What Is Windstreams Future For Dividend Investors 2015

Post on: 16 Март, 2015 No Comment

3A%2F%2Fwww.fool.com%2F?w=250 /% Current Windstream. Windstream Operations. Windstream REIT. Market Value. $4.9 billion. $1 billion. $5 billion. Number of Shares. 603 million. 101 million

3A%2F%2Fwww.fool.com%2F?w=250 /% With Windstream, if you look at GAAP earnings, you’ll see a dire picture of the health of the telecom’s dividend. Currently, Windstream has generated just

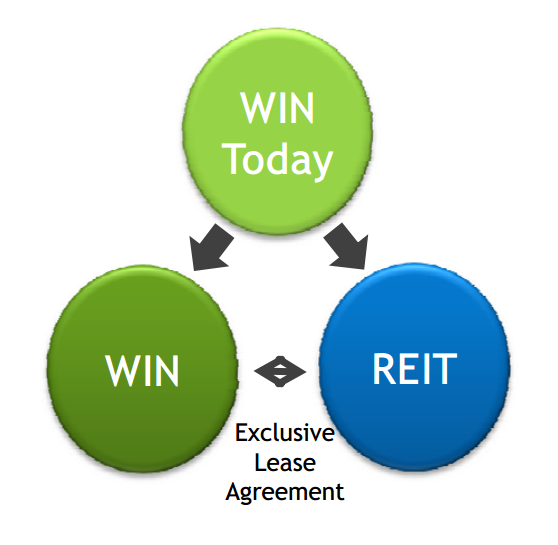

3A%2F%2Fseekingalpha.com%2F?w=250 /% In my previous article on Windstream Holdings (NASDAQ:WIN), I discussed that the management had proposed a REIT structure, in which it would spin off its

3A%2F%2Finvestor.windstream.com%2F?w=250 /% Windstream made cash distributions to you in 2012. The Distribution History of Windstream table above provides the details of these distributions.

3A%2F%2Fwww.dividend.com%2F?w=250 /% WIN’s dividend yield, history, payout ratio, proprietary DARS™ rating & much more! Dividend.com: The #1 Source For Dividend Investing

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% See the upcoming ex dividend date and dividend history for Windstream Holdings, Inc. (WIN). Stay alerted to dividend announcements for WIN and all the companies you

