What are the risks of investing in hybrid securities

Post on: 26 Июнь, 2015 No Comment

Get social

Article utilities

As Europes economic woes wreak havoc on investor confidence, more people are tapping hybrid securities to help boost stability in their portfolio returns. But experts warn that mums and dads could be in for a wild ride as these risky debt investments can be closely linked to the fluctuations of the sharemarket.

Australian investors fed up with double-digit losses in sharemarkets are seeking less volatile assets in which to park their funds and at face value, hybrid securities (such as income notes, securities and various preference shares) appear to be a good bet.

Sometimes marketed as a best of both worlds investment that boasts income security similar to bonds but with higher yields hybrid securities seem to be undergoing a revival in Australia.

For the company issuing the security, its a way of raising capital; for investors, its an avenue to secure regular income while keeping their capital relatively secure compared with riskier shares.

Safety catches

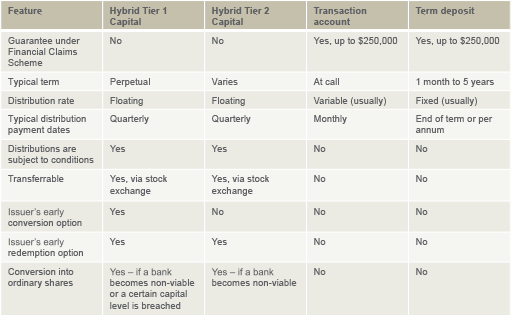

But theres a catch. Unlike term deposits, these investments are not guaranteed by banks and returns may be affected by fluctuating margins over bank bill rates.

Investors capital may also evaporate if a company goes bust; or their regular income streams cease if the issuer opts to defer payments.

That, however, is not stopping an increasing number of investors from seeking out these investments, and the recent issuance by big banks has helped to boost mums and dads confidence in the sector.

Each offering is different, with margins over bank rates, for instance, varying significantly.

Despite their perceived income security, government regulators, brokers and financial planners warn that some of hybrids may not be as safe as investors believe.

Risk-return mismatch

MoneySmart. the governments financial information website, highlights that some hybrid securities and notes make investors take on equity-like risks but give at best, bond-like returns. Some also have terms and conditions that allow the issuer to exit the deal or suspend interest payments when they choose, MoneySmart says.

Investors should consider how the security is constructed, its term, and what it will provide in return. This includes its face value or the amount repayable upon maturity, and the coupon rate, which may be fixed or floating based on a benchmark.

Investors taking a long-term view need to know when the security expires and what theyll receive when companies call the securities back. In some cases, the principal is returned to the investor while in others, it is converted into ordinary shares of the company.

Ignorant investors

Jordan Financial Solutions director and financial adviser Damien Jordan says the number of client inquiries about hybrids increases when the products are announced to the market. But he worries that most people do not realise how these products operate.

Jordan chooses not to advise clients to take on securities. He prefers to stick with lower yielding but arguably safer fixed-interest investments or cash, and equities.

They [investors] dont really weigh up the risks, Jordan says.

Volatility

The main one for me is market volatility. Just like company shares, your listed hybrid securities can fall below the market in value or if something happens to the company, they can defer payments.

A lot of [investors] go into it for regular payments, but if you . . . [invest] for cash flow and a company suspends payments, it wont match up to your goal.

RMG Financial Services partner Patrick Canion echoes Jordans concerns. Because [hybrids> are issued by large companies, mum and dad investors tend to perceive them as having the same safety and security as term deposits.

But in extreme events, the value of these securities may come down and they are not guaranteed like bank deposits are it can be quite volatile, Canion says.

This was evident during the global financial crisis five years ago, when the risk of a credit squeeze showed that hybrids can be correlated closely to equity markets.

Warning

The surge of interest in the sector has prompted the corporate watchdog to issue a warning to consumers about the risks of investing in the sector.

in 2011 the Australian Securities and Investments Commission (ASIC) released a statement urging consumers to ensure they understand the conditions and risks of hybrid securities and unsecured notes before committing their funds.

