What is a Hedge

Post on: 22 Май, 2015 No Comment

I realize its been a minute since my last post, but its been an unusually busy January and first half February.

Todays blog is about hedging, and here are some of the topics Ill be discussing.

What is futures hedging? What is a hedge for a producer? Why should i hedge? How can i accomplish hedging without my own futures account?

Sometimes the most basic hedge will actually be the most effect strategy that can be implemented.

What is Futures Hedging?

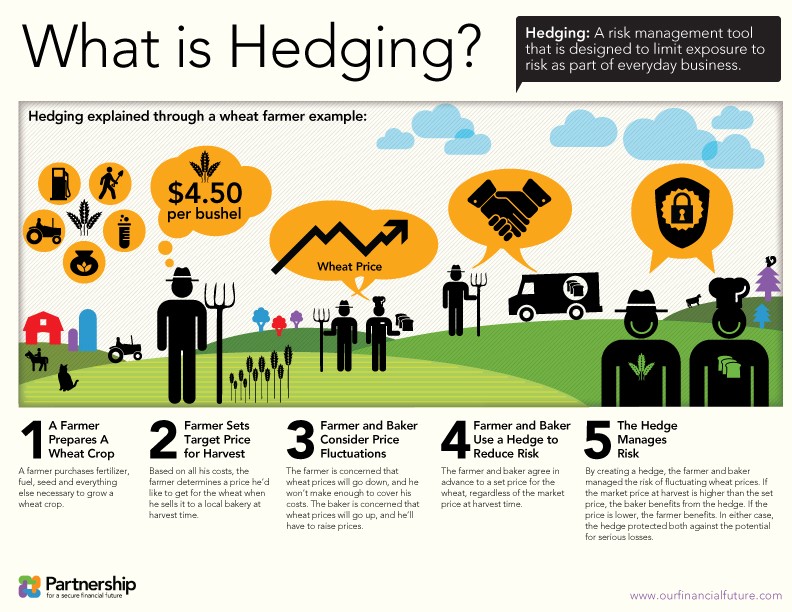

The technical definition of hedging: Making an investment to reduce the risk of adverse price movements in a commodity.

OK. you have that all figured out now right. yeah, thats what i thought. The more realistic version of this is taking an equal and opposite action in the paper market against a current position in the physical market. Ok still clear as mud?

Alright, to hedge financial risk of any commodity you just need to offset your biggest price risk scenario in the physical/cash market through a secondary paper market (futures or options). For example, if Im a grain producer Im worried about my price going lower every day; so I would sell futures or buy puts.

How does a Grain Producer Hedge his Crop?

For a producer to understand a hedge, it is important to think about their marketing in terms of Futures and Basis. Hedging will protect desirable futures levels ahead of harvest without locking in poor pre-harvest basis levels. The simplest way to enter into a hedge is to sell futures in the corn market at the Chicago Board of Trade (CBOT). This is essentially a paper trade that locks in a futures price, as long as trades are offset correctly at expiration, there is no delivery obligation.

By selling futures on the CBOT you have locked the price in on that specific quantity. Some would ask, how can that be? Let me show you a picture of what I mean.

Once you have your futures price set, you will always be even between your Physical Grain Bank and your Futures Price Bank. Huh? In the image below find the horizontal line labeled Sold Futures Price, this could be $3.80, $4.00, $5.00 it doesnt matter, but this is the price youve locked in on that specific quantity. The vertical line is your market price, it can move higher or lower than your sold price as the market trades.

So as the picture shows, if the market goes higher than your sold price, your grain bank makes money & your futures bank loses an equal amount of money on the hedged quantity. Likewise, if the market goes lower than your sold futures, your grain bank loses money, but your futures bank gains an equal amount of money on the hedged quantity.

Alright, so the picture probably helps make a little bit more sense of it all. Now lets work through some numbers.

The main principle behind the math is to buy low & sell high. Thus, if you have a sold futures position you will make money in a margin account to offset losses in the cash account when the market drops. Just the opposite if the market rallies, you will make money in the cash account and lose it in the futures margin account. The key to doing all of this successfully is lifting your sold futures the exact same day (preferably at the exact same time) as you set your cash futures. By lifting them at the same time you ensure the same futures price in each transaction. So, if I have a sold futures hedge of $4 in February and when I get to October I sell cash with a $4.40 futures, Ive got a 40c gain in the cash futures that offsets a 40c loss in the sold futures hedge.

Now, there is still a matter of basis that must be figured into your cash price, but well talk about that in another post.

So, Why Should I Hedge my Crop?

This is a question that as a grain advisor i generally respond to with why wouldnt you hedge your crop? Most responses end up in I dont know. Hedging allows you to capture desirable futures prices ahead of when you are ready to make a cash transaction. Hedging in the futures market or through a 3rd party also allows you to retain basis ownership and negotiate better basis levels closer to delivery. Here are two current examples:

1. My break-even is $3.80. On 2/6/15 December corn futures are $4.1075. I sell corn futures. On 9/25/15 I am ready to sell cash grain to an end-user for October delivery, I sell my cash futures at $4.00 less basis. The same day i sell cash I buy back my December corn futures at $4.00 for a net gain in my futures account of $0.1075/bu. In this scenario basis levels in February for October delivery were -25c to -35c, when i sold my cash grain on 9/25/15 there were end users desperate for corn and so i received a -5 basis for my October delivery corn, yahoo! So not only did I receive a higher futures for my corn, i also picked up 20c to 30c in basis appreciation throughout the year.

2/6/15 cash = 4.1075-.35 = 3.7575

9/25/15 cash = 4.00-.05+.1075 =4.0575

2. My break-even is $3.80. On 2/6/15 December corn futures are $4.1075. I sell corn futures. On 9/25/15 I am ready to sell cash grain to an end-user for October delivery, I sell my cash futures at $4.80 less basis. The same day i sell cash i buy back my December corn futures at $4.80 for a net loss in my futures account of $0.80/bu. In this scenario basis levels in February for October delivery were -25c to -35c, when i sold my cash grain on 9/25/15 there were end users desperate for corn and so i received a -5 basis for my October delivery corn. So i received a great basis level, I locked in futures above my break-even, and the market ended up higher on my unsold grain.

2/6/15 cash = 4.1075-.35 = 3.7575

9/25/15 cash = 4.80-.05-.80 = 3.95

How can I Hedge without my own Futures Account (No Margin)?

You can utilize any of these strategies without having to put up your own margin money through a hedge-to-arrive. There is usually a fee to cover admin and interest costs on the margin the other party is carrying for you, but thats pretty minimal to be able to capture a good futures level and basis appreciation throughout the year. Everything works the same to ensure you get paid the futures level locked in ahead of delivery. I would recommend having a HTA through an independent firm rather than your intended end-user since it gives you better negotiating power.

Hit me up with questions if you have them!

In the next post Ill spend time talking about basis, basis appreciation, and why end users care so much about it.