What is the value trap and how can I avoid it

Post on: 24 Апрель, 2015 No Comment

Get social

Article utilities

How many times have you heard a broker say a particular share is cheap? The one-liner would have been touted many times this week when a host of stocks hit 52-week lows and the sharemarket posted a technical correction.

But just because a stock is 20 per cent, 30 per cent or 60 per cent off itshigh doesnt mean its cheap.

Hastie Group shares fell 91per cent in the year before they were placed in administration in May 2012.

Price and value arent the same

At first glance, price and value appear understandable and intertwined. But the high number of investors who get stung after confusing a low share price with good value is evidence many fail to distinguish between the two.

Billionaire investor Warren Buffett says that price is what you pay, value is what you get; while Platinum Asset Managements Kerr Neilson believes a good company doesnt necessarily make a good investment.

He, too, says its all about the price you pay and tells would-be investors they should ask themselves two questions before they hit the buy button: Am I sure the company is worth more than its current price? And what do I see in this stock that everyone else has failed to notice?

How to find the stocks to buy

One way of measuring the best stocks to buy can be ensuring the dividend yield is above the average yield of the S&P/ASX200 Index and above the 10-year bond yield. A dividend coverage ratio above one isalso a key indicator, while the market cap of the stock should be above $500 million.

Stocks that make that grade include Commonwealth Bank, Telstra, Tabcorp, Coca-Cola Amatil, NAB and Westpac.

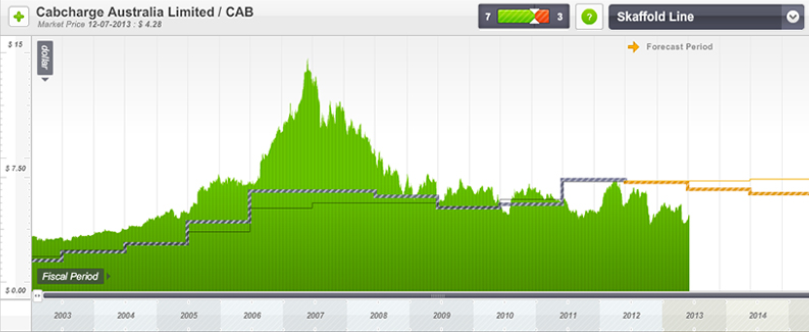

There are many ways to value stocks but the one measure used most often is the price-earnings multiple, or P/E ratio. Its beauty lies in its simplicity take the stock price and divide it byearnings per share. Itallows investors to compare one stocks value against others in the same sector or the broader market.

An earnings dilemma

But there is a hitch. When it comes to earnings, do investors use reported or adjusted earnings? Are past earnings or estimates of future earnings better? But then again, one years earnings or an average of past earnings can also be used.

Past earnings represent a rear-view look at a company and investors can also adjust or normalise numbers by taking into account a downturn in earnings due to a dramatic slowdown. Its also important to exclude one-off items.

Famed value investor Benjamin Graham preferred to use a moving average of earnings based on not less than five years and preferably seven or 10 years of numbers.

The bond effect

Bond yields can also prop up valuations. Analysts typically use the 10-year bond yield as a risk-free rate in discounted cash flow models.

Record low bond yields can boost the valuation of a companys cash flow and the valuation of its shares.

It can also mean a company could have lower debt burdens on debt with a market-linked component, boosting cash flow and profitability.

Follow us on Facebook and Twitter

You can follow Smart Investor on Twitter: https://twitter.com/#!/smartinvestr (or @smartinvestr) and on Facebook at facebook.com/afrsmartinvestor