What Are “Regulatory Assets Under Management” and Why Does a Private Fund Manager Need To Determine

Post on: 22 Май, 2015 No Comment

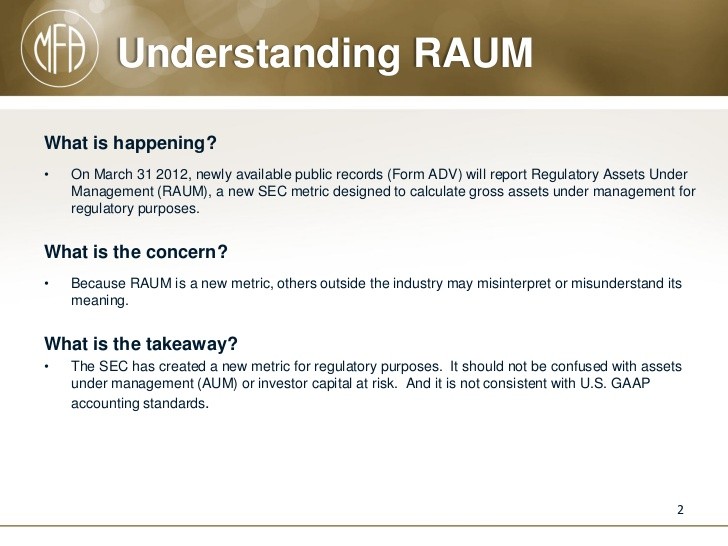

With the new registration requirements under the Dodd-Frank Act and the enhanced reporting required of some private fund managers under Form PF, private fund managers must now make a yearly (or sometimes more frequent) calculation of their regulatory assets under management. Essentially this is a total tally of the assets over which the fund manager provides investment advice, calculated using a method proscribed by the SEC. There are a number of instances where a fund manager needs to make this determination:

- ADV Reporting. With the new registration requirements under the Dodd-Frank Act, more private fund managers must now register as investment advisers with the SEC or with state securities divisions. In addition, even though some private fund managers may be exempt from such registration, they must still submit Form ADV as an exempt reporting adviser . In either case, Form ADV requires that the fund manager disclose its regulatory assets under management.

- Eligibility for an Exemption. Even after the enactment of the Dodd-Frank Act, some fund managers are still exempt from registration. Fund managers that have less than $25 million under management are exempt completely if the fund managers home state provides an exemption. In addition, fund managers with less than $150 million under management may be exempt from registration with the SEC (though they must still submit Form ADV as an exempt reporting adviser ). To make a determination whether a fund manager qualifies for one of these exemptions, the fund manager must calculate its regulatory assets under management.

- Division of Responsibility Between Federal or State Regulators. If a fund manager must register, because it does not qualify for an exemption, there is a division of responsibility between the state securities divisions and the SEC. If a fund manager has $100 million or less of regulatory assets under management, then in most cases, it must register with its state securities division instead of with the SEC. Once again, the calculation of regulatory assets under management is used to make this determination.

- Form PF. Private fund managers with $150 million or more of assets under management within private funds are required to file Form PF annually, which requires the fund manager to disclose regulatory assets under management. In addition, certain large fund managers such as those with over $1.5 billion in hedge fund assets under management will be required to report quarterly. A determination of regulatory assets under management is used to determining whether a fund manager qualifies for these requirements.

Therefore, being able to determine regulatory assets under management is important for a variety or reporting and compliance needs. The procedure for determining regulatory assets under management is described in the instructions for Form ADV and in the final rule published by the SEC regarding Exemptions for Advisers to Venture Capital Funds, Private Fund Advisers With Less Than $150 Million in Assets Under Management, and Foreign Private Advisers . For private fund managers, there are a number of pitfalls.

First, when counting assets, the fund manager is required to include all gross assets without any deduction for debt or leverage. Therefore, if a fund has $30 million of assets and $20 million in debt, it is considered to have $30 million in regulatory assets under management, not $10 million.

Second, the fund manager must also include uncalled capital commitments. This especially affects venture capital funds and private equity funds, who will often require investors to commit a certain amount of capital but not actually contribute cash to the fund until a later date. Therefore, if a fund manager obtains a commitment from an investor to invest $1 million, and the investor has only actually contributed $200,000, the fund manager must include the remaining $800,000 in its regulatory assets under management.

Finally, all assets must be valued at their market value or fair value. For assets that are publicly traded securities, this is relatively simple. The fund manager can use the most recent trade price. But private funds often hold illiquid assets that are difficult to value. How does the fund manager go about valuing those?

The SECs guidance offers a number of suggestions. First, for funds that issue financial statements for their investors that utilize GAAP or some other internationally recognized accounting standard, the values used in those statements can be used for calculating regulatory assets under management. However, there are funds that do not produce GAAP financial reporting (especially those which do not allow investors to enter or leave the fund over its lifespan). For these funds, the process of valuing assets becomes more complex. The SEC has explicitly said in its commentary to the final rule that the requirement for calculating fair value does not mandate a particular procedure nor require the use of a third-party pricing service or appraiser. Rather the fund manager must act consistently and in good faith. This ambiguity will likely cause fund managers a great number of headaches in the years to come. It will be crucial for them to adopt standards that are reasonable and consistently applied year in and year out across all illiquid assets and to document all decisions and methodologies used in determining asset values.

Fund managers should consult an attorney familiar with securities laws in making any difficult determinations. Failure to do so could lead to a fund manager failing to register when they should have, or reporting inaccurate information, both of which could lead to sanctions from securities regulators.

Read more articles by Alexander Davie at Strictly Business. a business law blog for entrepreneurs, emerging companies, and the investment management industry.

For more information about LexisNexis products and solutions connect with us through our corporate site .