What Is LIBOR How It s Determined How It Affects You

Post on: 16 Март, 2015 No Comment

How It’s Determined and How It Affects You Everyday

LIBOR sets the rates for most loans and mortgages. Photo: Image Source/Getty Images

Definition: LIBOR is the benchmark interest rate that banks charge each other for overnight, one-month, three-month, six-month and one-year loans. LIBOR is an acronym for London InterBank Offered Rate.This rate is published at 11 am by Reuters each day. It’s used as the benchmark for bank rates all over the world. It is published in five currencies: the Swiss franc. the euro, the pound sterling, the Japanese yen and the U.S. dollar.

The rates are determined by a calculation based on submissions from individual contributor banks. There is also an oversight panel of anywhere from 11-18 contributor banks for each currency calculated. The ICE Benchmark Administration (IBA) took over administration from the British Bankers Association (BBA) on August 1, 2014.

2012 LIBOR Scandal

Before ICE took over, the British Bankers’ Association ( BBA) managed LIBOR. It comprised the rate from a panel of banks representing countries in each of the quoted currencies. The banks were asked what rate they would charge for a given currency and a given length of time. BBA trusted that the rates quoted by the banks were the actual ones.

In 2012, Barclays’ bank was accused of falsely reporting lower rates than they were actually being offered during the period 2005-2009. As a result, Barclays’ was fined $450 million, and its CEO Bob Diamond resigned. However, Mr. Diamond said that most other banks were doing the same thing, and that the Bank of England knew about it.

Why would Barclays’, or any bank, lie about its LIBOR rate? It could make higher profits, because a low LIBOR rate is seen as a mark that the bank is more sound than one with a higher LIBOR rate. Since Barclays’ submitted a lower rate. you might have benefited, too. A lower LIBOR rate translates to a lower interest rate on many adjustable-rate loans. (Source: Business Live, Barclays’ Defense on LIBOR Fixing. July 4, 2012)

How Is LIBOR Used?

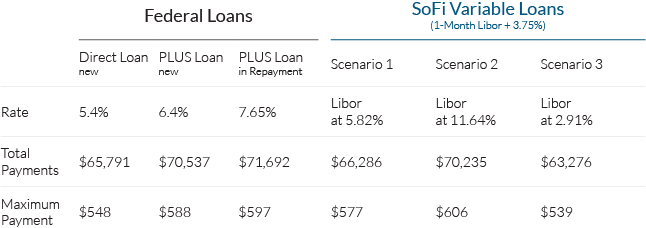

In addition to setting rates for interbank loans, LIBOR is also used to guide banks in setting rates for adjustable-rate loans, including interest-only mortgages and credit card debt. Lenders typically add a point or two to create a profit. The BBA estimated that $10 trillion in loans are affected by the LIBOR rate .

LIBOR is also the rate used to base the price for credit default swaps. These are a form of insurance against the default of loans. They helped caused the financial crisis of 2008 by lulling banks and hedge funds into thinking there was no risk to the mortgage-backed securities these swaps insured. However, when the subprime mortgages that were behind these derivatives began to default, insurance companies like AIG didn’t have enough cash on hand to pay off all the swaps. The Federal Reserve had to bail out AIG to keep all those who held swaps from going bankrupt. Even today, LIBOR is the basis for $350 trillion of credit default swaps.

LIBOR was created in the 1980s as banks called for a reliable source to set interest rates for derivatives. The first LIBOR rate was announced in 1986 for three currencies: the U.S. dollar. the British sterling and the Japanese Yen. (Source: BBA, The Basics )

LIBOR Goes Haywire in 2008

LIBOR is usually a few tenths of a point above the Fed funds rate. However, in April 2008, the 3-month LIBOR rose to 2.9% even as the Federal Reserve dropped its rate to 2%. Banks panicked when the Fed bailed out Bear Stearns. which went belly-up thanks to investments in subprime mortgages. Through the summer of 2008, banks wouldn’t lend to each other, fearing they would inherit each others’ subprime mortgages as collateral. LIBOR rose steadily, reflecting the higher cost of borrowing. In October, the Fed dropped the Fed funds rate to 1.5%, but LIBOR rose to a high of 4.8%.

In response, the Dow dropped 14% as investors panicked. Why? A higher LIBOR rate is like a fear tax. At the time, the LIBOR rate affected $360 trillion worth of financial products. The size of the problem is mind-boggling. To try and put this into perspective, the entire global economy only produces $65 trillion in goods and services.

As LIBOR rose to a full point above the Fed funds rate, it was like an additional $3.6 trillion in interest that was being charged to borrowers, but contributing nothing in return. Investors were afraid this fear tax would slow economic growth — which is exactly what it did. Not until the $700 billion bailout helped reassure banks did LIBOR return to normal levels.

However, despite LIBOR’s return to normal, banks continued to hoard cash. As late as December 2008, banks were still depositing 101 billion euros in the European Central Bank — down from the 200 billion euro level at the height of the crisis. However, it was much higher than the normal 427 million euro level. Why did they do this? They were afraid to lend to each other. No one wanted more potential subprime mortgage-backed securities as collateral. Banks were afraid their colleagues would just dump more bad debt onto their books. This means that banks were relying on central banks for their cash needs, instead of each other.

The LIBOR rate rose a bit in late 2011, as investors worried about sovereign debt default due to the eurozone crisis. As late as 2012, credit is still constrained as banks use excess cash to write down ongoing mortgage foreclosures. For more detail about the actual LIBOR rates. see Historical LIBOR Rates .

How It Affects You

If you have an adjustable-rate loan, your rate will reset based on the LIBOR rate. As a result, if LIBOR rises, so will your monthly payments. The same will happen to your outstanding monthly credit card debt.

Even if you have a fixed-rate loan and pay off your credit cards each month, a rising LIBOR will make all types of consumer and business loans more expensive. This reduced liquidity will cut back on consumer demand. slowing economic growth. Businesses that can’t expand won’t need to hire. As demand falls, they may even need to lay off workers. If LIBOR remains high, then it could create a recession and resultant high unemployment. Article updated September 10, 2014