WertArt Capital

Post on: 25 Июнь, 2015 No Comment

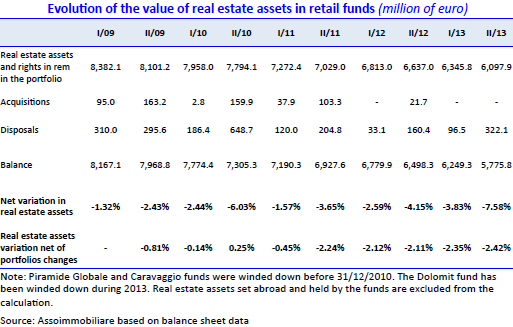

Recently, I published an introductory post about Italian closed end real estate funds (REIFs) which you can find here. After digging deeper into the different funds reports and their portfolios, I have decided to increase the allocation to this asset class. I will make the following investments for the portfolio starting from today:

1) Buy a 1.5% position for the portfolio in Amundi RE Europa (IT0001476412) with a limit price of EUR 1,200:

- Property location: 50% Rome/Milan, 20% UK, 15% France; Type: Office, 60% Single tenant; Occupancy: Close to 100%, with roughly 50% lease expiry until YE 2017; Discount to NAV: 43%; LTV: 45%; Gross rental yield based on appraised value¹. 7.7%; Gross rental yield based on current market cap² . 11.4%; Cash and other assets as % of total assets: 11%; Fund maturity: 2017.

2) Buy a 1.5% position for the portfolio in Europa Immobiliare Uno (IT0003725246) with a limit price of EUR 700:

- Property location: 25% Rome/Milan, 16% Netherlands, 15% Germany, 13% Sweden, 12% UK;

- Type: Office/Retail/Logistics, 60% Single tenant;

- Occupancy: Roughly 80%, with roughly 40% lease expiry until YE 2017;

- Discount to NAV: 55%;

- LTV: 32%;

- Gross rental yield based on appraised value¹. 8.0%;

- Gross rental yield based on current market cap² . 14.7%;

- Cash and other assets as % of total assets: 11%;

- Fund maturity: 2017.

3) Buy a 1.5% position for the portfolio in Valore Immobiliare Globale (IT0001260113) with a limit price of EUR 1,500:

- Property location: 80% Rome/Milan;

- Type: Office/Logistics, 70% Single tenant;

- Occupancy: Roughly 80% incl 2 letters of intent;

- Discount to NAV: 48%;

- LTV: 0%;

- Gross rental yield based on appraised value¹. 5.6%;

- Gross rental yield based on current market cap². 14.8%;

- Cash (excl projected capex) and other assets as % of total assets: 19%;

- Fund maturity: 2019.

4) Add a 1.0% position for the portfolio to Unicredito Immobiliare Uno (IT0001358479) with a limit price of EUR 2,050:

My initial investment thesis as of January 2015 can be found here. Yesterday, fund management announced that they closed the sale of their two Milan office buildings to Partners Group. The disposition price is close to appraised value (NAV of the sub fund) and therefore higher than my original estimate (I took a 10% haircut on the sub fund’s NAV). The fund has already received a payment of EUR 153.5 m (EUR 960 per share). Additionally, the fund might receive a payment of up to EUR 7 m (EUR 44 per share) within 60 business days after the closing of the deal. The exact amount will depend on the sub fund’s NAV as of the closing date. Fund management will announce the terms of an upcoming distribution to shareholders with the release of the annual report at the end of February 2015. I expect that the distribution will be around EUR 900 per share. Excluding the expected distribution, an investor can buy the “stub” at a discount to appraised value of 39%. Taking into account that the quality of the properties (i.e. lease terms, location of properties, tenants) seems to be relatively good and that the fund has no loans outstanding, I think that the risk/return profile of this investment is highly attractive.

Edit 3/2/2015: Management announced a EUR 750 reimbursement per share or EUR120m in total, which is substantially below the net proceeds from the sale of the two assets in Milan.

I will publish a more detailed analysis regarding Amundi RE Europa, Europa Immobiliare Uno and Valore Immobiliare Globale in a separate post.

1) Gross rental yield based on appraised value = gross rent / gross asset value

2) Gross rental yield based on current market cap = gross rent / ((current market cap + bank debt) (cash + other assets other liabilities))

The content contained on this site represents only the opinions of its author(s). I may hold a position in securities mentioned on this site. In no way should anything on this website be considered investment advice and should never be relied on in making an investment decision. As always please do your own research!