What are financial statement footnotes Questions & Answers

Post on: 12 Май, 2015 No Comment

What are financial statement footnotes?

Financial statement footnotes are explanatory and supplemental notes that accompany the financial statements issued by an entity. The exact nature of these footnotes varies, depending upon the financial framework used to construct the financial statements (such as GAAP or IFRS ). Financial statement footnotes are an integral part of the financial statements, so you must issue them to users along with the financial statements. They are extremely valuable to the financial analyst, who can discern from the footnotes how various accounting policies used by a company are impacting its reported results and financial position.

If you have hired an auditor to conduct an audit of your financial statements, that person will conduct just as thorough an investigation of the footnotes as of the financial statements, and will base his or her opinion of the financial statements partially on the information contained within the footnotes.

An even more extensive set of footnotes are required by the Securities and Exchange Commission of any publicly-held company when they issue their annual financial statements in the Form 10-K and quarterly financial statements in the Form 10-Q .

The number of possible footnote disclosures is extremely long. The following list touches upon the more common footnotes, and is by no means even remotely comprehensive. If your company is in a specialized industry, there may be a number of additional disclosures required that are specific to that industry.

- Accounting policies. Describe significant principles followed.

- Accounting changes. The nature and justification of a change in accounting principle, and the effect of the change.

- Related parties. The nature of the relationship with a related party, and the amounts due to or from the other party.

- Contingencies and commitments. Describe the nature of any reasonably possible losses, and any guarantees, including maximum liabilities.

- Risks and uncertainties. Note the use of significant estimates in accounting transactions. as well as various business vulnerabilities.

- Nonmonetary transactions. Describe nonmonetary transactions and any resulting gains or losses .

- Subsequent events. Disclose the nature of subsequent events and estimate their financial effect.

- Business combinations. Describe the type of combination, the reason for the acquisition, the payment price, liabilities assumed, goodwill incurred, acquisition-related costs, and many other factors.

- Fair value. Disclose the amount of fair value measurements, the reasons for the fair value election (if applicable), and various reconciliations.

- Cash. Note any uninsured cash balances.

- Receivables. Note the carrying amount of any financial instruments that are used as collateral for borrowings, and concentrations of credit risk.

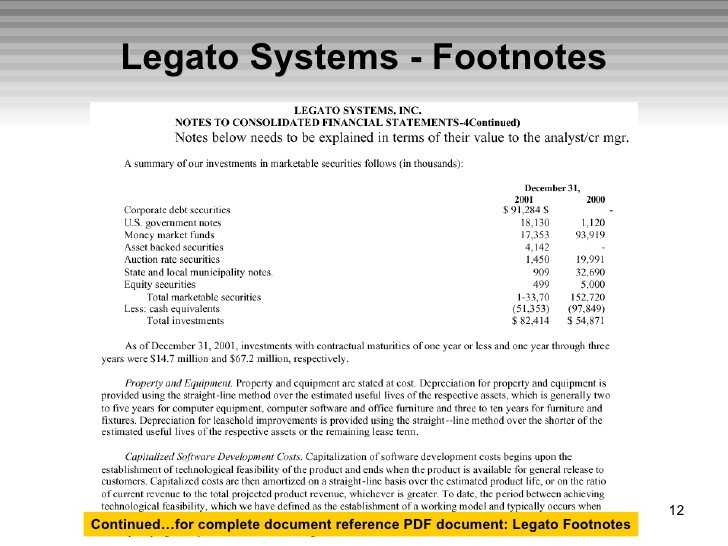

- Investments. Note the fair value and unrealized gains and losses on investments.

- Inventories. Describe an cost flow assumptions used, as well as any lower of cost or market losses.

- Fixed assets. Note the methods of depreciation used, the amount of capitalized interest. asset retirement obligations. and impairments .

- Goodwill and intangibles. Reconcile any changes in goodwill during the period, and any impairment losses.

- Liabilities. Described larger accrued liabilities.

- Debt. Describe loans payable, interest rates, and maturities occurring over the next five years.

- Pensions. Reconcile various elements of the company pension plan during the period, and describe investment policies.

- Leases. Itemize future minimum lease payments.

- Stockholders’ equity. Describe the terms of any convertible equity, dividends in arrears. and reconcile changes in equity during the period.

- Segment data. Identify company segments and the operational results of each one.

- Revenue recognition. Note the company’s revenue recognition policies.

Clearly, the sheer size of the footnotes can overshadow the financial statements themselves. This can present a considerable problem from the perspective of issuing the footnotes in a timely manner, since footnotes are manually generated separately from the financial statements. Thus, if you make a change in the financial statements, it may impact a number of disclosures in the footnotes that must be altered by hand.

The accounting standards allow you to consolidate the information in overlapping footnotes, which keeps the disclosures from becoming inordinately long, repetitive, and difficult to update.

Similar Terms

Financial statement footnotes are also known as notes to the financial statements and notes to accounts .

Related Topics