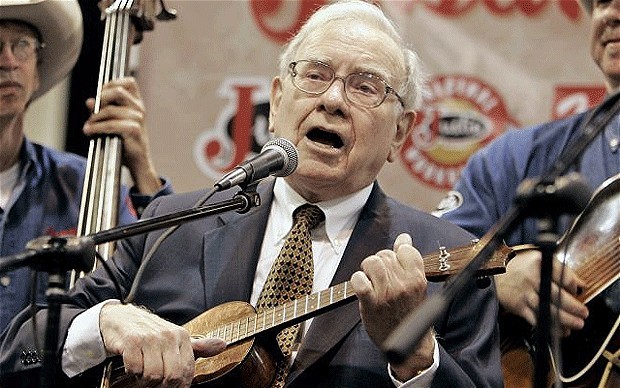

Warren Buffett Investing Advice For YouAnd My Wife (And Other Quotes Of The Week)

Post on: 22 Август, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

While Russia’s actions in the Ukraine were dominating the headlines over the weekend, Warren Buffett’s Annual Shareholder Letter was also released, with its usual mix of good news, hard-headed business and investing advice to readers, and broad explanations of the performance of various Berkshire Hathaway business units and investments.

The top-line results for fiscal 2013 were very positive, with Berkshire (BRK-A and BRK-B) posting operating earnings of $15.139 billion, up from $12.597 billion in 2012.

Buffett said, “At December 31, 2013, our book value had increased by 18.2 percent since year-end 2012 to $134,973 per Class A equivalent share” and “On the operating front, just about everything turned out well for us last year – in certain cases very well.”

Later in the text, Buffett gets into a discussion of investing philosophy, beginning with a quote from the famous author and investor Benjamin Graham, widely considered the founder of value investing: “Investment is most intelligent when it is most businesslike.”

His main points here surround rational and patient investing, viewing the purchase of a company’s stock as “buying a small portion of their business” and advising that one should recognize the strengths and weaknesses of one’s “circle of competence.” He once again reminds us all that most investors are blinded by the markets’ gyrations and spend far too much time trying to form macro opinions or listen to market predictions—rather than investing simply and prudently for the long-term.

In fact, for his wife (and her future trustee) he has the following plan:

What I advise here is essentially identical to certain instructions I’ve laid out in my will. One bequest provides that cash will be delivered to a trustee for my wife’s benefit…My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors…

Berkshire’s results capped off a largely positive market week, with equities once again finding the groove of 2013 and posting all-time record closing highs on the S&P.

Janet Yellen’s Senate remarks, and those of some other Fed members, helped to boost equities, as did some more upbeat economic data on durable goods, Chicago PMI and consumer confidence, and a lessening of concerns over some of the emerging market issues.

For the week, the Dow was up 1.4%, while still modestly in negative territory for the year, the S&P was up 1.3%, notching new all-time intraday and closing highs, and the Nasdaq Composite was up 1.0%. This week’s performance virtually wiped out the desultory start to 2014, and February went into the books with a 4-5% increase in most major indices.

Tonight’s open of the futures markets could be volatile, with the Russian-Ukraine situation so fluid. Breaking news continues as this piece is being written, both on the status of Russia’s military intentions and the response of other world powers.

Earlier in the week, ousted President Viktor Yanukovych turned up in Russia after several days of mystery and proclaimed, “I continue to consider myself the lawful head of the Ukrainian government…we will drive out the bandits and extremists.”

Secretary of State John Kerry said mid-week in trying to defuse tensions, “We do not believe this should be East vs. West, Russia vs. the United States. This is not Rocky IV.”

But that was before the latest developments, and this morning, based on Russia’s latest actions, former National Security Advisor Zbigniew Brzezinski said on CNN. “We must prevent, deter and discourage (Russia). We must warn them explicitly of the negative consequences (of armed conflict).”

And Kerry today escalated the U.S. position, calling the situation “an incredible act of aggression” by Russia and that U.S. and Western powers are prepared “to go to the hilt” to isolate Russia by political, diplomatic and economic actions. (NY Daily News)

Let’s take a look at what some of the other newsmakers were saying in this jam-packed news week.

– “A number of data releases have pointed to softer spending than many analysts had expected. Part of that softness may reflect adverse weather conditions, but at this point it is difficult to discern how much.” –new Fed Chair Janet Yellen in her delayed Senate appearance, more or less begging off the question on whether or not Fed policy will change based on some recent weaker than expected economic reports. She added, “In the weeks and months ahead, my colleagues and I will be attentive to signals that indicate whether the recovery is progressing.” (MarketWatch)

–“I stopped using Mt. Gox this summer when it started to look like roach motel.” — Tyler Winklevoss, Founder, Winklevoss Capital and one of the Winklevoss twins of Facebook fame. He added, “My thoughts are with all those who may have lost money with Mt. Gox.” (winklevosscapital.com)