What is a Negative Cash Flow (with pictures)

Post on: 23 Апрель, 2015 No Comment

These 10 animal facts will amaze you.

Adorable animal families that will make you aww.

These 10 facts about space will blow your mind.

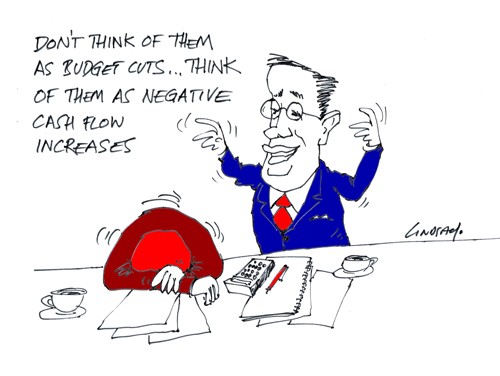

When a company spends more than it receives during a set period of time, typically a quarter, the company is said to have a negative cash flow. This is often viewed as an indicator of financial ill health by people who are assessing companies to determine whether or not to invest in the company. Many things can influence cash flow, however, and one that’s negative should not necessarily be seen as a black mark.

Publicly traded companies send out documentation of their financial circumstances to their shareholders so that the shareholders can get an idea of how well the company is doing. This documentation typically includes a cash flow statement. which breaks down the cash inflow and outflow and shows the net change in cash flow, which can be positive or negative. The cash flow statement typically includes operating, financing, and investing activities, each of which can be positive or negative.

The operating activities of a company involve the company’s core purpose, such as selling a product or service, and they usually generate a cash inflow. Financing activities involve the exchange of funds between a company and creditors or debtors, and they may be positive or negative. For example, a company servicing debt would be paying out a lot, while a company that had just financed a major endeavor might have a positive flow of cash. Likewise, a company that just paid a dividend to shareholders would probably record a negative number in this column. The investing activities refer to the company’s investment in other companies and goods, or to investments made in the company by others.

When a company records negative cash flow, it may be because the company is struggling, or it may be because the company had a number of expenses that upped outflow. Cash flow is not necessarily always linked to profit, and companies can actually record a negative one for several periods and still be profitable. Of greater concern are radical changes in cash flow between periods, or a consistent and prolonged negative period, which suggests that a company may be overreaching.

The term “negative cash flow” can be used in reference to personal finance as well as the corporate world. When people experience this as individuals, it means that they are spending more money than they are earning, which can result in long term debt and serious financial problems.