What You Need to Know About Gold ETF

Post on: 23 Июль, 2016 No Comment

Is a Gold ETF the Right Investment?

What is a Gold ETF?

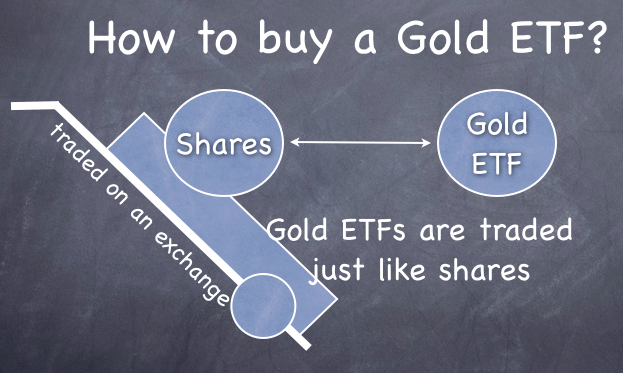

A gold exchange traded fund is commodity ETF that consists of only one principle asset, Gold. However, the fund itself consists of gold derivative contracts that are backed by gold. You do not actually own any gold. Even when you redeem a gold ETF, you do not receive the precious metal in any form. Instead, an investor receives the cash equivalent.

What is the Purpose of a Gold ETF?

The strategy behind a gold ETF is to track and reflect the price of gold. While the assets in the fund are backed by the commodity, the intent is not for an investors to own gold. A gold ETF gives an investor an opportunity to gain exposure to the performance of gold.

What are the Advantages of a Gold ETF?

Gold tends to rise when the dollar is weak, so if your investment portfolio has risk to the dollar’s downside, purchasing a gold ETF may help you hedge that exposure. Selling a gold ETF can help if your exposure is to the upside.

A gold ETF is a commodity exchange traded fund that can be used to hedge gold commodity risk or gain exposure to gold itself. If an investor has risk when the price of gold rises, owning a gold ETF can help reduce risk on that position. Or if after ample research an investor decides to short gold, trading an inverse gold ETF may be a quick way to put on that position.

And while gold is a commodity ETF, it can act as an industry ETF as well. For example, if an investor wants to gain exposure to the gold mining industry, owning a gold ETF may be an investment strategy that can fit his or her portfolio. While there are individual gold-mining stocks like Barrick Gold (ABX) and precious metals indexes like the XAU, a gold ETF may be a simpler or more diverse way to make an investment in the gold mining industry. There are a lot of benefits that come with ETFs and therefore sometimes they are a solid tool to have in one’s investment arsenal.

Gold ETFs can also be applied as a hedge for regional risk or to gain foreign exposure. If a certain country is solely dependent on gold as its main source of income, and investor with risk in that country can short a gold ETF as protection. So if gold drops, the short ETF position will help lessen the loss.

What are the Disadvantages of Gold ETFs?

As I mentioned, if you are seeking to actually own a gold asset, you cannot do so through a gold ETF. At no time do you actually own a gold bar, bullion, or even a ring. Gold ETFs are made up of gold contracts and derivatives and can only be redeemed for cash, never gold itself.

While ETFs have many tax benefits. a gold ETF may be at a disadvantage. In some cases and locations, gold ETFs do not have the same capital gain tax breaks that tradition exchange traded funds have. So before you dive into gold ETFs, understand how they will affect your tax return.

What are the Most Popular Gold ETFs?

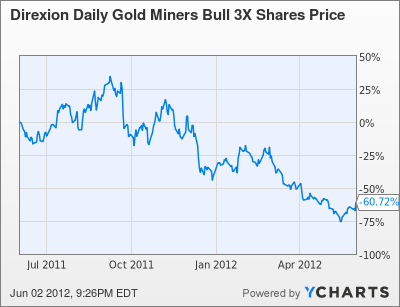

There are many types of gold ETFs to explore, but before you include them in your investment strategy. I advise you to watch the performance of a few of the more popular funds and see how they act. Once you have a better understanding of gold ETFs, then you can get started by deciding which ones best fit your portfolio. Here are some gold ETFs to keep an eye on.

If this has tempted you to research more gold and precious metal ETFs, here is more diverse and inclusive list. A List of Gold ETFs