What Is A SelfDirected Roth IRA

Post on: 17 Июль, 2015 No Comment

August 2, 2011

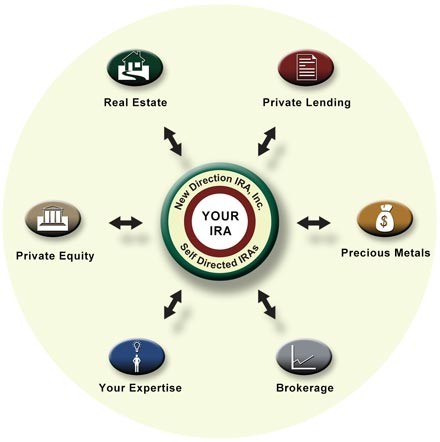

Your investments in a Roth IRA do not have to be confined simply to the stock and bonds that the mutual fund companies recommend and purchase for you. A vast majority of those investing in a Roth IRA for retirement do so inside mutual funds. But what if you had control over your Roth IRA? What if you got to pick which stocks you invested in and when you bought shares? What if could purchase an apartment building inside of an IRA?

You can, and it is called a self-directed IRA — and you can set up your self-directed IRA to be a self-directed Roth IRA too! There are many different types of investments that you can invest in with a self-directed Roth IRA. You are almost only limited by your imagination in the types of investment possibilities. You call the shots with a self-directed Roth IRA instead of a mutual fund manager or other financial planner which can make these account very appealing to many investors.

What Is A Self-Directed Roth IRA?

A self-directed retirement account is exactly what its name implies. The investor gets to make all of the choices in how his or her investments are allocated across which types of investments and asset classes. There is a wide range of investments that you can choose to place into your self-directed retirement account beyond stocks and bonds. One of the greatest benefits of these types of accounts is that you can invest in things such as real estate or partnerships inside your self-directed IRA to grow and allow you to use the proceeds in retirement just as you normally would with a Roth IRA. You can designate a self-directed IRA as a self-directed Roth IRA if you qualify to own a Roth IRA. The same income limits still apply if you are designating your self-directed retirement account as a self-directed Roth IRA account, and investors are still bound by the same annual contribution limits of $5,500 per person with a self-directed Roth IRA. All of the same rules still apply as with typical Roth IRAs, but with a self-directed Roth IRA, you determine what is invested in the account instead of someone else.

What Types Of Investments Can You Have In A Self-Directed Roth IRA?

The benefit of a self-directed Roth IRA is that you choose which investments that will help you save for retirement, and there are very few types of investments that you are not allowed to hold in a self-directed Roth IRA. In addition to the standard investments of stocks, bonds, cash, money market funds, and mutual funds, you can also hold other investments that are not typically in a retirement investment. For example, in a self-directed Roth IRA, you can purchase investment real estate to hold in your account. You can also hold other investments such as partnerships and tax liens. You are even allowed to own a franchise business in a self-directed IRA.

What Cannot Be Invested In With A Self-Directed Roth IRA?

While your investing options are typically wide open with a self-directed Roth IRA, there are a few things that the Internal Revenue Service (IRS) specifically forbids investors from holding in their self-directed IRA, both the Roth and Traditional account versions. Investors are not allowed to invest in life insurance contracts, collectibles, and S Corporations in their self-directed retirement accounts. Collectibles can fall under a wide range of items, from things such as artwork, baseball cards, memorabilia, jewelry, and other items that are considered collectible and can be bought and sold. A self-directed retirement account, whether it is in a Traditional or Roth IRA version, provides you with an incredible array of retirement investment options. A self-directed Roth IRA provides investors with a wide range of choice of investments with the benefit of the tax free growth of a Roth IRA. The self-directed Roth IRA also provides investors with an increase diversification through the sheer number of investing options that are now available to you.

Photo by Wonderlane via Flickr.