What Are Convertible Bonds

Post on: 26 Апрель, 2015 No Comment

Connect With Us

As Published by State Street Global Advisors

Convertible bonds might be considered the yin and yang of investing, combining both bond and equity characteristics. Sometimes referred to as CVs, convertibles are essentially corporate bonds that the holder can redeem for a predetermined number of shares of common stock. While a convertible’s bond-like nature may limit, to an extent, the upside potential, it may provide some level of potential risk reduction, too. Their dual nature not only distinguishes convertible bonds from other fixed income asset classes, but it enhances their appeal among investors seeking capital appreciation.

Growth In Convertible Bonds:

While convertibles were first introduced in the 1970s, the management and valuation challenges they present kept their appeal limited to institutional investors.

Over the past decade, however, convertibles’ growth has accelerated. The market capitalization of convertibles, just $65 billion in 1990, has grown to $252 billion as of June 30, 2011. 1 Institutions began using these instruments as tools for raising capital while attempting to minimize negative investor sentiment or reduce the potential adverse effect on corporate balance sheets. To minimize the potential negative impacts of issuing additional equity securities, a company may choose to issue convertible bonds instead. The yield that buyers of convertibles give up in exchange for the option to convert also translates into lower borrowing costs for corporations versus the alternative of having to issue traditional bonds in order to raise capital.

As corporations of all sizes and across a wide array of industries continue to issue convertibles, the investment universe grows ever larger and more diverse. There are four primary investment categories:

- Zero-Coupon/Original Issue Discount (OID); Cash Pay Bonds; Preferred; and Mandatory.

Exposure to all types of convertibles is now accessible not only by purchasing individual securities, but also by investing in pooled vehicles ranging from arbitrage and high yield institutional funds to investment-grade mutual funds. And now, for the first time ever, investors can access this market via an exchange traded fund (ETF). 2

Types Of Convertible Bonds:

– ZERO-COUPON/OIDS (ORIGINAL ISSUE DISCOUNT): bonds that do not make periodic interest payments during the life of the bond. Instead, investors buy these bonds at a deep discount from their face value and at maturity, the investor will receive one lump sum equal to the initial investment plus the interest earned.

– CASH PAY BOND: similar to conventional non-convertible fixed income bonds, they pay interest on a periodic, usually semiannual, basis.

– PREFERRED: fixed income securities that the investor can choose to convert into a certain number of shares of the company’s common stock after either a predetermined time span or a specific date.

– MANDATORY: convertible bonds that have a required conversion or redemption feature where the holder must, either on or before a contractual conversion date, convert the mandatory convertible into the underlying common stock.

Convertible Bond Characteristics:

Like traditional bonds, convertibles are debt issues with fixed coupons and fixed maturities. They are issued at a par value and pay a coupon or fixed interest rate to their holders. The bondholder receives this stable coupon income until the bond matures or is redeemed so long as the issuer remains solvent.

Convertibles are affected by the same factors that influence other bonds, such as interest rate movements, inflationary expectations, time to maturity and credit quality. There are several features, however, that distinguish it from other fixed income vehicles.

Option To Convert:

As its name implies, a convertible’s key distinguishing attribute is the ability of the holder to convert the shares to a fixed amount of company stock at the holder’s discretion.

Equity Sensitivity:

