What is Beta in CAPM

Post on: 12 Июнь, 2015 No Comment

Investopedia defines beta as

A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole

Beta is a very important measure that is used as a key input for Discounted Cash Flow or DCF valuations. In this article, we look at the nuts and bolts of CAPM Beta

Introduction to Beta

If you have a slightest of the hint regarding DCF, then you would have heard about Capital Asset Pricing Model (CAPM) that calculates Cost of Equity as per the below formula.

Cost of Equity = Risk Free Rate + Beta x Risk Premium

If you have not heard of Beta yet, then worry not. this article explains you about Beta in most basic way.

Let us take an example: when we invest in stocks, it is but human to pick stocks that have the highest possible returns. However, if one chases only returns, the other corresponding element is missed i.e. Risk.

Actually, every stock is exposed to two types of risks

- Non-Systematic Risks include risks that are specific to a company or industry. This kind of risk can be eliminated through diversification across sectors and companies. . The effect of diversification is that the diversifiable risks of various equities can offset each other. Systematic Risks are those risks that affect the overall stock markets. Systematic risks cant be mitigated through diversification but can be well understood via an important risk measure called as BETA

What is Beta?

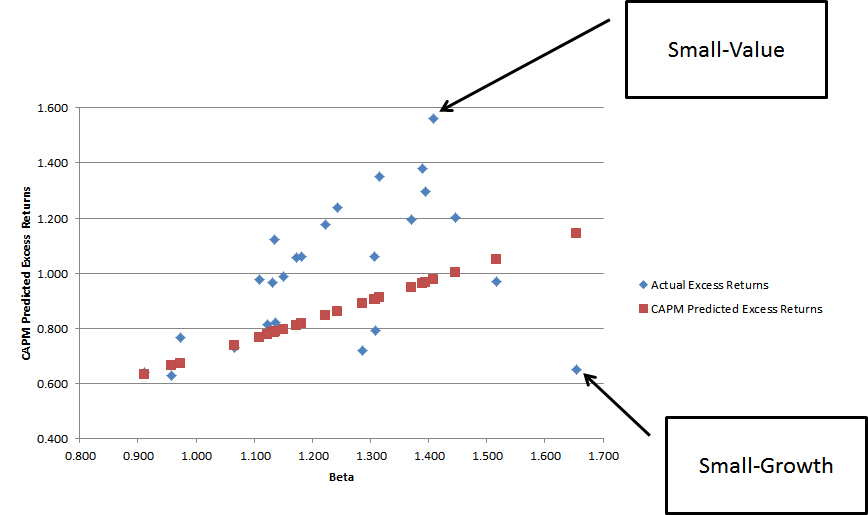

Basic Definition of Beta Beta measures the stock risks in relation to the overall market.

- If Beta = 1: If Beta of the stock is one, then it has the same level of risk as the stock market. Hence, if stock market (NASDAQ, NYSE etc) rises up by 1%, the stock price will also move up by 1%. If the stock market moves down by 1%, the stock price will also move down by 1%. If Beta > 1: If the Beta of the stock is greater than one, then it implies higher level of risk and volatility as compared to the stock market. Though the direction of the stock price change will be same, however, the stock price movements will be rather extremes. For example, assume the Beta of the ABC stock is two, then if stock market moves up by 1%, the stock price of ABC will move up by two percent (higher returns in the rising market). However, if the stock market moves down by 1%, the stock price of ABC will move down by two percent (thereby signifying higher downside and risk). If Beta >0 and Beta<1: If the Beta of the stock is less than one and greater than zero, it implies the stock prices will move with the overall market, however, the stock prices will remain less risky and volatile. For example, if the beta of the stock XYZ is 0.5, it means if the overall market moves up or down by 1%, XYZ stock price will show a an increase or decrease of only 0.5% (less volatile)

In general, large companies with more predictable Financial Statements and profitability will have a lower beta value. For example, Energy, Utilities and Banks etc, all tend to have lower beta. Most betas normally fall between 0.1 and 2.0 though negative and higher numbers are possible.

Key Determinants of Beta

Now that we understood Beta as a measure of Risk, it is important for us to also understand the sources of risks. Beta depends on lot of factors usually the nature of business, operating and financial leverages etc.

Below diagram shows the key determinants of Beta -

- Nature of Business The beta value for a firm depends on the kind of products and services offered and its relationship with the overall marco-economic environment. Note that Cyclical companies have higher betas than non-cyclical firms firms. Also, discretionary product firms will have higher betas than firms that sell less discretionary products

- Operating leverage: The greater the proportion of fixed costs in the cost structure of the business, the higher the beta

- Financial leverage: The more debt a firm takes on, the higher the beta will be of the equity in that business. Debt creates a fixed cost, interest expenses, that increases exposure to market risks

Step by Step Guide to Calculate Beta

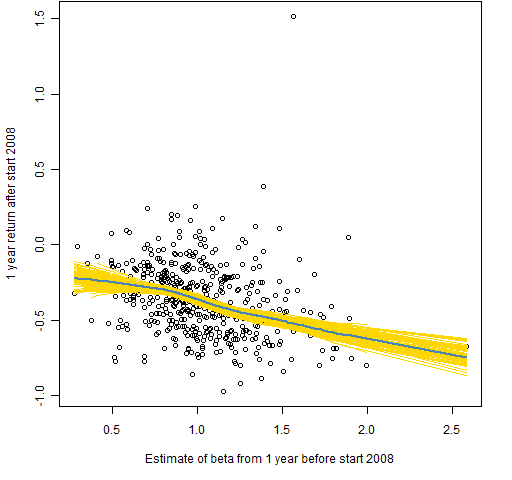

Technically speaking, Beta is a measure of stock price variability in relation to the overall stock market (NYSE, NASDAQ etc). Beta is calculated by regressing the percentage change in stock prices versus the percentage change in the overall stock market.

Let us calculate Beta of MakeMyTrip (MMTY) and Market Index as NASDAQ

Step 1 Download the Stock Prices & Index Data for Past 3 years

The first step is to download the stock price and Index data. For NASDAQ, download the dataset from Yahoo Finance

Likewise, download the corresponding stock price data for MakeMyTrip example from here.

- Sort the dates and Adjusted Closing prices in ascending order

- Delete Open, High, Low, Close & Volume Column. They are not required for Beta Calculations.