ASIC chairman Greg Medcraft said retail investors may be attracted by the interest rates offered by household-name companies and trusted brands but hybrid securities should not be confused with government bonds or vanilla corporate debt.

Investors need to understand the conditions of these offers, such as terms and conditions that allow the issuer to exit the deal or suspend interest payments, and long-term maturity dates of several decades, Medcraft said.

Investors should weigh up the risks, returns, interest rates, whether the product would achieve their objectives, and an exit strategy before they tapped into these investments, ASIC warned.

Complicated assessment

The devil is often in the detail, argues Stephen Nash, strategy and market development director at FIIG Securities, and its important for investors to work out how their coupon is paid and whether their investments boast floating or fixed margins over the bank rates.

Typically the hybrid securities are what they call lower tier or subordinated style transactions, and they typically offer the issuer flexibility in terms of payment, unlike a bond which is locked in, Nash says.

Its a positive for the issuer but investors have to make an independent assessment, and often its not a straightforward process.

But Andrew Jones, a financial planner and director at Eureka Financial Group, says that when proper due diligence is conducted, hybrids make a credible addition to an investors portfolio.

For cautious investors who might lump 70 per cent of their portfolio in defensive assets such as fixed income and cash, hybrid securities could make up 15 per cent to 20 per cent of the defensive component.

Our experience has been quite a positive one for investors, Jones says. We participated in quite a few of the larger ones Origin [Energy], Woolworths, ANZ . . . the experience over the last 18 months was that the majority of them are trading above their starting point, their face value.

That means clients have made a bit of capital growth, and theyre collecting income four times a year.

The capital ladder

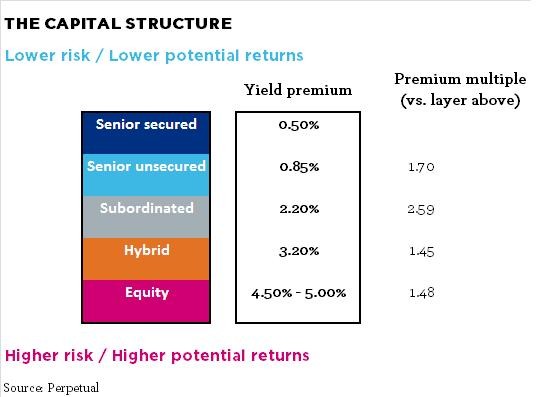

What is critical for investors to understand is where the hybrid security sits on the issuers capital ladder, Jones argues.

Is it just one rung above ordinary equity, which is at the bottom [of the ladder], for example.

There are different levels of capital security you have the hybrids, which are unsecured forms of credit; and then you have subordinated debt, secure debt, and deposit holders, Jones explains.

The higher up the ladder you are, the more protection you get and, as a result, the lower the coupon rate.

Adelaide-based adviser and Prescott Securities principal Nick Loxton says: My view is that you have money that you put at risk and money that you dont put at risk.

The ground in between can sometimes be a little murky, he adds, particularly if investors buy securities on the secondary market.

Smoother returns

Marilyn Carter, a fixed interest adviser at Cameron Stockbrokers, says its important to remember that ultimately, most fixed-income hybrids provide less volatility than their equities counterparts.

For a strong issuer like a bank, you wont get the volatility of price as you would [from] a share, so you have that relative price stability. Of course youll also have more reliable income streams quarterly or six monthly.

In the worst case, investors could end up with losses if they hold subordinated notes, for example which are generally unsecured should the company go bust.

You could end up with nothing, it depends on your risk with the company. Its something people have to think about, Carter warns.

Follow us on Facebook and Twitter

You can follow Smart Investor on Twitter: https://twitter.com/#!/smartinvestr (or @smartinvestr) and on Facebook at facebook.com/afrsmartinvestor