What Are VIX Options And How Should You Trade Them

Post on: 11 Июнь, 2015 No Comment

The Chicago Board of Exchange (CBOE) introduced VIX options in February 2006. These options can be purchased as both put and call options. These options make it possible for traders to trade on the volatility of stocks.

Prior to the introduction of these VIX options, there weren’t any ways for traders to profit from the volatility of stock directly.

You should be able to purchase and sell VIX options by using your normal stock brokers account; these are traded in exactly the same way as a standard option. There are however a few differences which make VIX options different to other types of stock options.

Differences

Other stock options expire on Friday; VIX Options will always expire on Wednesday

VIX options are based on European options and this means that it is only possible to exercise the option on the expiry date. These options are also cash settled.

What Does VIX mean?

VIX is a volatility index for the Chicago Board Options Exchange (CBOE). This index shows how volatile the market is over a month. The index is constructed using S&P 500 index options. The VIX index is very useful to help measure the risk of the market, some traders even call it the fear gauge.

VIX and VIX Options

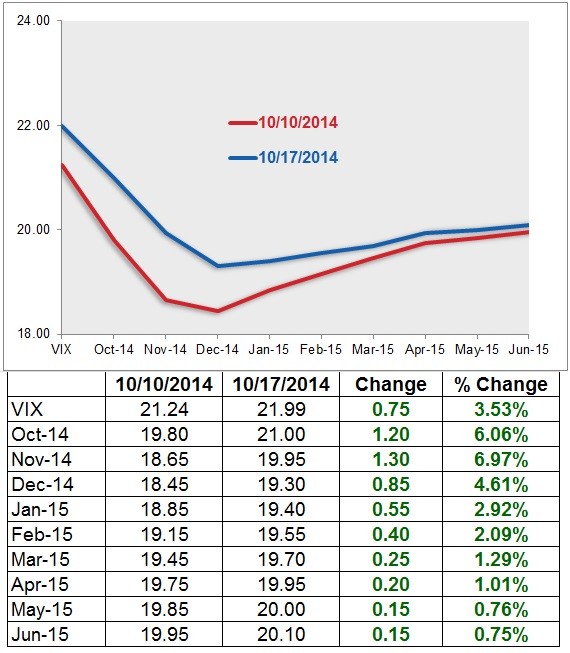

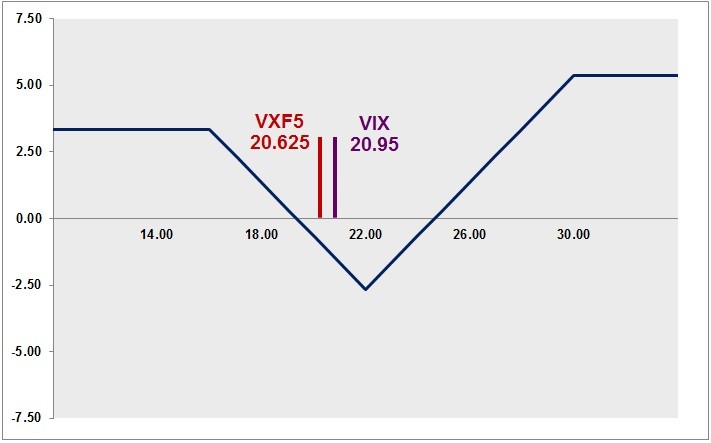

The VIX options prices won’t always follow the VIX movements, this can be very confusing and frustrating for a beginner. VIX Options may seem to be discounted after a spike in the VIX level. This is because VIX is a European style option and VIX is a mean reverting index.

As these are European options, it is only possible to exercise the right of the option at the expiration date of the option. This means that their value is based upon the value expected of the option at the date of expiry, rather than the current price of the option.

As the VIX index is a mean reverting based index, this means that any spikes don’t normally last for very long. This means that normally, traders will only take these peaks into account when the peak is close to the expiry date of the option.

Using VIX Options with Other Options

When trying to profit from volatile options when using methods such as Long Straddle, this depends upon increasing volatility to grow profits. If viability drops then this is likely to affect the profitability of the option.

It is possible to buy VIX put options in combination with volatile options, this would mean that any loss due to a volatility reduction would be countered by profits from the VIX options.

Speculation

You can also use VIX options for speculative purposes, you are able to speculate on future movement of VIX. Although this is an index, it cannot ever go down to zero because the market will never remain completely still. It also can’t go higher than 50 for a long period of time.

Traders can also employ bull call spread when using VIX options and the VIX is around 10, bearish strategies should be used when the VIX index is higher.

Verdict

As a beginner you might think that VIX options are too confusing to invest in. Trading in options is already complicated enough as it is. However, if you spend some time doing your homework then you should learn that VIX options are actually fairly easy to understand.

You are able to trade VIX options on their own, but you will find that it’s better to combine them with a different strategy. VIX will also serve as an indication over how volatile the market is.

A good way of learning about VIX options is to use a virtual account. This allows you to get to grips with them. Not every broker offers this service, so make sure you choose carefully. optionsXpress is one of the best brokers for beginners because they make trading in VIX options very easy.