What exactly is ‘other comprehensive income’

Post on: 7 Сентябрь, 2015 No Comment

PwC’s dedicated IFRS blog discusses and debates the hot topics in International Financial Reporting Standards and latest IFRS news.

What exactly is ‘other comprehensive income’?

11 September 2009

Many companies with December year ends have by now completed their half-year reporting cycle and are more familiar with the new presentation requirements introduced in IAS 1 (Revised). In many cases, the changes have been cosmetic – an extra line item here and an additional disclosure there – but we have to remember that this is only a step in the IASB’s financial statement presentation journey.

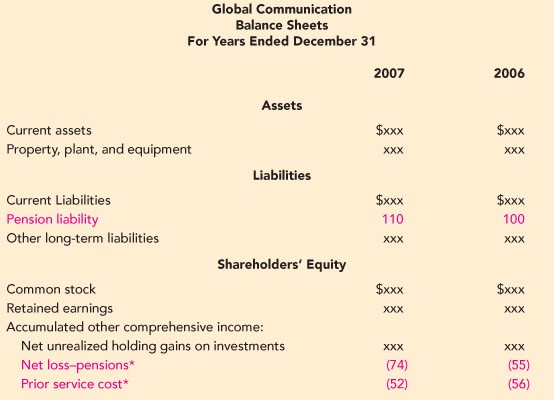

One of the new concepts introduced this year is the notion of other comprehensive income (OCI). This might appear in a separate statement (looking rather similar to its predecessor – the statement of recognised income and expense) or towards the bottom of a single performance statement – a statement of comprehensive income.

What is OCI? This is an extremely difficult question to answer. The following are examples of items that IFRS either permits or requires to be presented as OCI:

• Foreign currency translation adjustments on foreign subsidiaries

• Changes in the fair value of available-for-sale financial assets

• Actuarial gains and losses arising on a defined benefit pension plan

• Revaluations of property, plant and equipment

• Changes in the fair value of a financial instrument in a cash flow hedge

There is no obvious principle that drives these gains and losses out of earnings and into OCI. They all reflect re-measurements as a result of movements in a price or valuation, but so do some items that are unquestionably included within earnings (such as fair value gains and losses on traded derivatives and investment properties). There is also the question of recycling.

Some of these items (such as foreign currency translation adjustments and changes in the fair value of available-for-sale financial assets) are recognised in OCI but are then recognised again in earnings when the underlying item (that is, the foreign subsidiary or available-for-sale financial asset) is sold or realised. In other cases (such as actuarial gains and losses and revaluations of property, plant and equipment) there is no recycling.

Items that historically have been recorded outside of earnings have largely been addressed piecemeal in order to resolve specific issues. A recent example has been the proposed treatment of equity investments in July’s exposure draft on financial instruments classification and measurement. However, in that particular case the IASB highlighted the complexity of the issue when it commented that “it would be difficult, and perhaps impossible, to develop a clear and robust principle that would identify investments that are different enough in nature to justify a different presentation requirement”.

This might explain why the IASB has not, in its financial statement presentation project or separately, addressed the following fundamental questions: What is the purpose of OCI and its separation from earnings? Which gains and losses on re-measurement to fair value should be reported in earnings and which in OCI? Which items, if any, should be recycled?

Is pragmatism the right approach, or should the IASB initiate a separate project to address these issues as a matter of priority?