What is a Stock Worth Part 4 – Discounted Cash Flow Models Financial Education Everything You

Post on: 29 Июль, 2015 No Comment

Meta

What is a Stock Worth? Part 4 – Discounted Cash Flow Models

Editors Note: This post originally appeared on Blueprint for Financial Prosperity and Stock Market Beat. reprinted here with permission of the author.

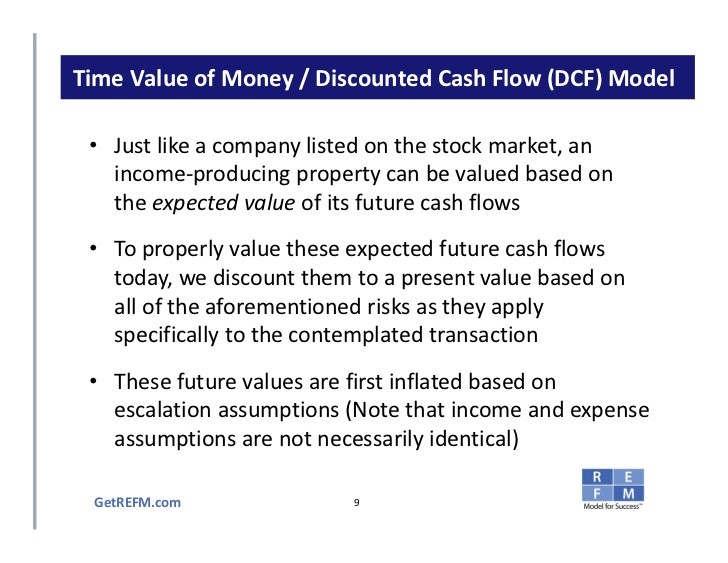

In Part 1 we showed how to calculate the present value of a cash flow that is expected to be received in the future: divide it by (1 + r) n. In Part 3 we concluded by saying the value of a stock is the present value of all the dividends the shareholder will receive, plus the present value of whatever it will be worth when the investor decides to sell it. Simple, eh?

Sure. Until you consider that an investor may hold the stock for many years (we used 35 years as an example in Part 2 ) and both the dividend and the stock price will grow at an uncertain rate in the future. For our investor, that means first forecasting each dividend for the next 35 years, as well as figuring out what the stock price will be in 35 years, then calculating their present values as follows:

D1/(1+r) + D2/(1+r) 2 + D3/(1+r) 3 … + D35/(1+r) 35 + (Ending Stock Price)/(1+r) 35. At this point, you are probably thinking “never mind. I’ll take my chances with the lower return on bonds.”

Fortunately, there is a formula that simplifies all of these calculations. It is called the discounted cash flow model. First, with a little algebra you can prove that, as long as the dividend stays the same over time the value of a stock today is equal to the current dividend divided by the required return. (V = CF/r) In Part 3 we used the example of Verizon, which pays a $1.62 dividend. If investors want to earn a 10% return on stocks (the current bond yield plus the historic average risk premium of about 5%) the stock would have to sell at $1.62/0.10 = $16.20 to be fairly priced. $32.24 sounds overvalued.

But didn’t we say that the dividend tends to grow? No problem. As long as we make the assumption that the rate of growth stays constant (or at least averages a certain rate) we can express the formula this way:

V = CF/(r-g) where g is the rate of growth. So if we make the assumption that Verizon’s dividend can grow 3% per year, the stock’s value climbs to $1.62/(0.10-0.03) = $23.14. By some algebraic manipulation, we can also figure out that at the current stock price of $32.24 investors on average expect 5% growth in the dividend.

There are even other variations of the model that allow you to assume different growth rates at different periods, but for most people the single-growth-rate model (also called the Gordon Growth Model) is sufficient.

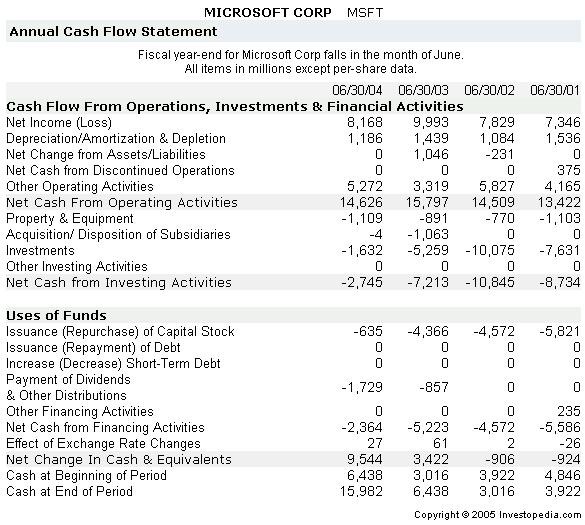

One final note: We used the abbreviation “CF” in the model rather than “D” because the model works for any definition of cash flow. The most common variants are dividends, earnings, and free cash flow. The advantages and disadvantages of these measures are summarized in the following table: