What Economic Factors are Affecting the Stock Market

Post on: 16 Март, 2015 No Comment

The stock market is always subject to change due to economic as well as social factors. For example, if there is a social unrest in a country, you will observe a downturn in a stock market. Also, if a company discovers new sources of renewable energy, it adversely affects the stock market. Therefore, it is important that every investor should be aware of factors that affect the stock market before deciding to invest in a stock market.

You can also seek guidance of Your Personal Financial Mentor because being an expert, he can guide you the rules of trading in a stock market and will help you take effective decisions based on the economic factors that are influencing a stock market. Let’s look at some of the potential economic factors in order to create a better understanding.

Inflation & Deflation

Inflation can adversely affect the stock market movements. It is a rate at which the value of goods and services increases. There are several factors due to which inflation occurs. These factors include, increase in transporting costs, manufacturing costs and cost of selling goods. When the inflation is low, an upward trend in selling is observed in a stock market but in case of high inflation, companies tend to hold back on spending, which causes an across the board decreasing trend in revenue and increasing trend in cost of goods. This in turn, causes the stock market to drop.

Although, it seems that investors should be encouraged to welcome deflation but instead, a downturn is faced by the stock market in case of deflation because investors perceive it as a result of a poor economy.

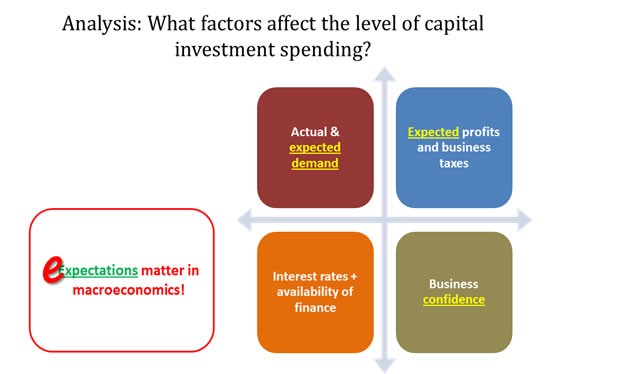

Rate of Interest

The rate of interest, established by government institutions and banks, can also affect a stock market. If a rate of interest is higher in the economy, it shows that a borrower will have to face a high cost of borrowing. Therefore, businesses may have to cut down expenses or make their workers redundant in order to compensate for higher interest costs. It also implies that a business cannot borrow as much as it used to, and hence adversely affects the company’s earnings. Consequently, it causes a drop in the stock market.

Foreign Market

When the overall global economy is down, goods and services cannot be sold overseas as they used to. It causes revenue to decline and as a result, the decline in the stock market is observed. If foreign stock exchanges start failing or experience sharp declines, a ripple effect can be anticipated which ultimately results in the overall drop in a global stock market.