Warren Buffett Bought Shares of Restaurant Brands International Inc Should You Buy Too

Post on: 16 Март, 2015 No Comment

Warren Buffett Bought 8.4 Million Shares of Restaurant Brands International Inc: Should You Buy Too?

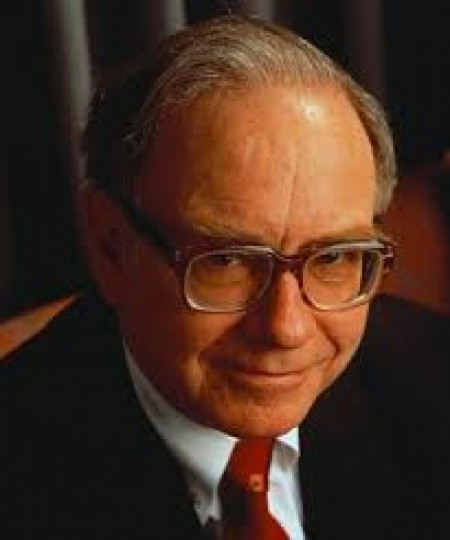

Warren Buffett has made a living buying wonderful businesses.

Since 1965, he has been the Chairman and CEO of Berkshire Hathaway. Over that time, Buffett has cranked out a 21% annual return for shareholders. If you had invested just $1 in Berkshire back then, your investment would be worth $18,260 today.

Based on his exceptional track record, I always pay attention to what stocks Buffett is buying. Right now, he’s making some big bets on a Canadian icon.

Warren Buffett invested $330 million in this forever stock

The business is Restaurant Brands International Inc (TSX:QSR) (NYSE:QSR). If you follow the news, you know the company was formed through a merger between Canadian coffee shop Tim Hortons and American fast food giant Burger King.

According to SEC filings, Buffett owns 8.4 million shares of the company. As of December 31, his total stake was valued at US$330 million.

So, why is Buffett backing up the truck on RBI? There’s no better business in the world than fast food, especially if you like collecting globs of dividend income.

Here’s why

Coffee and burgers only cost a few cents to make. You sell them for a couple of dollars, and theyre addictive.

Fast food isn’t impacted by recessions or wars. People dont stop drinking their favourite coffee just because the economy takes a downturn. That means the companys cash flows are as steady as bond coupons.

RBI has tremendous advantages in scale. The new entity will be the third largest fast-food business in the world. This gives RBI a lot of negotiating power over suppliers, which keeps costs down.

While most businesses require huge capital investments, the companys operations are not that costly to expand. Franchisees are generally responsible for constructing new restaurants, whereas RBI is just there to collect the royalty cheques. Ongoing costs are only a small fraction of revenues; the rest can be paid out to shareholders.

Best of all, RBIs customer base is incredibly loyal. People are very careful about what they put in their mouth. So, if prices go up a nickel or two, customers arent going to switch to the no-name burger joint across the street.

Its this ability to retain customers that is the hallmark of a wonderful business. Firms that can lock in a loyal base generate superior profit margins and strong free cash flows, putting them in a better position to return money to shareholders through dividends and buybacks.

And RBI plans to do exactly that. Last month, the companys board of directors declared a dividend of $0.09 per share for the first quarter of 2015. I expect that payout will be the first of many to come.

One dividend stock to buy and hold forever

And Buffett isn’t the only investor backing RBI. According to recent SEC filings, a number of hedge fund managers—including D.E. Shaw, Steven Cohen, and Ken Griffin—have been building stakes in the stock. Billionaire investor Bill Ackman also boosted his position in the restaurant giant last quarter.

Now, I have to ask, what would have these money mavens so excited? I’d say it could only mean one thing—they see a truly wonderful business.

Who else wants more dividend income?

Restaurant Brands International Inc is a great investment, but it’s not the only stock that cranks out reliable income. Check out my special FREE report: 3 Dividend Stocks to Buy and Hold Forever. These three firms have paid dividends to shareholders for decades (and even centuries!). Click here now to get the full story!

Fool contributor Robert Baillieul has no position in any stocks mentioned. The Motley Fool owns shares of Berkshire Hathaway.

Warren Buffett has made a living buying wonderful businesses.

Since 1965, he has been the Chairman and CEO of Berkshire Hathaway. Over that time, Buffett has cranked out a 21% annual return for shareholders. If you had invested just $1 in Berkshire back then, your investment would be worth $18,260 today.

Based on his exceptional track record, I always pay attention to what stocks Buffett is buying. Right now, hes making some big bets on a Canadian icon.