What is a Cash Flow Statement_2

Post on: 16 Март, 2015 No Comment

Share this post:

It is important for any business owner to understand the financial health of the business. It is for this reason that you need to understand the purposes of different financial statements. Some of the basic financial statements include a balance sheet, profit and loss statement and cash flow statement.

What Does a Cash Flow Statement Reveal about Your Business?

It is important for you to understand the difference between cash flow and profitability. You can be profitable even with a negative cash flow. It is for this reason that many business owners find it difficult to understand the concept of cash flow.

There are transactions that take cash out of a business but still aren’t classified as expenses. For this reason, they are not reflected on the profit and loss statement.

Some of these transactions include:

- Payment of Loan Principal

- Owner’s withdrawals

- Payment of Credit Card Principal

Since these activities reduce the cash available to a business, they are reflected in the cash flow statement, but not on the profit and loss statement. Money borrowed from the bank is not considered an income. As such, when the money is paid back, it isn’t regarded as an expense. Only the interest that is paid on the borrowed amount is accounted for as expense. Likewise, when you invest money into your business, it is not regarded as income. As such, when you withdraw money, it is not counted as expense.

While these transactions impact the equity of business, they do not make any changes to the revenue and expense accounts.

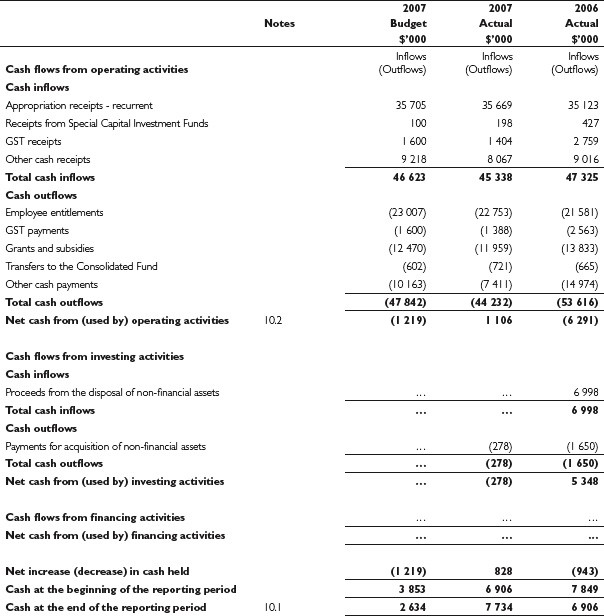

A cash flow statement reveals three areas from which the cash comes and goes:

- Operations

- Financing

- Investing

These include your business’ day to day activities. Decreases and increases in the payables and receivables are accounted for on the cash flow statement. Likewise, cash generated from running your business operations, and selling products and services is also noted in the cash flow statement. The long-term success of your business depends on a positive cash flow as well as healthy net profit from the operating activities.

Financing Activities

These activities include borrowing of money as well as repayment of your long-term liabilities.

Investing Activities

These include the sale and purchase of long-term fixed assets, such as equipment, property and factory.

Reading a Cash Flow Statement

Your cash flow statement will vary depending on the size and complexity of your business. The net cash flow is reflected by the important figure at the bottom of the cash flow statement.

Compare the net cash flow of your current cash flow statement with that of the previous statements. An increased net cash flow figure reflects an increase in business’ cash reserves and indicates a healthy business that is headed in the right direction. On the other hand, if the cash reserves remain unchanged, it reflects that there has been no substantive growth in the business’ cash reserves. You should be concerned if you see the cash flow decreasing. You will find it more and more difficult to pay off your liabilities and your business will start relying on more borrowing. You should seriously look into the situation with the management team and identify the causes of the cash shortfall as well as remedial measures that need to be taken by your business.

Managing Cash Flow

Here are some ways of managing your cash flow:

1. Shorten your payment terms with your customers

2. For major purchases, request customers to make advance payment

3. Offer small incentives for timely settlement of bills

4. Request suppliers to extend credit terms

5. Order more frequent stock in lesser quantity

6. Lease equipment rather than buying it