What Is a Balance Sheet_1

Post on: 15 Июль, 2015 No Comment

Assets = Liabilities + Equity

If you’re in the process of starting a business or writing a business plan document, you’ll have heard the phrase “balance sheet” mentioned, or maybe you’ve seen one in a sample business plan. The balance sheet is one of three essential parts that form the bedrock of a company’s financial statements: cash flow, balance sheet, and income statement.

The idea behind a balance sheet is fairly straightforward; you are determining if your business has more assets than liabilities, and your assets and liabilities must balance out for the business to be financially healthy.

As Investopedia defines it, “a company has to pay for all the things it has (assets) by either borrowing money (liabilities) or getting it from shareholders (shareholders equity).”

Trevor Betenson, our CFO here at Palo Alto Software, offers this insight about reading your balance sheet: “By subtracting liabilities from assets, you can determine your company’s net worth at any given point in time.”

By subtracting liabilities from assets, you can determine your company’s net worth at any given point in time.” The balance sheet for your business will allow you to see that the businesses’ assets and liabilities are balanced and what the companys net worth is, and typically this information is compiled every quarter.

The assets and liabilities on a balance sheet are both organized by time; with assets, the faster the business could make an asset liquid (convert it to cash), the higher it should be on the balance sheet. With liabilities, the sooner something needs to be paid, the higher up that line item goes.

Now that weve had a general overview of the balance sheet, let’s take a deeper look at the information a balance sheet should include.

In this article, I’ll review:

- The components of a balance sheet

- The importance of a balance sheet in a business plan

- Balance sheet examples

Line by Line Breakdown of a Balance Sheet:

As businesses differ from one another, so will their assets and liabilities. Inclusion of certain line items and their titles will vary slightly from business to business, but the equation remains the same: your businesss assets are reflected by its liabilities plus equity.

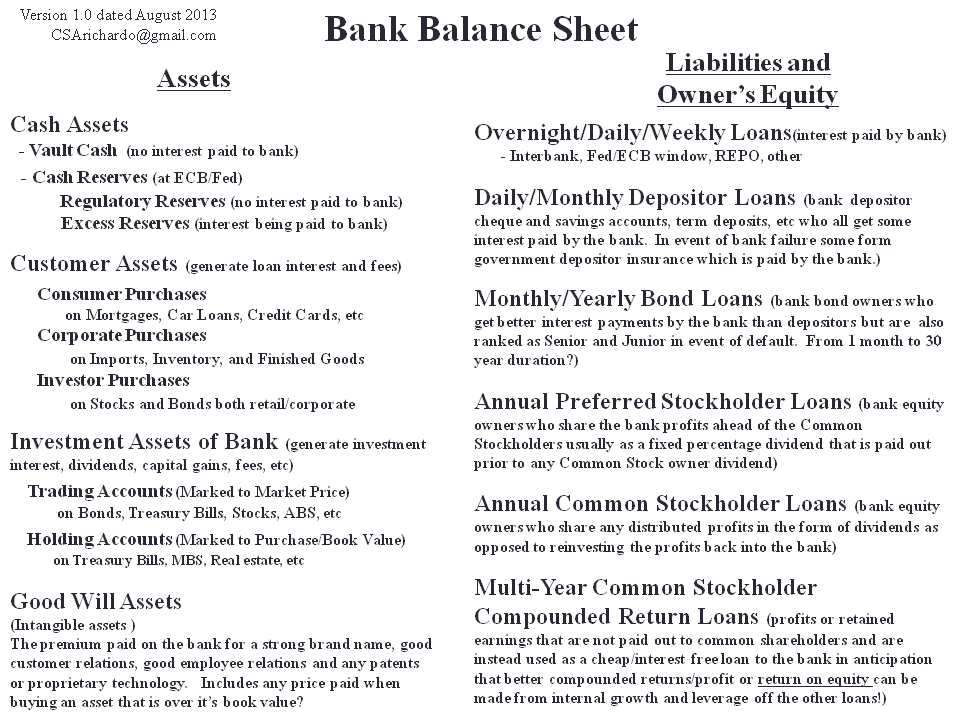

Assets

In the context of a balance sheet, cash means the money you currently have on hand. In business planning, the term cash represents the bank or checking account balance for the business, also sometimes referred to as cash and cash equivalents or CCE. A cash equivalent is an asset that is liquid and can be converted to cash immediately.

