Watch online Capital Budgeting Part One Introduction And Payback Period ~ March 2015 from

Post on: 10 Апрель, 2015 No Comment

There are the Movies results for Capital Budgeting Part One Introduction And Payback Period from trusted resources, if you don’t find any related movies to Capital Budgeting Part One Introduction And Payback Period. please try again to search using other keywords.

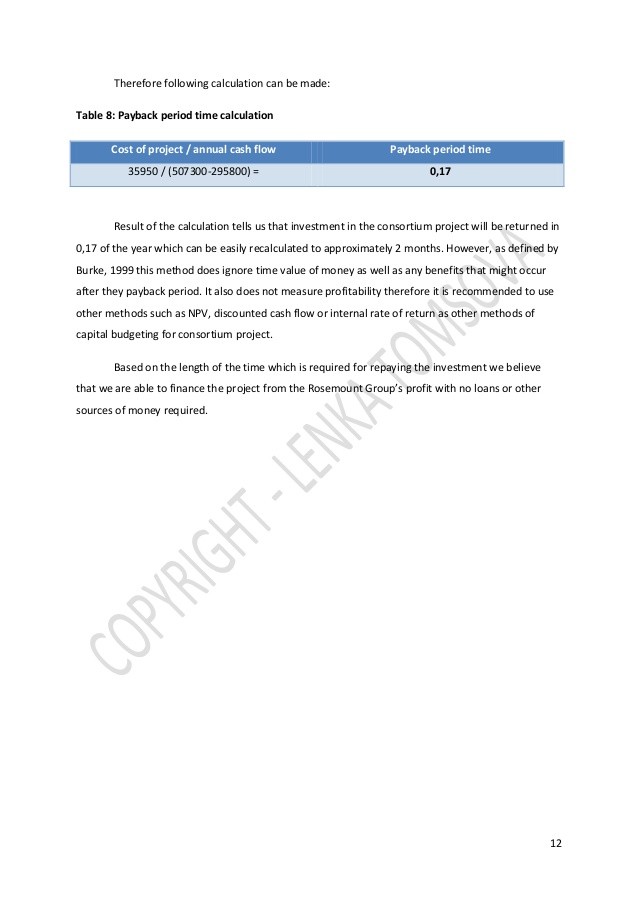

Capital budgeting part one — introduction and payback period

This is a part one of a four-part series on capital budgeting calculations and analysis. this part introduces the problem and walks through a calculation.

Capital budgeting part four — analysis of decision — youtube

The goal with capital budgeting is to select the projects that bring the most value to the firm. ideally, we’d like to select all of the projects that add value.

Capital budgeting part two (hp10bii) — calculating

Capital budgeting, or investment appraisal, is the planning process used to determine whether an organization’s long term investments such as new machinery.

What is capital budgeting: introduction — managerial

This is a part four of a four-part series on capital budgeting calculations and analysis. this part discusses the decision process for independent and.

Capital budgeting — youtube

Advantages & disadvantages of payback capital budgeting method by jim woodruff, demand media.

Payback period.mp4 — youtube

Since the payback period does not reflect the added value of a capital budgeting decision, it is usually considered the least relevant valuation approach.

Ti-83 and ti-84 capital budgeting three — npv — youtube

Payback period calculator — youtube

This tutorial will conclude with some basic, yet illustrative examples of the capital budgeting process at work. example 1: payback periodassume that two gas stations.

Part 2 — wacc weighted average cost of capital, how to

Finance > capital budgeting. capital budgeting. a capital expenditure is an outlay of cash for a project that is expected to produce a cash inflow over a period of.

Episode 129: how to calculate the payback period — youtube

Project classifications: capital budgeting projects are classified as either independent projects or mutually exclusive projects. an independent project is a project.