Where To Find Income For Retirement

Post on: 18 Май, 2015 No Comment

As any retiree can tell you, accumulating money for retirement is only half the battle. Figuring out how to convert those savings into a reliable income stream during retirement is what throws many for a loop.

Ch. 3: Retirement decisions

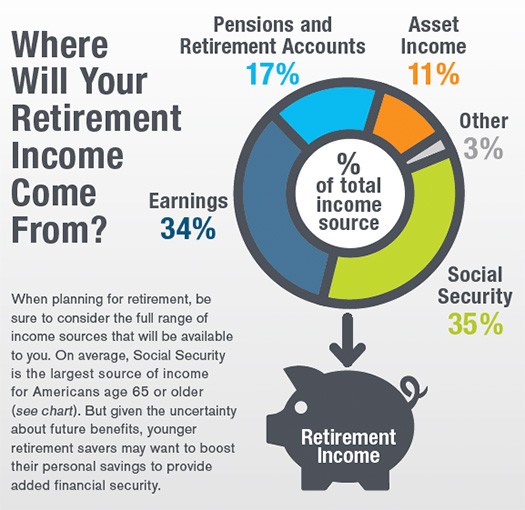

Indeed, with pensions going the way of the electric typewriter, retirees are forced to fend for themselves, using a combination of dividends, interest paying bonds, annuities and systematic withdrawals from their equity portfolios to create cash flow.

A new category of products aimed at providing income payments during retirement. however, is making that job easier.

DB(k) retirement plan

The newest player in the line-up, which became available in 2010, is the DB(k) plan — a combination pension and 401(k).

Made possible by the Pension Protection Act of 2006, DB(k) plans allow businesses with 500 or fewer employees to offer workers a 401(k) savings option, while also providing a small, guaranteed lifetime monthly income during retirement. The pension part is equal to 1 percent of final average pay multiplied by the number of years of service, or 20 percent of the employee’s average pay during the five consecutive highest earning years.

The defined benefit (pension) portion of the plan becomes fully vested after three years.

Under the defined contribution part of the plan — the 401(k) — employers who provide the DB(k) are required to automatically enroll workers at 4 percent of their salary, and offer a 50 percent, fully vested match.

The push is already on to make such plans available to larger employers as well.

Monthly income funds

Heeding the call to provide retirement income on a regular basis, several mutual fund concerns have introduced monthly income funds in the last three years, including Fidelity, Vanguard, Schwab, Baron, Russell, ING, John Hancock and Pimco.

Some return your capital and are intended to liquidate by a particular date while others attempt to maintain or grow your principal amount through retirement.

The funds, which go by many names, combine income-generating bond funds and varying degrees of equity exposure to help retirees generate a targeted — but not guaranteed — annual payout. They are designed to supplement other sources of retirement income, including annuities, pensions and Social Security.

Fidelity’s Income Replacement funds, for example, rely on professionally managed withdrawals to create regular payments that seek to keep pace with inflation. It offers no-load as well as adviser versions of these funds.

The company notes its series of income replacement funds can be used to bridge an income gap or cover expenses until other income sources become available. For example, some retirees may wish to postpone receiving Social Security or pension payments so they can get larger payments from those sources in the future.

Because the funds are new, long-term performance information is not available. But because of their diversified holdings, it’s a good bet that they won’t fly as high as the S&P 500 in bull markets or sink as low as that benchmark in bear markets. The performance snapshots below bear this theory out.

For example, Fidelity Income Replacement 2024 (FIRNX), which uses a payment strategy designed to liquidate the fund by 2024, posted a 36 percent return over the one year through February, compared to a 54 percent gain for the S&P 500. Since the fund’s inception in August 2007, the fund lost 1 percent while the S&P 500 fell 8 percent.