What Is a Short Sale

Post on: 16 Март, 2015 No Comment

As missed payments and mortgage defaults continue to rise, many homeowners are looking for a way out, hoping to avoid foreclosure along the way. One such way is with a “short sale.”

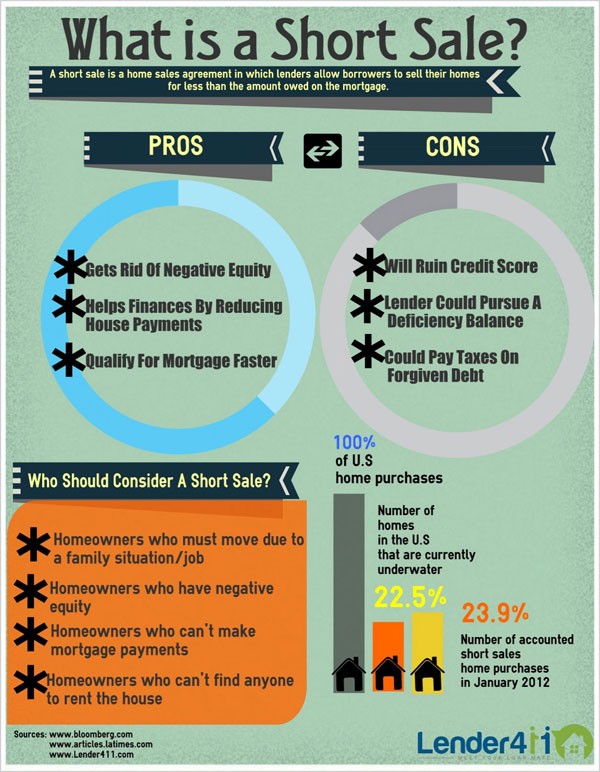

So what is a short sale anyways? Well, in short. its a carefully agreed upon sale of a property for less than the amount of the mortgage balance, executed as a means for both a homeowner and a mortgage lender to essentially cut their losses.

Although not normally a common practice, short sales have surged in popularity as a result of the most recent mortgage crisis. Typically, short sales are reserved for extreme cases when the bank or lender decides that it is in their best interest to take an early loss instead of enduring costly foreclosure proceedings. Yes, foreclosures cost banks and lenders money too.

If you’ve missed a few mortgage payments, and recently received an NOD, or Notice of Default, you may be seeking out foreclosure alternatives. But if your existing mortgage balance is greater than the value of your property (underwater mortgage ), and you don’t have the ability to make your mortgage payments in full, you could have few places to turn aside from foreclosure.

The reason foreclosures weren’t an issue in the preceding few years was due to appreciating home prices. Even if homeowners fell behind on payments, their homes would be worth more than what they bought them for, so a standard sale would be possible because they gained equity in their home beyond the mortgage balance.

Nowadays, with home prices moving sideways or dropping, homeowners aren’t so lucky. That’s why many borrowers who got into negative amortization loans or even high loan-to-value loans are finding themselves with a mortgage balance that exceeds the value of their home. Even if you put 20% down and made all your payments on time, you may have just purchased a home at exactly the wrong time, which eventually pushed your loan underwater.

Let’s look at an example where a short sale isnt necessary:

2003 Property Value: $500,000

Existing mortgage balance: $490,000

2012 Property Value: $600,000

In the above situation, though very little of the mortgage has been paid off, there is still $110,000 in home equity. so a short sale is not necessary, as the owner could sell the home and cover the cost of the mortgage with plenty of room to spare.

The homeowner in this example may have pulled cash out or opened a home equity line of credit. but because they didnt fully tap out their equity, theyve still got breathing room to avoid a short sale if theyre unable to make payments.

Here’s an example of when a short sale may make sense:

2006 Property Value: $650,000

Existing mortgage balance: $675,000

2012 Property Value: $655,000

In this example, though the home appreciated ever so slightly, the borrower was making 1% payments each month via an option arm. thus tacking additional interest on top of the existing loan balance. The result is a mortgage balance greater than the value of the home, making the situation ideal for a short sale if the borrower falls seriously behind on payments.