This is how much money people are supposed to pay you, but that you have not actually received yet (hence the receivables). Usually, this money is sales on credit, often from business to business (or B2B) sales, where your business has invoiced a customer.

Inventory includes the value of all of the finished goods and ready materials that your business has on hand but isn’t immediately using.

Current assets are those that can be converted to cash within one year, says Betenson. Cash, accounts receivable, and inventory are all current assets, and these amounts accumulated are sometimes referenced on a balance sheet as Total Current Assets.

Long term assets are also referred to as fixed assets and include things that will have a long standing value, such as land or equipment.

Liabilities

This is the money that your business owes, the other side of the coin to accounts receivable. Your accounts payable number is comprised of the regular bills that your business is expected to pay. Be aware if this number is exceedingly high, or if your business doesnt have enough to cover it.

This only applies to businesses that don’t pay sales tax right away, for example a business that pays its sales tax each quarter. That might not be your business, so if it doesnt apply, skip it.

This is debt that you have to pay back within a year, usually any short-term loans. This can also be referred to on a balance sheet as a line item called current liabilities or short-term loans. Your related interest expenses dont go here or anywhere on the balance sheet; those should be included in the income statement.

The above numbers added together are considered the current liabilities of a business, meaning that the business is responsible for paying them within one year.

These are the financial obligations that it takes more than a year to pay back. This is often a hefty number, and it doesn’t include interest. For example, this number reflects long term loans. It should be decreasing over time as the business makes payments and lowers the principal amount of the loan.

Equity

Paid-in Capital:

Money paid into the company as investments. This is not to be confused with par value of stock, or market value of stock. This is actual money paid into the company as equity investments by owners.

Retained Earnings:

Earnings (or losses) that have been reinvested into the company, not paid out as dividends to the owners. When retained earnings are negative, the company has accumulated losses. This can also be referred to as “shareholder’s equity.

This doesnt apply to all legal structures for a business; if you are a pass-through tax entity, then all profits or losses will passed on to owners and your balance sheet should reflect that.

Net Earnings:

This is an important number—the higher it is, the more profitable your company is. This line item can also be called income or net profit. Earnings are the proverbial “bottom line”: sales less costs of sales and expenses.

Total Owners Equity:

Equity means business ownership, also called capital. Equity can be calculated as the difference between assets and liabilities. This can also be referred to as shareholders equity or stockholders equity.

Total Liabilities and Equity:

This is that final equation I mentioned at the beginning of this post, assets = liabilities + equity.

The Importance of a Balance Sheet in Your Business Plan

There are three aspects of business financials that are really indispensable; the income statement, cash flow statement, and the balance sheet.

Including a balance sheet in your business plan is an essential part of your financials. There are three aspects of business financials that are really indispensable; the income statement, cash flow statement, and the balance sheet.

These give anyone looking over the numbers a solid idea of the overall state of the business financially. In the case of the balance sheet in particular, what it’s telling you is whether or not you’re in debt, and how much your assets are worth. This information is critical to managing your business and the creation of a business plan.

Balance Sheet Examples

Large businesses will have longer and more complex balance sheets for their businesses, sometimes having separate balance sheets for different segments or departments of their business. A small business balance sheet will be more straightforward and have less line items.

Here is a balance sheet from Apple, for example. Youll see that it includes a complex stockholders equity section and several specifically itemized types of long term assets and liabilities.

Youll also notice that it says Period Ending at the top; this indicates that these numbers are reflective of the time up until the date listed at the top of the column. This terminology is used when you are reporting actual values, not creating a financial forecast for the future.

Here is a balance sheet from a LivePlan sample business plan. LivePlan is a cloud-based business plan writing software. This example is reflective of what a small business balance sheet looks like:

You can see that is called a projected balance sheet, which indicates that these numbers are estimates of the future being used for business planning purposes, not a record of actual values. There are also less line items and it is simpler overall.

Here are some related articles on Bplans:

Do you have more questions about balance sheets? Let me know in the comments below!

About the Author Angelique is a copywriter at Palo Alto Software. She is interested in business ethics, social enterprise and nonprofit ventures, and likes to envision innovative ways businesses can make a positive impact in the world. She has a background in anthropology and performing arts. Follow Angelique on Google+ Read more