What Are Company Financial Statements Definition Analysis Examples

Post on: 10 Май, 2015 No Comment

Instructor: Rebekiah Hill

Rebekiah has taught college accounting and has a master’s in both management and business.

In this lesson you will learn about the financial statements that a company must issue for the purpose of financial reporting. You will learn what the statements are, what order they are prepared in, and what each statement includes.

Financial Statements Defined

The Income Statement

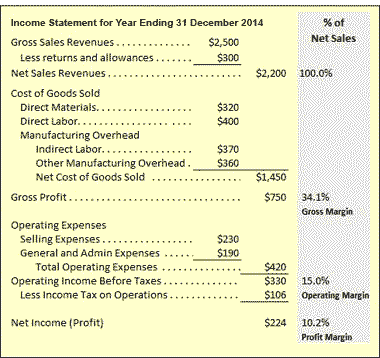

The income statement is the report that measures the success of company operations during a given time period. Its purpose is to allow potential financers and investors to determine profitability, investment value and creditworthiness. This same group of individuals can use an income statement to evaluate the past performance of a company and compare it to competitors. They can also use the income statement to predict future performance and cash flows.

There are four key components of an income statement. They are: Revenue, Expenses, Gains and Losses. Revenue is the cash inflow of the company. It is the money that is generated from the company’s normal business operations. Expenses are the cash outflow of the company. They are the costs that are associated with earning revenue. Gains or losses occur when a company sells a company asset. If the sale produces more revenue than the asset is worth, a gain occurred. If the sale produces less revenue that the asset is worth, a loss occurs. The total amount of net income, or profit, is figured by the following formula:

NET INCOME= (TOTAL REVENUES — TOTAL EXPENSES) +/- Gains or Losses

Most companies also report earnings per share on their income statement. Earnings per share (EPS) are another indicator of a company’s profitability. It signifies the amount of profit, or net income, that will go to each outstanding shareholder of common stock. The formula for earnings per share is:

Statement of Retained Earnings

The statement of retained earnings is the statement that shows the retained earnings of the organization from the company’s startup date until the balance sheet date. Retained earnings are the portion of net income that is retained for use by the company and not paid out to owners or investors. The total of retained earnings increase or decrease each reporting period based on the net profit or loss for the time period, as well as any dividends paid. The formula for the figuring the ending retained earnings total is:

Retained Earnings= Beginning retained earnings +/- net income or loss — dividends paid

Retained Earnings Statement

The Balance Sheet

On the right side of the balance sheet are the liabilities, or ‘what we owe.’ The liabilities section is broken down into two categories:

- Current liabilities- This category includes items that are due and payable in the immediate future. Examples of current liabilities are accounts payable, wages payable, current portion of long-term debt, and interest payable.

- Long-term liabilities- Included in this category are items that are not payable within one year such as bonds payable and long-term notes payable.

Also on the right side, and reported as the last section of the balance sheet, is the area for reporting stockholder’s equity. This is sometimes called owner’s equity. In this area of the balance sheet the amount of investment by owners, and/or stockholders is reported. The total amount of owner’s equity on the balance sheet is the difference between total assets and total liabilities. It is very important to note that the final totals on both sides of the balance sheet must be equal in order for the balance sheet to be accurate.

Statement of Cash Flows

To remain healthy and functioning, a company must keep track of cash flows on a continuing basis. The statement of cash flows is the financial report that does just that. It shows the pattern of cash inflow and cash outflow for a specific accounting period. That time period usually coincides with the time period reported on the company income statement.

The statement of cash flows is arguably one of the most important financial statements that a company can generate. It provides users of financial statements the information needed to judge the company’s ability to pay its obligations to creditors as well as its obligations to any stockholders that it may have. The statement of cash flows also allows investors to see the what, when and why for changes in a company’s financial position.