VXX Contango And Cash

Post on: 16 Март, 2015 No Comment

OPTIONS OPPORTUNITIES

Stock market volatility is on the rise, which not only presents trading opportunities in stocks, but in volatility itself.

The recent 6% market decline as sent the VIX (INDEXCBOE:VIX) is up some 30% over past two weeks. Im using this jump in the VIX to establish two separate positions in the iPath S&P Short-Term VIX (NYSEARCA:VXX ): one low-risk long-term, which Ill look at today, and a riskier short-term one Ill discuss tomorrow.

Before getting to the specific trades, we need to discuss some particulars surrounding the volatility-based products. This previous article on volatility trading addresses some of the nuances in price behavior and product structure that make trading volatility a bit more complex than stock or index options.

There are three important concepts to understand:

- The VIX is a statistical measure of implied volatility of S&P 500 (INDEXSP:.INX) Index options. The index cannot be directly bought or sold.

- Implied volatility tends to be mean reverting. Levels can be high or low in absolute terms but expensiveness is relative.

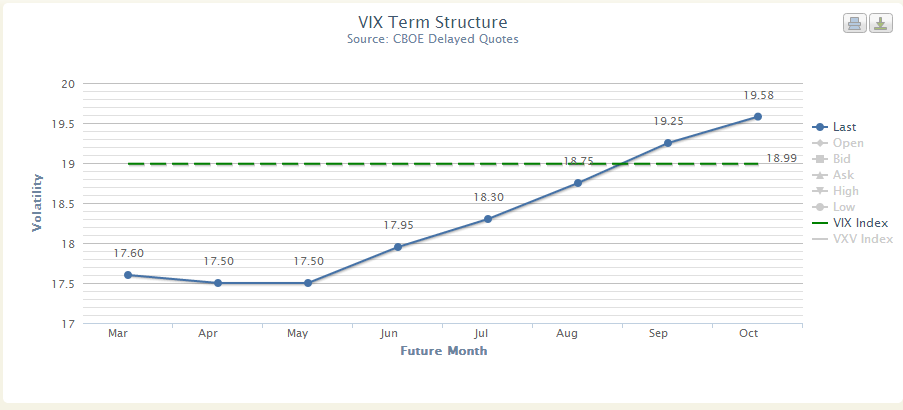

- The futures natural structure is one of contango, in which later dates carry higher premiums.

The first issue is easily addressed through the plethora of VIX-related exchange traded products (ETPs) that have been introduced over the past few years. They cover every major index, a variety of time frames, and include leveraged and inverse ETPs.

As mentioned above, my trading vehicle of choice is the VXX. The main points to know about its construction are that 1) it is calculated by a combination of the one month and two month VIX futures, and 2) it is constantly adjusted forward on a daily basis.

Skew and Term Structure

Term structure refers to the relationship of futures contracts with the cash or spot price. The natural term structure for VIX futures is a state of contango, which is also normal for a variety for commodities which have carrying costs like storage, which is due to the fact that the probability of a certain percentage move increases over longer periods of time. Simply put, a stock or the market is more likely to move 10% in six months than it is in six weeks.

Given that the VXX is constructed with one and two month futures contracts, this means you are typically paying a premium above the cash VIX. The futures price must naturally converge to the VIX spot price by the contract expiration, creating a downward bias in VXX. Assuming no change in the cash VIX, the VXX would over time head toward zero. In fact, to offset this leakage of value the VXX has undergone four separate 1-for-4 reverse stock splits since its 2009 launch. Its current price of about 53 is down from $6,600 on a split-adjusted a basis. Thats a 98.7% decline.

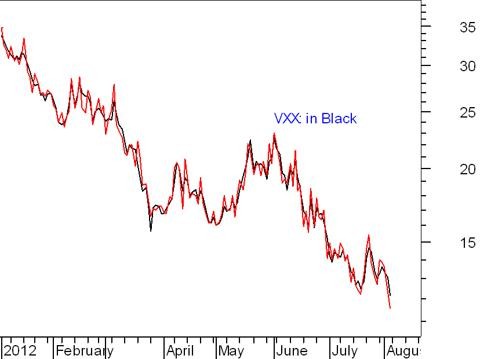

The cost of contango was extreme during 2012 as fears of potential crisis were averted and the premium in later dated VIX futures was constantly crushed. The graphic below illustrates the long=term underperformance and cost of the VXX versus the cash VIX during that period.

Click to enlarge

With the term structure in a current state of backwardation, I expect a return to the normal cantango, to create a favorable tailwind for a bearish trade on VXX.

Working on the assumption that the markets will stabilize over the next few months, leading to a decline in volatility, Ive established a bearish put spread in VXX.

Specifically, I bought the April $48 put and sold the April $44 put for a $2 net debit. That $2 represents the maximum loss per lot which would be incurred if the VXX is above $48 at the April expiration. The maximum profit is $2 if the VXX is below $44 at expiration.

Given the tailwind provided by the VXX structural downward bias and my expectations of a stabilizing market, I think the probability of VXX heading lower in coming months is much greater than just 50/50, giving this trade an attractive risk/reward proposition.

Steve Smiths OptionSmith portfolio was up 43% in 2013. Take a FREE 14 day trial to get exclusive access to the portfolio and Steves top trading ideas. Learn more now .

POSITION: No positions in stocks mentioned.