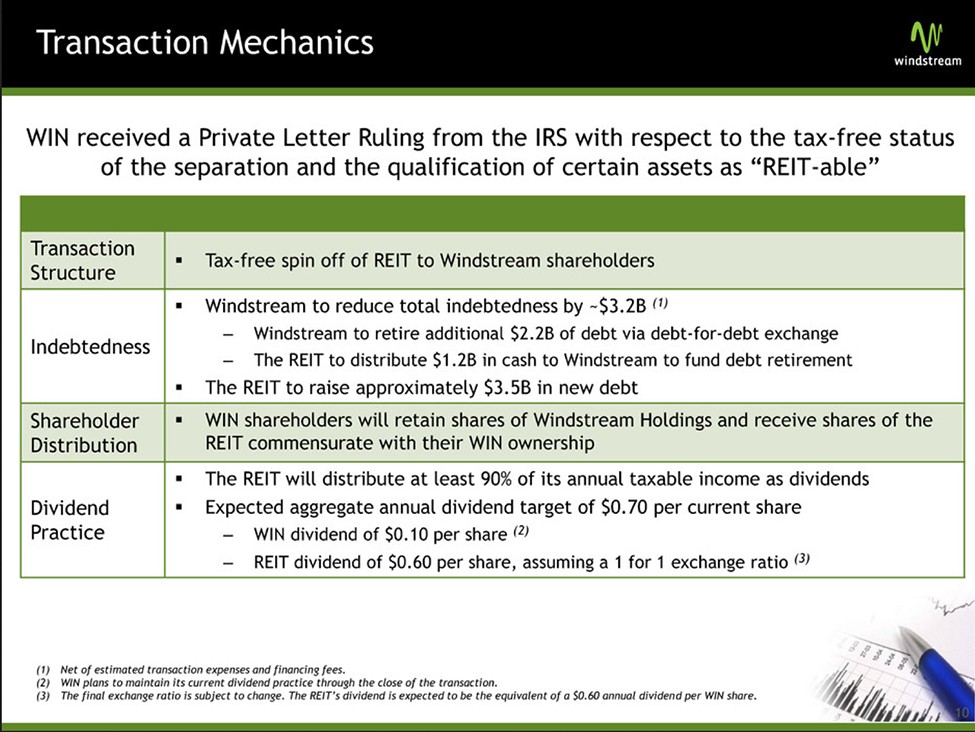

3A%2F%2Fwww.windstreamreit.com%2F?w=250 /% Windstream provided an update on its planned real estate investment trust (REIT) spinoff on Dec 18. Windstream announced it is refining the transaction structure in

3A%2F%2Fseekingalpha.com%2F?w=250 /% Summary. Windstream shares rallied on Tuesday after announcing a REIT, but this was a mistake. Windstream will put its network assets to a REIT

3A%2F%2Fwww.zacks.com%2F?w=250 /% My Portfolio Tracker Is it Time to Sell? One of the most important steps you can take today is to set up your portfolio tracker on Zacks.com. Once you do, you’ll be

3A%2F%2Fnews.windstream.com%2F?w=250 /% Windstream Newsroom official site for press releases, photos, video, audio, pr contact information, presskits and more.

3A%2F%2Fseekingalpha.com%2F?w=250 /% While past performance is no guarantee of the future, this stock has historically is will this be resulting in a dividend cut? That is one thing that has investors spooked. On the surface, yes. Right now Windstream pays $1.00 per share annually.

3A%2F%2Fwww.fool.com%2F?w=250 /% Nevertheless, with major changes to its corporate structure in the offing, Windstream will look a lot different to dividend investors in the near future. With that in mind, let’s look more closely at two things every dividend investor should know about

3A%2F%2Fwww.dailyfinance.com%2F?w=250 /% will look a lot different to dividend investors in the near future. With that in mind, let’s look more closely at two things every dividend investor should know about Windstream Holdings. 1. Windstream expects that its total dividend will fall

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% The DividendRank formula at Dividend Windstream Holdings Inc (Symbol: WIN) presently has an excellent rank, in the top 25% of the coverage universe, which suggests it is among the top most interesting ideas that merit further research by investors.

3A%2F%2Fwww.investopedia.com%2F?w=250 /% Younger investors have an unfair advantage versus their older peers in this regard. Given that dividends and compounding play such an important role in future returns important when it comes to creating a dividend portfolio. Firstly, each stock

3A%2F%2F247wallst.com%2F?w=250 /% Investors should also be extra diligent and question whether such companies can maintain their high yields. If income and cash flows are not suitable to cover the dividend payouts in the future, then there may be trouble. That is certainly not always the

3A%2F%2Fwww.gurufocus.com%2F?w=250 /% diversification process and it could yield long term benefits for investors. On the dividends front too, things are not looking rosy for the company. In the near future, Windstream will be spinning off its net assets department into a REIT (Real

3A%2F%2Fwww.mysanantonio.com%2F?w=250 /% Dividend alternatives Windstream and CenturyLink also available as attractive dividend plays, investors need to understand what sets Frontier apart. Let’s look closely at two things every dividend investor should know about Frontier Communications

3A%2F%2Fwww.benzinga.com%2F?w=250 /% Some, such as the 12.52 percent yield of Windstream (NYSE: WIN), are in the double digits. All of those dividend payments had to be approved by the board of the publicly traded company. With Bernie Madoff back in the news, the big headline for investors is

3A%2F%2Fmarketrealist.com%2F?w=250 /% In most cases, these companies maintained their dividend payouts in the past. Investors looking for high dividend yield segment—may restrict significant growth in dividends in the future. Among the large telecom companies, Sprint (S) and T-mobile