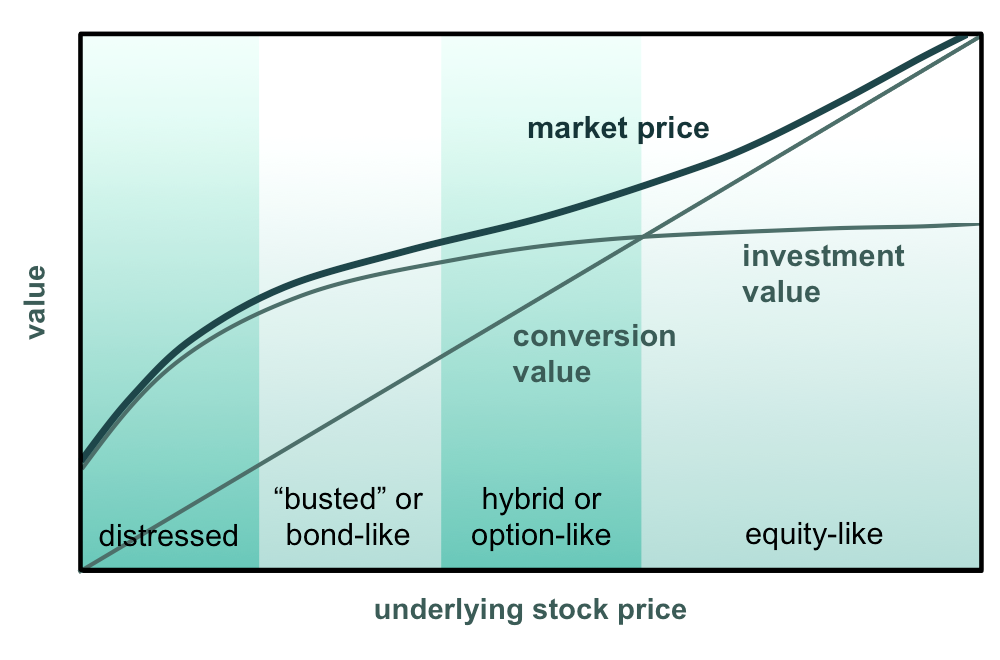

Convertibles tend to perform more similarly to equities than to other segments of the fixed income market, increasing in value along with the price of their underlying stock. The bondholder, then, does not necessarily need to convert his shares in order to reap the benefits of capital appreciation. He can simply sell them at a premium. However, if the convertible bond is callable, the issuer maintains the right to force a conversion and turn the bonds into shares of the company’s stock. An issuer would likely do so if the price of the stock is higher than the amount it would be if the bond were redeemed, or at the bond’s call date. This effectively caps the capital appreciation potential of the convertible bond.

Alternatively, convertibles generally decrease in value as the underlying stock price decreases. That’s where the bond’s attributes provide a measure of downside protection. In the event that a stock performs poorly, there is no conversion. The investor will receive only the return provided by the bond, or the par value.

Potential Reduction Of Risks:

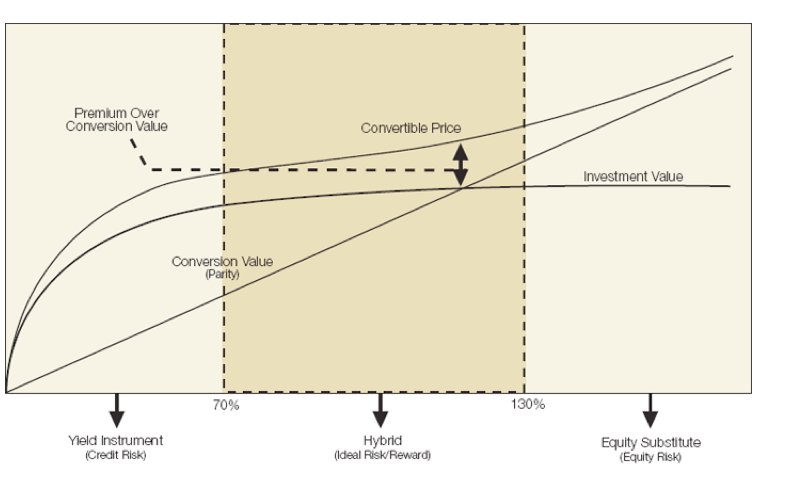

Even if a convertible’s underlying stock declines considerably, its bond-like characteristics provide some potential reduction of the risks equivalent to the bond’s par value or the principal paid by the holder so long as the issuer remains solvent and creditworthy enough to meet its obligations (see Figure 1).

Convertibles are frequently issued at a par value of $1,000.00. The coupon rate is set at issue by the corporation and is typically lower than the fixed interest rate of other types of bonds with comparable maturities and credit quality, but is generally higher than the dividends an investor might receive from holding the underlying stock. Consider that the convertible’s lower yield is in essence a trade-off between the benefit of its potential upside performance and possible risk reduction on the downside.

Risks & Challenges:

While convertibles may prove to be potentially valuable investments for investors seeking capital appreciation and preservation, they bear risks characteristic of both fixed income and equity instruments. For instance, the risks associated with these investments include, but may not be limited to:

— MARKET RISK: the risk inherent to being exposed to the market by being invested in it, including the possibility that convertible bonds may fluctuate inversely to interest rates when the underlying investments fluctuate;

— CALL RISK: the risk, faced by a holder of a callable bond, that a bond issuer will take advantage of the callable bond feature and redeem the issue prior to maturity;

— DEFAULT RISK: the possibility that a bond issuer will default, by failing to repay principal and interest in a timely manner;

— LIQUIDITY RISK: because most individual convertible bonds trade in an over-the-counter negotiated market, liquidity can be difficult for all but large institutional investors.

— CONVERTIBLE SECURITY RISK: Issuers of convertible securities may not be as financially strong as those issuing securities with higher credit ratings and may be more vulnerable to changes in the economy. Bond funds contain interest rate risk (as interest rates rise bond prices usually fall). There are additional risks for funds that invest in mortgage-backed and asset-backed securities including credit risk and inflation risk.

The Evolution Of Convertibles Investing:

Convertible bonds seek to offer investors capital appreciation with potential limited protection against risk; however, managing direct investment in individual convertibles can be highly complex, time-consuming and costly. Now, with the introduction of a convertible bond ETF, investors have an alternative to mutual funds that is a more efficient, cost-effective, transparent and liquid tool with which to take advantage of the potential capital appreciation and possible risk reduction these hybrid securities may offer.

Source: This article was originally published in What Are Convertible Bonds?, (SPDR State Street Global Advisors) www.spdru.com.

© 2011 State Street Corporation. All Rights Reserved. IBG-4675 Exp. Date: 7/31/2012 IBG.EDU.WACB.0911

REPRINTED WITH PERMISSION OF STATE STREET GLOBAL ADVISORS 2012

Disclosure/Copyright/Usage Policy