What Type of Investor are You Conservative Moderate or Aggressive_1

Post on: 16 Март, 2015 No Comment

When it comes to investing one cannot adopt a “one size fits all” approach. Just as each individual’s personality differs from that of another, so too does their risk profile. This is why it is essential to determine your risk profile and circumstances before making investment decisions .

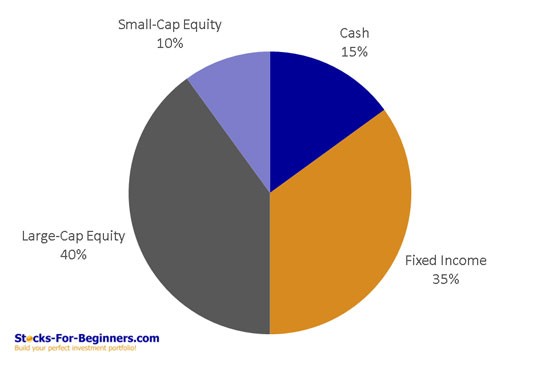

A risk profile can broadly be defined as the amount of risk that an investor is willing to take with their money in exchange for investment returns and can be split into the following main categories:

• Conservative

A conservative investor is an individual who seeks stability when it comes to investing and is more concerned with protecting their capital than increasing its real value. As a result they are normally willing to accept lower returns in exchange for capital preservation associated with short term funds.

Moderate investors are more concerned with relative yet stable growth in excess of those provided by conservative funds. They are willing to tolerate more fluctuations in exchange for more reasonable returns, but are still not comfortable enough with market risk to invest their funds aggressively.

Aggressive investors are more drawn to higher levels of risk in exchange for higher levels of capital growth. They are comfortable with volatility and fluctuations over the shorter to medium term as long as they can achieve their objective of substantially increasing their real capital value over the long term.

How to determine your risk profile

You can determine your risk profile yourself by completing the What Type of Investor are You? Determine Your Risk Profile questionnaire and calculating your risk profile based on your answers. It would also be advisable to determine your risk profile for the purpose of the investment based on your investment time frame. This can be done as follows:

Conservative = 0 – 5 years

Moderate = 5 – 10 years

Aggressive = 10 years +

By determining you risk profile based on these time frames you can avoid falling into the pitfalls of trying to time the market as this can in many cases lead to you not being able to meet your investment goals due to unexpected market fluctuations.

How to go about investing

For those investors who feel comfortable enough with their knowledge of their tolerance for risk, purpose for investing, as well as with the financial products and markets, the above mentioned information will be enough to get them started on their path to wealth creation. For those of you who need more guidance in terms of investing for whichever purpose you may require, it is recommended to consult with a financial planner.

How to go about finding the right financial planner

When it comes to finding the right person to help you with your investments and financial planning in general the following factors are of significant importance:

Trust is of the utmost importance when it comes to discussing your investment portfolio. When meeting with a financial planner consider whether you feel that he/she is trustworthy as their advice will determine your wealth creation or lack thereof.

Accreditation

At an initial meeting with a financial planner they are obligated to provide you with their permit to verify that they are accredited with companies with which you wish to deal and whether they are qualified to provide advice. When presented with such a permit read through it and ensure that you are satisfied with his/her accreditations before continuing. If still unsatisfied you can view the financial planners details on the FSB website to ensure that he/she is accredited for the products that you seek advice on.

Based on your discussion with the financial planner in question, consider whether this is a person that you would consider building a professional relationship with and whether you will feel comfortable in future dealings with this individual. If you feel that this person does not answer you honestly or does not display the kind of integrity that you would expect from a professional, consider discussing your portfolio with another planner with whom you would feel more comfortable.