What You Need To Know About Dividend Investing

Post on: 16 Март, 2015 No Comment

November 15, 2013 Craig Adeyanju Follow me on Twitter here.

Dividend investing has become a practice for people who look to secure a steady stream of income in retirement. It’s a pretty reliable practice – it offers lower risk than capital growth investing.

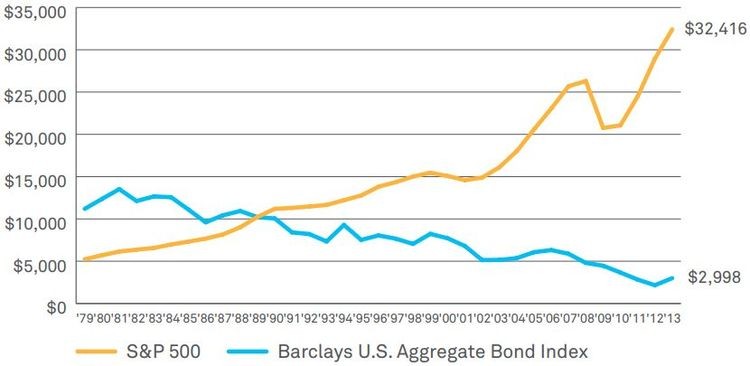

Even during the great recession, dividends understandably fell 23%, but that’s just about half the total fall of the entire market. But there are a number of things you need to consider when investing for dividend .

High yield isn’t everything

Most dividend investing articles that you’d find around lay so much emphasis on yields. It’s generally a good thing that a company offers high yield.

But a big question is can the high yield be sustained?

As an income investor, you’d be better off with a relatively low dividend yield stock that’s consistent than one with unsustainable high dividend yield. After all, consistency is the reason you chose dividend investing over other types of investing.

Instead of focusing on high yield, you want to consider these things.

Free cash flow matters

In general, companies pay dividends from their cash reserve or free cash flow (FCF). So when you’re looking to buy into a company for the purpose of steady income, you want to look into the history of the company’s cash reserve. A company that has a good track record of healthy cash reserve is good for income investing. In addition, it’s important to take note of the proportion of FCF that the company in question uses to pay dividends. Let’s consider Microsoft as an example.

Many people love to hate Microsoft these days, simply because it’s not doing mobile business the way want it. This has hindered many investors from seeing the awesome income generating ability of the company. At present, Microsoft pays an annualized dividend of $1.12 a share. In fiscal 2012, it paid about $6.4 billion in dividends out of the $29 billion+ it generated in FCF. That means Microsoft used just over 20% of its FCF to pay dividends, which is healthy.

Moreover, the rate at which Microsoft’s FCF has been increasing over the last five years suggests that Microsoft will be able to continue increasing the dividends it pays easily. Over the last five years, its FCF has increased by just over 8% on a cumulative annual growth rate (CAGR) basis.

Comparing this to the rate at which it increases its dividend payout – about 16% on a CAGR basis over the same period – only confirms our thesis that FCF matters when investing for dividend. In addition, the impressive dividend growth that comes with increasing FCF offers hope that, if the trend continues, Microsoft will keep increasing its dividend payout. This model should fit into just about company, provided the company isn’t struggling with debt.

Just so you can understand the significance of FCF, let’s compare Microsoft with Google – which doesn’t pay dividend at the moment. A Yahoo Finance article claims that if Google were to use all of its FCF to pay dividends, its yield would be 4.6%, which is less than twice the yield of Microsoft that uses just over 20% of its FCF to pay dividends. If Microsoft, on the other hand, were to use all of its FCF to pay dividends, its yield would be in the region of 15%.

It’s easy to be carried away by the headlines, most of which cover short-term gains and happening companies. However, as an income investor, you need to look beyond interesting headlines to find companies that are more reliable income generators. Many times, boring businesses have strong business core, thereby enabling them to be able to provide investors with steady return through dividend.

Since we’ve already referenced a tech company coupled with the fact we have many eye-catching headlines in this sector, we’ll reference two other tech companies – IBM and Cisco.

When talking about relevance in the IT world, you’d have probably mentioned many other “big” companies before you think of mentioning any of those two. The simple reason for that is they don’t quite belong in the much-publicized mobile revolution. But both of these companies own majority of the market in some boring businesses.

For instance, IBM owns the highest portion of the server market. Cisco, on the other hand, is the leader in the networking market. These businesses are boring because they deal with raw computer algorithms, which are never pretty.

But boring IBM and Cisco are reliable when it comes to providing steady income. Over last five years, IBM has increased its dividend payout by 13.7% CAGR. Cisco started paying dividends in 2011 and has since increased its payout by about 40% CAGR. You should note that both company’s dividend growth out performs that of their respective industries.

Final Thoughts

As briefly mentioned above, debt levels also determine how well a company can perform in terms of dividend payout. So it’s important to look out for the long-term debts of companies along with their maturity before investing in them.

In addition, you should always remember that dividends were affected during the great recession. And since you’re planning toward your retirement, low risk should be your watchword. Dividend investing might offer low risk, but proper diversification of your portfolio would definitely offer a lower risk.