any money in the account tax-free (gains or otherwise) once youre 59 1/2 years old. This results in a smaller tax bill later on, as Traditional IRAs require you to pay taxes with all withdrawals from the account.

A 401(k)/403(b) operates much like a Traditional IRA in this regard. You make contributions today that are fully tax-deductible with regards to your taxes for the coming year. However, there are no tax benefits when you withdraw.

Which is better? It depends strongly on what you think tax rates will do in the future. If you expect them to stay the same or go down, then the Traditional IRA and the 401(k)/403(b) route is better. If you expect them to go up, then the Roth IRA is better. I expect them to go up, so I give the Roth IRA the nod here.

When Can I Withdraw?

I have this money in the account. When can I take it out without a stiff tax penalty?

You can withdraw from a Traditional IRA at age 59 1/2 or any time after that. Withdrawals made from a Traditional IRA will be viewed as income and taxed as such. You must start taking withdrawals at age 70 if you havent already started.

You can withdraw from a Roth IRA at any time (once youve had the account for five years) as long as you merely withdraw your contributions. You can begin to withdraw your investment gains at age 59 1/2. You do not have to start withdrawing at age 70.

You can withdraw from a 401(k)/403(b) in almost exactly the same way as a Traditional IRA. You may start withdrawing at age 59 1/2. The withdraws you make are taxed. You must start withdrawing at age 70.

The Roth IRA is clearly the most flexible account here. There are no tax penalties for withdrawing contributions early. Theres also no requirement to begin withdrawing at age 70.

How Can I Withdraw Early?

What if I desperately need the cash early? This is usually a bad idea, but its worth knowing.

You can withdraw early from a Traditional IRA if you pay a 10% additional tax penalty on your withdraws. This is beyond the normal income tax youd have to pay on it. So, if you withdraw $10,000 from a Traditional IRA early and are in the 25% tax bracket, youll pay $2,500 in taxes on it plus an additional $1,000 penalty. There are some exceptions to these rules for special situations.

You can withdraw early from a Roth IRA if youve had the account more than five years. At that point, you can withdraw contributions with no penalty and no tax. If youve not had the account for that long, youll have to pay a 10% tax penalty on your early withdrawal. If you withdraw above and beyond your contributions before youre 59 1/2, youll have to both pay taxes and a 10% penalty on those additional withdrawals. There are some exceptions to these rules for special situations.

You can withdraw early from a 401(k)/403(b) much like a Traditional IRA. You pay a 10% additional tax penalty on your withdraws beyond the normal income tax youd have to pay on it. As always, there are some exceptions to these rules for special situations.

Again, the Roth IRA is the best deal here. It offers more flexibility with early withdrawals than the other plans.

A Final Factor

At this point, a 401(k)/403(b) plan looks like the worst option, but there is one huge factor in that plans favor. With many employers, the employer will offer matching contributions. For example, one employer that I know of offers one-to-one matching of every dollar an employee contributes to their 401(k)/403(b) up to 6% of the employees pay. So, if the employee makes $50,000 per year and contributes 6% of that which would be $3,000 per year the employer would match that, giving that employee a total of $6,000 invested each year.

This blows away the benefits offered by other plans. The strength of this kind of multiplying of retirement funds is the best tool you have available to you if your employer offers it.

What Should I Do?

Heres my take on the plans as a whole and how I invest for my own retirement.

If my employer offers matching funds on my 401(k)/403(b) plan. I take advantage of those matching funds first. I would contribute as much as possible to retirement to get every drop of matching funds. This is free money that you should never turn down.

After that, I would fully fund a Roth IRA if I were eligible for it. If you make less than $100,000 a year, youre eligible for it. Find a trustworthy investment house. but do your own research and open a Roth IRA with them. Theyll make it easy for you to open the account and set up an automatic investment plan that pulls money from your checking account.

If I wasnt eligible for a Roth IRA. I would fully fund a Traditional IRA.

If I was still not saving 10% of my income for retirement. I would invest enough in my 401(k)/403(b) to add up to 10% of my salary. So, for example, if I were making $100,000 a year and I contributed $4,000 to my 401(k) to get matching and $5,000 to my Roth IRA to fully fund it, Id still only be saving 9% per year. Id contribute another $1,000 to my 401(k) to get to that 10% threshold.

I would then pay off any and all debts I have. Before contributing more than 10%, I would get myself to complete debt freedom. I would also take care of buying whatever house I wanted to live in for the long term and make sure that I was saving for major purchases like automobiles. Riding a merry-go-round of debt eats away at your retirement like anything else.

If I were completely and securely debt free, I would increase my personal retirement savings to 15% of my income. This might mean fully funding a Roth IRA, contributing more to a 401(k), or even just saving money in a savings account or non-retirement investment account.

That is the plan I would follow at my age (32, as I write this). My only exception to that is that if I were over 35 and hadnt saved for retirement yet, Id put the 15% total savings at a higher priority than total debt freedom, as you have some retirement ground to make up for the years you werent saving.