What Is the Time Value of Money Textbook Personal Finance

Post on: 16 Март, 2015 No Comment

Last week we looked at opportunity costs. One thing to take into account when you calculate an opportunity cost is the time value of money .

The time value of money is the increases in a sum of money as a result of interest earned on that money.

Time Value and Simple Interest

For example, if I put $1500 in a 1-year CD that earns 3% APY (annual percentage yield), at the end of the year Ill have $1545. So when deciding whether or not to spend that $1500, I have to take into account that if I dont spend it, itll be worth more in a year.

To calculate simple interestinterest on a single amount of money which gets paid out once, rather than at intervals before its withdrawnmultiply the sum by the annual interest rate and the period of time. In the equation above, its $1500 x 0.03 (3%/year) x 1 (year). If it were for half a year, then itd be $1500 x 0.03 x 0.5.

Time Value and Compound Interest

But suppose that my choice is between spending that $1500 now and putting it in a CD that compounds annually for the next 5 years. This means that the interest on the CD is calculated and added to the CD each year.

To calculate compound interest that you use the same equation as above for each period its compounded for as many periods as there are in the time its invested. So if its compounded annually for 5 years, then you run a calculation for the first year, add the interest to the initial sum, calculate for the 2nd year based on that, etc.

Year 1) $1500 x 0.03 x 1 = $45 + $1500 = $1545

Year 2) $1545 x 0.03 x 1 = $46.35 + $1545 = $1591.35

Year 3) $1591.35 x 0.03 x 1 = $47.74 + $1591.35 = $1639.09

Year 4) $1639.09 x 0.03 x 1 = $49.17 + $1639.09 = $1688.26

Year 5) $1688.26 x 0.03 x 1 = $50.65 + $1688.26 = $1738.91

Thats $238.91 in interest. Not bad.

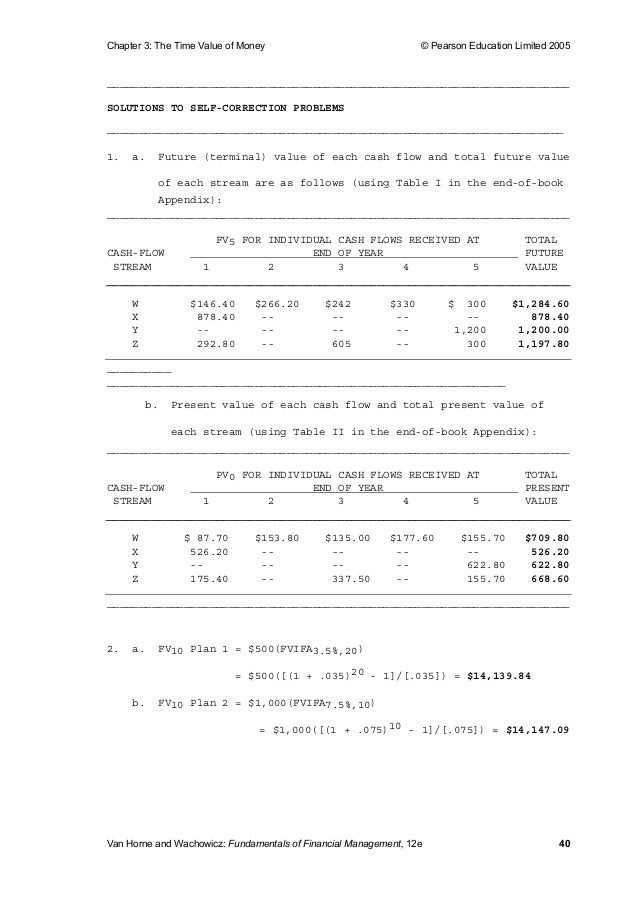

The equations get more complex as the time period of compounding gets shorter. Fortunately there are charts and calculators which will give you variables you can use or will even do the calculation for you, so you dont have to spell it all out like I did.

There are other tables and calculators which will take into account things like year addition of $500 or help you figure out how much you need to put into an account now at a certain interest rate in order to have a desired future return.

When Time Value Works Against You

Compound interest is awesome. But its important to remember that the time value of other peoples money can work against you. Suppose that you have the choice of paying off $500/month on a debt or the $200/month minimum. If the interest you can earn on that $300 difference by putting it in a savings account or CD (the stock market isnt easy to calculate in short-term situations) isnt more than the interest on the debt, then youre better served by paying it against the debt.

In most cases, the interest you pay on the debt isnt set in stone ahead of time, it depends on your monthly balance. The larger the debt you still owe, the more interest you pay.

Interest on your debts is just the time value of other peoples money (which they loaned to you).

Time Value and Inflation

The most important reason to put your money somewhere that pays off (vs. keeping it all in a 0% APY checking account) is inflation. If you have 3% more money in a year and that money is worth 3% less (due to inflation), then youre still breaking even.

Understanding the time value of money is key to making other decisionswhether its how much you can spend or how much youll need to save to get the desired amount. It shows you the long-term impact of decisions you make now.