VIX Futures Explained

Post on: 11 Июнь, 2015 No Comment

On March 26, 2004, the CBOE transformed the widely followed stock market volatility indicator — the VIX — into a security by introducing the VIX Futures.

VIX futures can be used as an effective tool to diversify portfolios, hedge equity returns and to spread implied vs realized market volatility. VIX futures also enable market speculators to trade volatility independent of the direction or the level of stock prices.

VIX futures are standard futures contracts on forward 30-day implied volatilities of the S&P 500 index. For example, a July futures contract is a forward contract on 30-day implied volatility on July expiration date.

CBOE VIX Future Contract specifications

- Ticker Symbol: VX

- Contract Size: $1000 times VIX

- Minimum Tick Size: 0.01 (each tick is worth $10 per contract)

- Contract Months: Available for all 12 months of the year

- Expiration Date: The Wednesday that is thirty days prior to the third Friday of the calendar month immediately following the month in which the contract expires

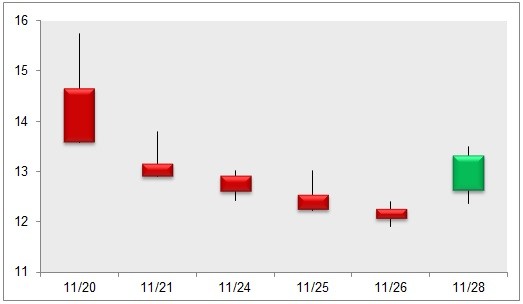

Eg. At a quoted price of $12.1, one VIX futures contract is worth $12,100.

Settlement

CBOE VIX futures are cash-settled and so, unlike futures on commodities, there’s no physical delivery. On settlement date, your account will simply be credited or debited the difference between your purchase (or sale) price and the settlement price.

CBOE VIX futures are settled at the open, always thirty days before a final settlement of S&P 500 options (SPX).

Forward VIX vs Spot VIX

Depending on how the market perceive volatility, the price of a VIX futures contract can be lower, equal or higher than the VIX spot price. Often, due to the mean-reverting nature of the VIX, when the VIX is low, VIX futures trade at a premium and when the VIX is high, VIX futures trade at a discount.

VIX Futures Fair Value

Those of you who are familiar with stock index futures will know that the fair value of the futures is derived from the cost-of-carry relationship between the underlying stock index and the futures. The fair value of the VIX futures cannot be computed using a similar relationship as there is no cost of carry between VIX and a position in the VIX Futures.

cfe.cboe.com/education/vixprimer/Features.aspx

Your new trading account is immediately funded with $5,000 of virtual money which you can use to test out your trading strategies using OptionHouse’s virtual trading platform without risking hard-earned money.

Once you start trading for real, your first 150 trades will be commission-free! (Make sure you click thru the link below and quote the promo code ’90FREE’ during sign-up)