What Does The Return On Capital Employed (ROCE) Tell Us

Post on: 21 Июль, 2015 No Comment

The Return On Capital Employed, ROCE, is one of the most important operating ratios that can be used to assess corporate profitability.

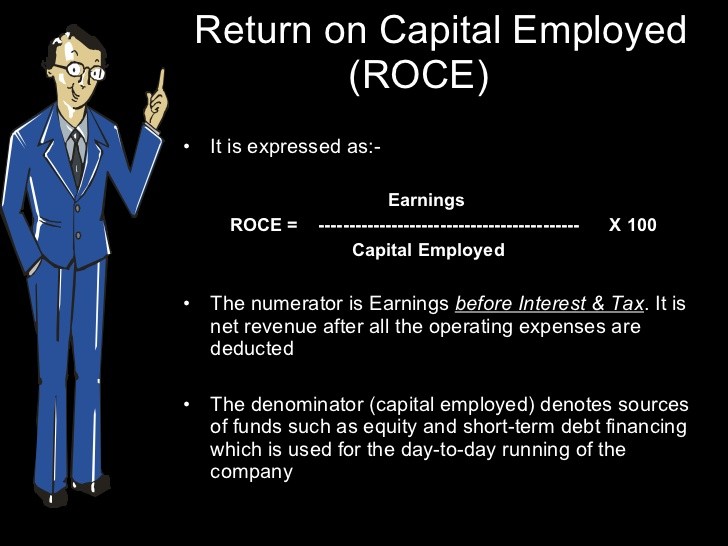

ROCE = Trading Profit / Capital Employed

where Capital Employed = share capital + reserves + all borrowing

It is expressed as a percentage and can be very revealing about the industry a company operates in, the skills of the management and occassionally the general business climate.

Analysis of potential investments over a reasonable period of time will expose an investor to many potential types of business and industry.

A common theme is that some companies and industries will be able to earn almost 100% ROCE. This is spectacular and is so profitabe that it is hard to imagine that it can be legal! The most likely type of business to earn such returns are consultancies.

At the other end of the scale, many manufacturing businesses will earn very low rates of return, possibly in single digits.

It is not always true, but as a rule, a firm with a high return on capital employed will probably be a very profitable business.

However, as with every other ratio availaible, there are potential problems. Firstly, the interpretation of ‘capital’ can be many and varied. Secondly, trading profit can be distorted by accounting policies and other unrelated expenses.

The ratio can be further broken into two strands:

Trading profit / Sales x Sales / Capital Employed= Trading Profit / Capital Employed

where sales = sales revenue or turnover

This means that:

Trading Profit / Sales = Profit Margin

The second of these strands is:

Sales / Capital Employed

This will express the volume of sales being generated by the business for the amount of capital being employed. It is therefore expressed as a multiple.

As you calculate this figure over a number of years, trends may emerge. For example, the ratio may be a rising number which might indicate improved performance. However, it may also be showing static sales being generated from a reducing amount of capital. This may be because of depreciation and thus is not improved performance at all.

Clearly ROCE is usually also representative of a strong cash flow and high levels of economic value added. These businesses also tend to have a high operating margin. These are the types of businesses we want to invest in! Whatever they do in real life, the numbers are worth understanding as they often lead to the secret of the company’s success.

It is not always true, but often will be, that such a company will have a fairly low gearing ratio. If the company is throwing off cash (and profit) they probably do not need to borrow money. Of course if they are borrowing, they are using the money well, but typically such firms struggle to employ new money quickly enough to make it work hard for them.

Hopefully, it is now clear what a useful number ROCE for finding highly profitable companies to invest in.

Other analysis pages of interest are: