Wealthfront closes round that brings it to $130 million

Post on: 16 Май, 2015 No Comment

David Paul Morris | Bloomberg | Getty Images

Adam Nash

One of the biggest robo-advisors just got bigger.

On Tuesday, Wealthfront announced that it has raised another $64 million, bringing its total funding to $130 million.The Silicon Valley-based start-up also reached $1.5 billion in assets under management this month, a milestone that helps it pull further ahead of other automated wealth management firms such as Betterment and FutureAdvisor. (It does not disclose revenues.)

With the latest round of funding, Wealthfront now has more than $100 million in cash reserves, a sum that CEO Adam Nash said will help it scale to serve its target audience of millennial investors and retain independence from Wall Street.

That may become increasingly challenging as Wall Street firms begin to offer their own competitive automated services or partner with other robo-advisor firms.

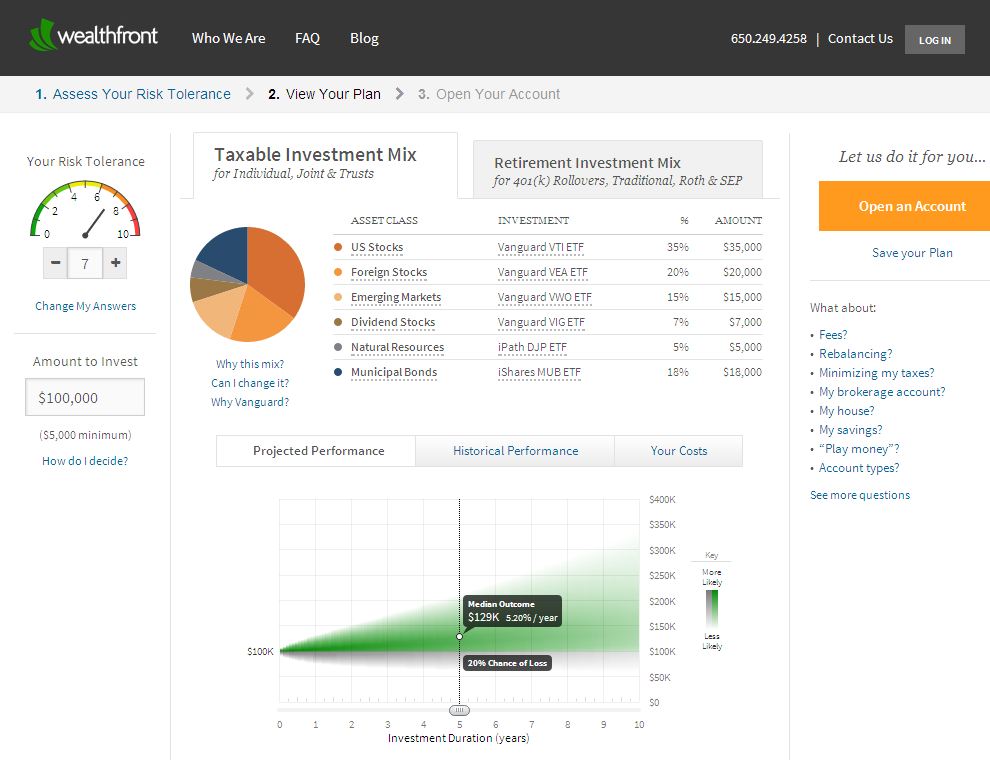

On Monday, Charles Schwab, one of the world’s largest full-service investment services firms, announced it would begin offering its own free robo-advising service, Intelligent Portfolio, to consumers next quarter and plans to roll out similar services to registered investment advisors soon after. (Automated services use algorithms a nd model portfolios to allocate investments according to an individual investor’s objectives and risk tolerance.)

Other full-service firms have chosen to join forces with robo-advisors. Earlier this month, Fidelity announced that it had formed a partnership with robo-advisor Betterment. That followed reports that TD Ameritrade would be making robo-technology available to the 4,000 independent registered investment advisors who use its custody and trade-clearing services, allowing several robo-advisors who hold assets in custody with the firm to integrate with its platform.

But analysts say Wealthfront is well positioned to emerge as a major player in its own right within the retail financial services sector.

They’re here to stay, says Grant Easterbrook, an analyst with the research firm Corporate Insight. They’re well-funded, and they’re in the lead in terms of gathering assets.

Wealthfront reached the $1 billion benchmark in assets under management in June and has added more than $100 million per month since, a pace that has caught the attention of analysts and venture capitalists alike.

In a report last month, Forrester Research analyst Bill Doyle noted that Wealthfront reached $1 billion in less than half the time it took Charles Schwab to do so, and its growth rate has only increased since. Wealthfront is capitalizing on a digital disruption, he wrote, just as Schwab seized on a market disruption nearly a half-century ago: the deregulation of the U.S. securities industry in 1975.

And the parallels don’t end there. Schwab targeted those in their 20s and 30s who were willing to trade in a new way—over the phone with a pool of unknown brokers, wrote Doyle—then grew with those Baby Boomers into a financial services firm with more than $2.3 trillion in client assets today.

Wealthfront, similarly, has targeted millennials in their 20s and 30s who are drawn to its automated investing service, which simplifies an often complicated process and offers additional benefits like tax-loss harvesting and periodic rebalancing. No other wealth-management firm is as focused on millennials, said Doyle, which puts it at a distinct advantage.

The estimated 90 million millennials in the U.S. are projected to have as much as $7 trillion to invest within the next five years, Nash said on Tuesday. And they’re increasingly demanding a different type of investment service than Wall Street offers their parents.

In a report last month, MyPrivateBanking Research, an independent research firm, estimated that within five years robo-advisors will have $255 billion under management globally, fueled in large part by younger investors. T he robo phenomenon is here to stay, and we believe that there is good reason to expect robo-advisors to be highly successful as a class, the firm concluded.

Still, in a managed account industry estimated at $5 trillion or more, robo-advisors like Wealthfront are tiny. And while full-service firms have mostly focused on clients with the most investable assets —baby boomers and seniors—they are starting to reach out to younger investors by expanding their digital offerings and lowering fees and account minimums. Vanguard’s Personal Advisor Services, for example, has been pushing to lower minimums and fees. And by 2016, Bank of America Merrill Lynch said it plans to double the number of its Merrill Edge advisors, a group that targets less-affluent investors.

The odds are stacked against any single disruptor, noted Doyle. Nonetheless, he added, his firm believes Wealthfront has a good chance to emerge as a substantial player in the retail financial services sector.

Nash agrees. We’ve only scratched the surface, he said Tuesday.