Of course, even those who made fully-amortized mortgage payments each month have found themselves upside down on their mortgages thanks to the precipitous drop in home prices over the past few years. This was mainly due to the zero down mortgages that were popular just at the height of the housing boom.

Clearly this was a deadly combination for even the most responsible of homeowners, which explains why short sales and foreclosures have become so prevalent.

Short Sales Are Complicated

So are short sales the answer? Before you think you’ve got the magic bullet, think again. Short sales are complicated, just like foreclosures. They take a lot of time and work, as well as cooperation from a number of interested parties, including the bank or lender, a home buyer, real estate agents, and you.

If you’ve missed multiple mortgage payments and are facing foreclosure, the bank or lender won’t automatically offer a short sale. You need to prove that your situation merits a short sale, which typically involves providing documentation that proves you are indeed in dire straits (not the band) with no other viable options. And even if your situation fits, the bank or lender must still decide if your particular situation works for them financially.

As the ailing homeowner, you’ll need to find a prospective buyer for your home. And as you already probably know, selling a home takes time, especially in today’s market. Couple that with the complicated process of assessing comparable sales in the area and the fact that the lender must decide if the price is right, and youll realize that things could take a while.

Short Sales Are a Last Resort

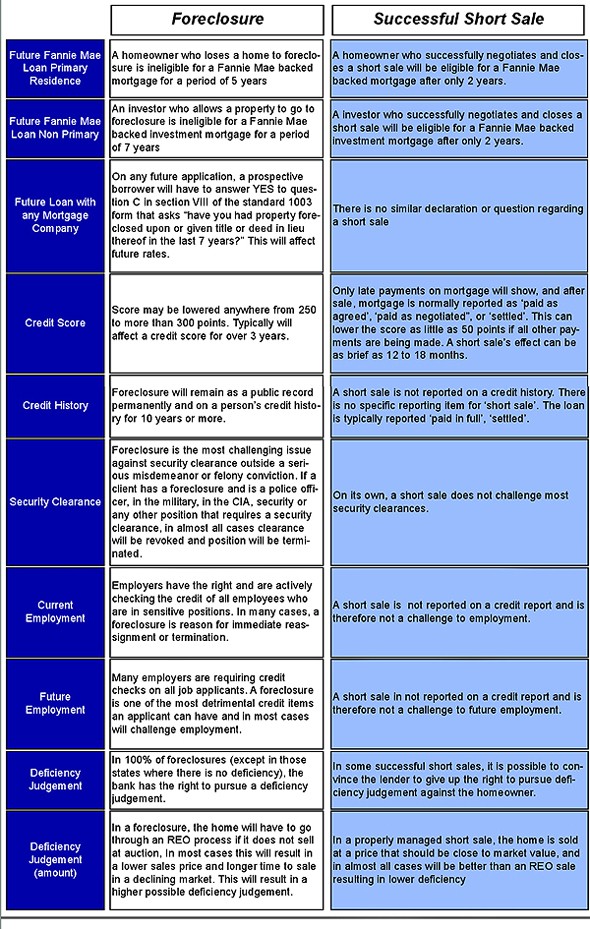

Though short sales can be a blessing to some homeowners, as they don’t do nearly as much credit score damage as a foreclosure (assuming you do them right), they should still be treated as a final option before foreclosure. Do you really want to lose your home and have difficulty buying another one in the future?

There are other options out there to stop loan foreclosure, such as a short refinance or a loan modification. and if you speak with the bank or lender servicing your loan, they’ll likely point out other alternatives first.

Ultimately, banks and lenders want to cut their losses, and they’ll do whatever is in their financial interest, first and foremost.

So if you do decide to pursue a short sale, youll need to make a strong case for yourself or you’ll likely be denied. Though the volume of short sales is picking up, it won’t always be an option. Make sure you consider all of your alternatives before making the huge decision to sell your home.