What Caused the Economic Crisis of 2008

Post on: 25 Август, 2015 No Comment

I think we can sum up the cause of our current economic crisis in one word GREED . Over the years, mortgage lenders were happy to lend money to people who couldnt afford their mortgages. But they did it anyway because there was nothing to lose. These lenders were able to charge higher interest rates and make more money on sub-prime loans. If the borrowers default, they simply seized the house and put it back on the market. On top of that, they were able to pass the risk off to mortgage insurer or package these mortgages as mortgage-backed securities. Easy money!

What Went Wrong With Our Financial System?

The whole thing was one big scheme. Everything was great when houses were selling like hot cakes and their values go up every month. Lenders made it easier to borrow money, and the higher demand drove up house values. Higher house values means that lenders could lend out even bigger mortgages, and it also gave lenders some protection against foreclosures. All of this translates into more money for the lenders, insurers, and investors.

Unfortunately, many borrowers got slammed when their adjustable mortgage finally adjusted. When too many of them couldnt afford to make their payments, it causes these lenders to suffer from liquidity issue and to sit on more foreclosures than they could sell. Mortgage-backed securities became more risky and worth less causing investment firms like Lehman Brothers to suffer. Moreover, insurers like AIG who insured these bad mortgages also got in trouble.

The scheme worked well, but it reverses course and is now coming back to hurt everyone with a vengeance.

The Case Of My Greedy Real Estate Agent

My own experience with these greedy lenders and real estate agents happened about two years ago. My wife and I were thinking about upgrading our home to something slightly bigger, and in a better neighborhood. As we go through the process, we resolved not to do it because it would double our monthly mortgage payment and add another 20 years to our mortgage term.

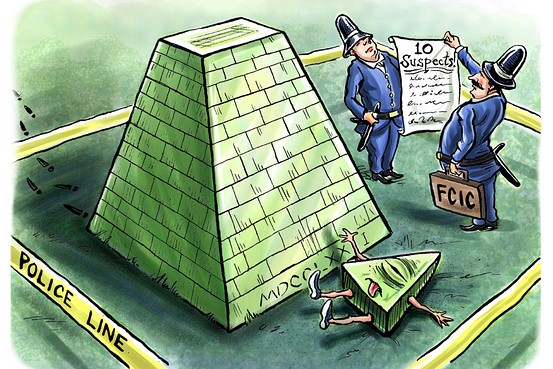

Illustration from The Skinny On The Housing Crisis . published with permission. The Skinny On .

When I told the real estate agent I couldnt afford the monthly payment, he said I could go for a 40 years mortgage with 5% down payment, and apply for more than what I needed so that Ill have an emergency fund. Basically, he advised me to decimate my cash flow and savings so that I can pay mortgage into my 70s. And while I am at it, I should pay private mortgage insurance (PMI) for a couple of years. Now, thats irresponsible and greedy.

The sad thing about the scenario above is that I am certain there are borrowers who didnt know any better and went along with a similar plan.

The Bailout And Who Should Pay

I dont like the idea of government bailout, because the government is using my money to help out greedy bankers. Unfortunately, it may be the only option we have right now, but I hope these greedy lenders wont get away scot-free. Somebody made a lot of money leading up to this crisis and they should pay for it at least the government should make them.

In my opinion, the government should force conversion of bad mortgages into 30 years fixed rate mortgages. The interest rate on these converted mortgages could be higher than normal. This way its more affordable to more borrowers resulting in a lower default rate. Yes the lenders will make less money, but in my opinion, they already made too much. By the way, the borrowers arent completely innocent either, thats why they should pay a little more as well.

Since it was fine from them to play with our economy and our lives, I think this is the least that they could do to take part in the recovery effort. Why should my tax dollars go toward helping these greedy bankers who already made billions out of the scheme? I am sure no one will come to my rescue if I my greed got me in trouble.