What Are Intangible Assets

Post on: 20 Май, 2015 No Comment

Companies own a variety of physical assets, such as buildings, computers and equipment. These things are tangible they can be touched or seen. Companies also own a variety of assets that cannot be touched or seen; these are intangible assets, such as goodwill, patents, trademarks, copyrights and more.

Examples of intangible assets

Assets without physical substance are created daily, continually expanding the definition of an intangible asset. Any resource controlled by an entity as part of a purchase or self-creation that creates a certain economic benefit constitutes an asset. While their intangible nature may make their value somewhat subjective, it is often these assets that govern the legality of business and the control of production.

Examples of intangible resources include:

- Goodwill. This intangible is often recognized when one business acquires another. It represents the excess of cost paid by the purchasing business over the value of the purchased business assets. For example, a purchasing company might pay $8 million for a company valued at $7 million, giving the purchased company a goodwill of $1 million based on its business reputation and other contributing factors.

- Copyright.

- Patents. A patent grants a manufacturing or research company control over the patents use and sale of a specific design. For example, a company may possess a patent for the only way of producing a specific product on the market. The purchasing company would claim ownership of the patent and be allowed to continue overseeing production of the patented design.

Intellectual properties such as songs, designs, trademarks and inventions are intangible assets. Additional intangible assets include software licenses, motion pictures, customer lists and franchises.

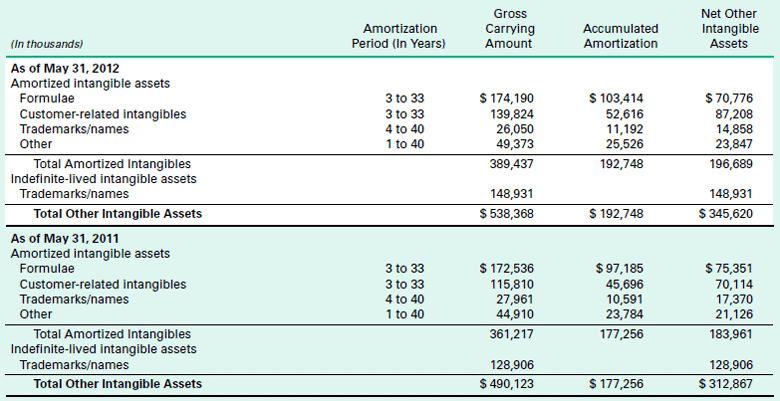

Amortizing intangible assets

Amortization of intangible assets entails expensing out their value over their intended lifetime. Much like tangible assets, intangible assets have a useful lifetime or depreciation. Some elements, such as goodwill, have an indefinite useful life, whereas things like patents only possess a useful lifetime of 20 years. The remaining useful lifetime influences the overall value of an intangible asset, much like the age of a companys equipment.

Some intangibles possess a determinable life, also known as a legal life or economic life. The overall value, or cost of the asset, is divided against the remaining duration of its useful life. Such assets include software licenses, patents and customer lists. Other assets have indeterminable lives dependent on how long the companys brand will hold value. These include assets such as brand name and goodwill elements dependent on a companys reputation and growth.

Accountants commonly amortize intangible assets using a straight-line method. For example, a patent may cost a company $50,000 to obtain. The patents legal life is 20 years, but the company only plans on utilizing the patent for 10 years before creating a newer product. The company would then be required to amortize the patent over 10 years, yielding a per-year amortization of $5,000.

Companies are regularly advised to carry intangible assets on balance sheets at cost rather than perceived value. When an entity decides to assign a value to things, such as jingles, this deceptively changes the perceived value of an organization and can boost stock value. However, when a company is audited and such incorrect information is included on an income statement or balance sheet, this creates a potentially problematic situation for investors and stockholders. Intangibles like the Coca-Cola brand name prove quite priceless, but cannot carry a value on financial reporting statements.

Acquiring intangible assets

Intangible assets are obtained through a variety of methods. A common practice among businesses is to obtain all assets during a company acquisition or merger. Additional methods include:

- Separate purchase. Assets can be purchased from an existing company, just like purchasing regular services. For the right price, companies will give up things such as patents and other production rights to the purchaser.

- Government grants. In some circumstances, intangible assets are acquired free of charge through the use of a government grant. For example, the government may transfer or allocate intangible assets to a company, such as licenses to operate or land usage rights.

- Assets exchange. A company might be acquired through the purchase of its assets in exchange for cash or stock from the purchasing company.

- Self-creation. Not all assets need to be purchased and can be created internally for use or future sale. In this instance, companies rely on their own in-house resources to create the intangible resource.

The value of intangible assets is dependent both on the cost of creation and the long-term value associated. How these assets are acquired and exchanged, in addition to how they influence the market, contribute to their value, factors that tangible assets like real estate cannot mirror.