What Is a Diagonal Bull Call Spread

Post on: 12 Апрель, 2015 No Comment

by James Brumley

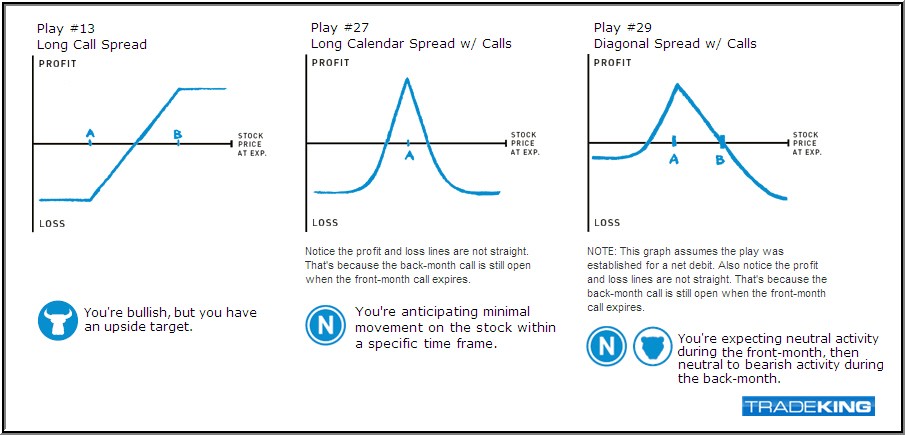

Most option spreads, whether traders know it or not, are vertical spreads. In other words, they seek to profit from a stock or an index being trapped between two strike prices. A diagonal option spread, however, enhances the profit potential of a spread by adding a time-based element to the equation.

With a diagonal spread – also called time spreads — the two options not only have different strike prices, but different expiration dates. As such, the trader can squeeze out more profits by also correctly predicting where an underlying stock will be at a certain point in time. Like most spreads, diagonal bull call spreads can either result in a credit (cash upfront), or a debit (an upfront cost, with a gain to be locked in later).

An example will illustrate the advantage of a diagonal bull call spread.

Diagonal Bull Call Spread Example

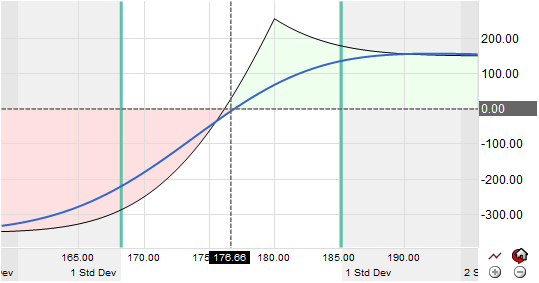

A bull call spread is built on the assumption that a stock’s price will rise later, but will not rise much (if any at all) in the near-term. For illustrative purposes, ABC stock is expected to remain at $23 per share for two months, and then start to rally to $30 three months or more from now.

To maximize the profit from a spread trade based on this assumption, a trader could buy a call expiring five months from now with a strike price of $20, and simultaneously selling a $25 call with an expiration two months from then. The former would cost approximately $4, while the latter would net about $1.50. All told, the debit spread would cost – up front (a net debit) – about $250 per contract.

If ABC falls under $20 and stays there, then both options expire worthless and the trader is out the entire $250 debit.

If instead ABC rallies to $30 before either expire, then the long $20 call is worth about $10, and the short $25 call is worth roughly $5 (though the different expirations would mean the intrinsic value varies slightly between the two). At that point, the trader could close out the trade by selling the long call and buying back the short call with a net credit of $500. Subtracting the original $250 debit from the $500 credit would yield a net profit of $250 per contract.

Ideal Diagonal Spread Outcome

The targeted scenario is something in between…. where the stock doesn’t move until after the first ‘front month’ option expires two months later, but the stock then moves before the second, later-expiration option expires. If ABC shares moved to $27 – or higher – three months after the trade, the short $25 call is worthless, but the long $20 call is worth $7, and could be sold at that price. Subtracting the initial $250 debit from the $700 per contract netted from the subsequent sale, the net income is $450 per contract.

The ideal scenario – and maximum profit – would occur if ABC shares rise significantly after the near-term option expires, but before the longer-term option does. If that happens, the maximum profit is theoretically infinite. The profit for the diagonal bull call spread would then be the difference between the stock’s price and the $20 strike price, less the initial $250 debit.

Suggested Reading

- Bear Call Credit Spread

- What is a Covered Call Option Trade?

- Option Greek for Beginners